A comprehensive guide to Consumer Price Index (CPI) and the Producer Price Index (PPI), and explaining their significance in economic analysis. It covers the calculation of CPI, the relationship between CPI and PPI, and how these two influence monetary policy decisions.

Introduction to the US Consumer Price Index (CPI)

The CPI (Consumer Price Index) is a reference to measure price dynamics. It is one of the most important economic indicators that central banks consider when making any monetary policy decision.

Every country will release its CPI data, letting us know whether an economy is in inflation or deflation.

What is inflation?

Inflation refers to the continuous increase in the value of goods, which tends to occur in good times.

What is deflation?

Deflation refers to the continuous decline in the value of goods, which tends to occur in bad times.

The responsibility and obligation of a central bank is to stabilise the value of its currency and support the growth of the economy, implementing monetary policy to maintain a specific rate of price increase.

When central banks implement monetary policies, they focus on price data, such as the CPI. The Federal Reserve, the central bank of the United States, also monitors an economic indicator called the PCE (Personal Consumption Expenditure Price Index).

If the inflation rate stays above the target, the central bank will tighten its monetary policy (raise interest rates) to curb price increases. Conversely, if the inflation rate stays below the target, the central bank will ease monetary policy (cut interest rates) to promote price increases.

As the central banks’ decisions strongly influence the financial markets, price indicators such as the CPI -the crucial indicator of inflation- are also closely watched, so the market is likely to react significantly around the release of such data.

Therefore, when trading forex and CFD, the CPI is one of the economic indicators that needs to be tracked.

This article, aimed at beginners, will explain in detail what the CPI is, how it is calculated, how it has evolved in the past, and how it affects the exchange rate.

What is the CPI?

The acronym CPI stands for "Consumer Price Index".

The CPI is an economic indicator that measures the overall change in consumer prices based on a representative basket of goods and services over time and shows this change as an index.

The CPI uses a point in time, the base year, to show how purchasing the same good or service changes.

The CPI measures the change in prices, but not in the cost of household style or consumer preferences.

How major central banks assess the inflation rate?

For major central banks, mild inflation benefits economic growth.

That is because the product price will rise and turnover will also increase. In addition to the increase in investment, wages will also increase, and higher wages will favor spending, increasing turnover and demand. Even if the sales price rises slightly, the product can still be sold, thus creating a virtuous cycle of rising prices.

By contrast, in deflation, the product price will decrease as a result of less consumer demand, making it harder to increase sales and investment, salaries, and spend more.

In this case, companies will try to secure sales even if they cut prices, leading to a downward price spiral.

However, if the inflation rate is too high, it will develop into an economic bubble, which will cause significant damage to the economy. If this happens, there is the risk that the currency will lose credibility, and the inflation rate will rise further, leading to hyperinflation. The central bank will therefore try to keep a mild inflation rate.

For major central banks in developed economies, 'mild inflation 'refers to a price increase of around 2% over the previous year.

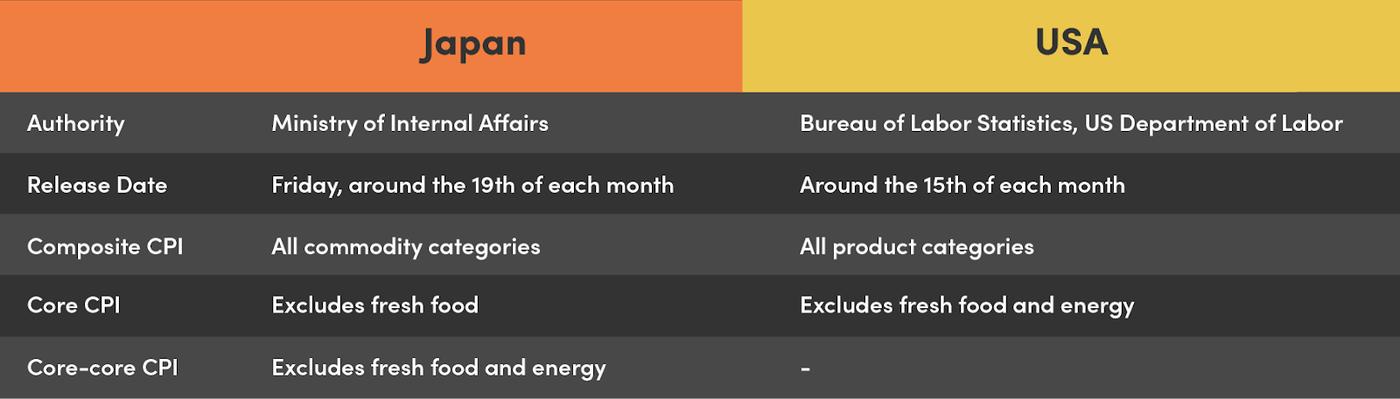

CPI in USA vs. CPI in Japan

Although all countries release CPI figures, not all countries use the same methodology. This is the case of the USA and Japan; let’s look at the differences.

In the composite CPI, all categories of goods are included in the calculation.

The core CPI in Japan is different from the core CPI in the United States, although generally speaking, the CPI that excludes more volatile items is called core CPI.

US core CPI = Japan core-core CPI

Because the price of fresh food varies greatly depending on the weather, it may be difficult to analyse price changes.

In addition, the energy sector is also affected by changes in oil prices due to geopolitical factors, but after removing this factor, it is easier to determine price changes.

We can understand the overall price action much better if we exclude the items with sharp price changes.

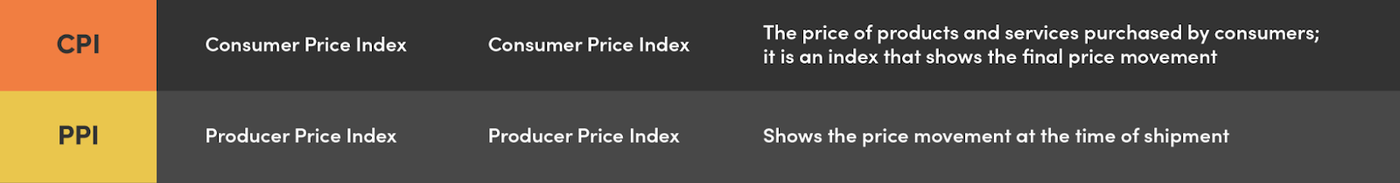

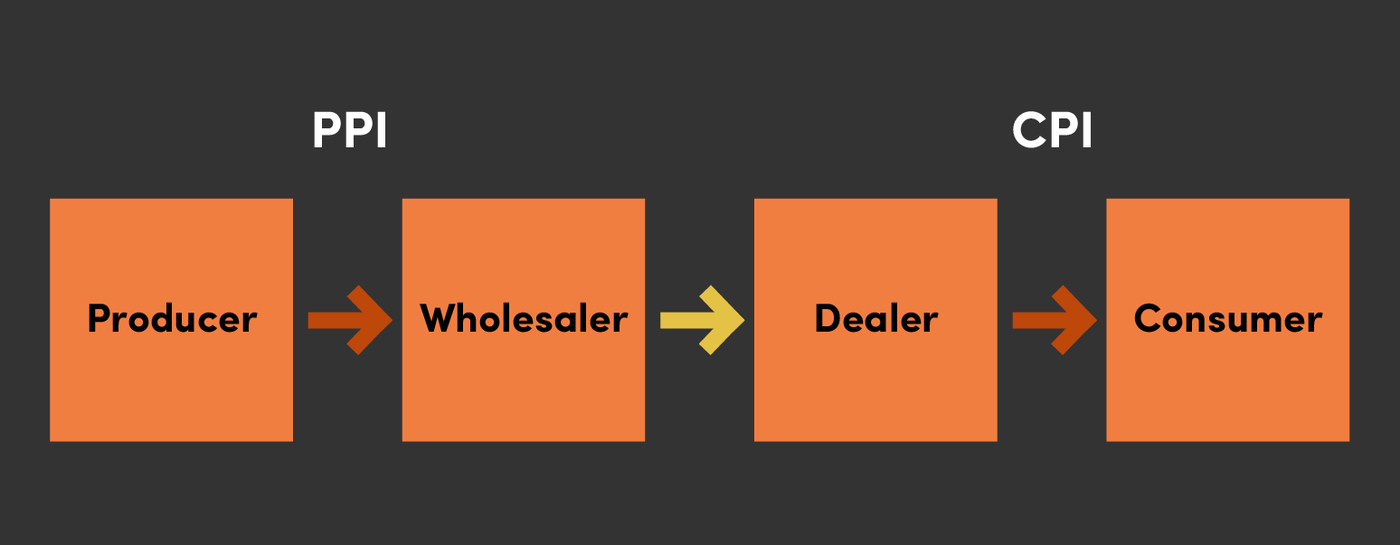

CPI vs. PPI (Producer Price Index)

Another way to measure inflation (price increase) is the PPI (Producer Price Index).

The PPI, like the CPI, is one of the most closely watched economic indicators.

The acronym PPI stands for "Producer Price Index".

The PPI is an economic indicator that calculates the price changes of products and raw materials that producers sell.

In contrast to the CPI, which shows price changes from the perspective of "buyers," the PPI shows price changes from the perspective of "sellers."

The relationship between CPI and PPI is as follows.

Changes in the PPI will eventually be reflected in the CPI. The PPI is one of the leading indicators of the CPI.

What is the "base year" for CPI?

The "base year" is the year that is used as the base for calculating changes in the CPI.

Set the price in the base year to "100" to calculate the CPI change rate.

Calculating CPI

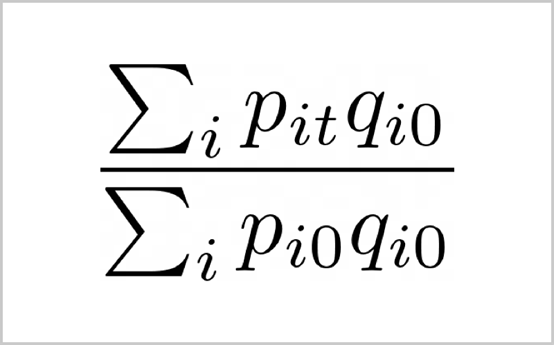

CPI is usually calculated using the Laspeyres Index.

What is the Laspeyres Index?

The Laspeyres Index was a price index formula created by Laspeyres. It looks like this:

The meanings of the symbols are described below.

Individual item = i

Base year price = pio

Comparison year price = pit

Base year number = qio

We can find the CPI ratio by calculating "(comparison year price × base year number ÷ base year price × base year number)×100".

For example, suppose that one rice ball costs 100 Yen in the base year, and 100 rice balls are sold.

In the comparison year, one rice ball costs 110 yen, and 90 rice balls are sold.

After applying the above formula, the result will be "(110×100÷100×100) ×100=110".

By setting the benchmark price as 100, we can see that the price has increased by 10% from the past to the present.

※ The Laspeyres index formula takes the number of base years as a weighted average, so the "90" figure in the comparison year is not considered.

The CPI shows how much prices have changed between the base year (past) and the present.

In other words, it is an index that evaluates how much it would have cost to buy the same goods or services now from a past point of view.

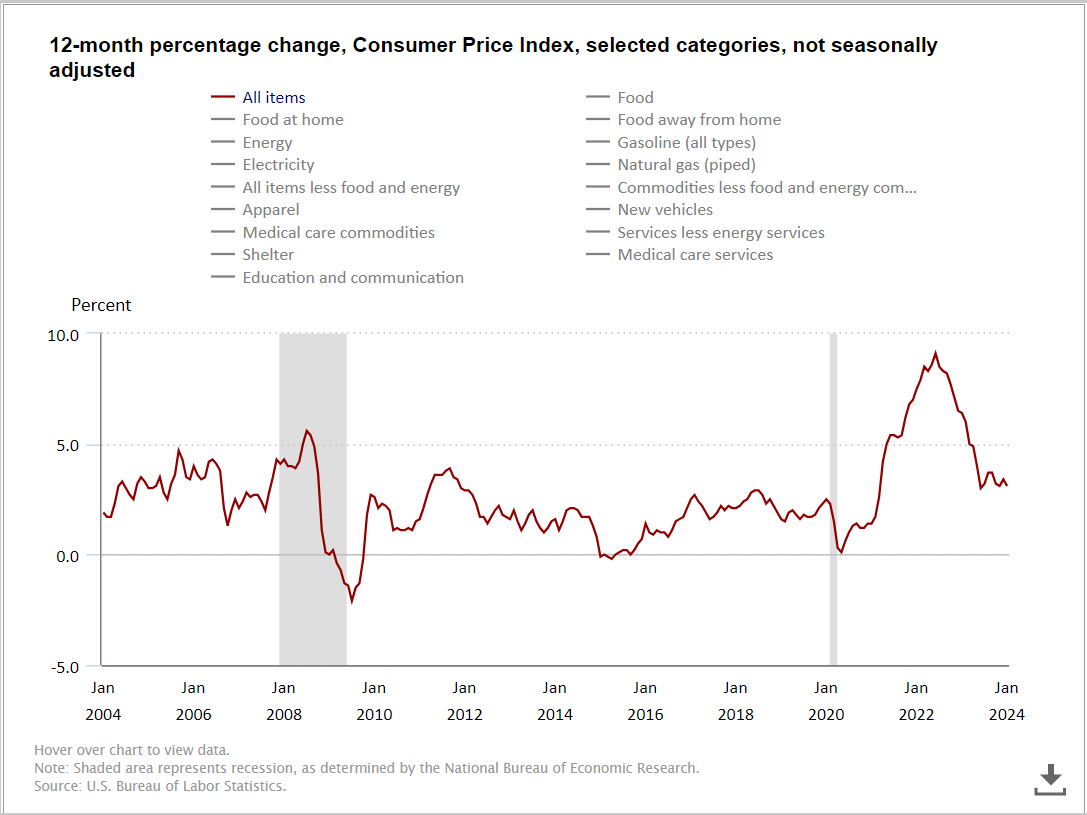

The evolution of the CPI

Let’s look at the evolution of the US CPI

The US CPI (Consumer Price Index) for August 2022 released in September 2022 rose by 8.3% compared to the previous year, and the record price increase continues.

The Federal Reserve initially ignored rising prices, but in March 2022, when the core CPI ※ rose over 6% from the previous year, the central bank began to raise interest rates and has continued the same policy to date with the goal of curbing price increases.

The Fed raised interest rates multiple times in 2022 and 2023

| Month | Raise (in bps) | Fed Funds Post Raise |

|---|---|---|

| March 2022 | +25 | 0.25% to 0.50% |

| May 2022 | +50 | 0.75% to 1% |

| June 2022 | +75 | 1.50% to 1.75% |

| Juy 2022 | +75 | 2.25% to 2.50% |

| September 2022 | +75 | 3% to 3.25% |

| November 2022 | +75 | 3.75% to 4% |

| December 2022 | +50 | 4.25% to 4.50% |

| February 2023 | +25 | 4.50% to 4.75% |

| March 2023 | +25 | 4.75% to 5% |

| May 2023 | +25 | 5% to 5.25% |

| July 2023 | +25 | 5.25% to 5.50% |

(Information as of January 2024)

Interest rate changes have a significant impact on the exchange rate.

Let's see how.

The Federal Reserve emphasises the PCE (Personal Consumption Expenditures) index over the CPI when deciding monetary policies. Still, in terms of market trends, the CPI, which is relatively front-end, reacts more strongly than the PCE.

CPI impact on the exchange rate

Let’s sort out the ideas we have outlined so far.

- The CPI is an economic indicator that measures the price change of a good or service

- A rising CPI represents inflation

- A falling CPI represents deflation

- Moderate price increases are necessary for moderate economic growth

- Central banks in important economies implement monetary policies with an inflation target of around 2%

CPI and monetary policy

The central bank will decide on monetary policy to guide the inflation rate to the target value.

In general, when monetary tightening is in place (this involves raising the interest rate and reducing quantitative easing), fewer people borrow money and less money circulates in the market, which depresses the demand for goods and services.

Consequently, the prices of goods and services will fall, keeping prices down.

When inflation is low, central banks implement monetary easing measures such as cuts in interest rates or quantitative easing. This makes financial borrowing easier, more money circulates in the market, and an environment is created where the demand for goods or services increases and prices tend to rise.

Central banks use monetary tightening and monetary easing measures to control inflation.

However, there may be differences in the effects of monetary policies due to price changes.

There are two main types of factor for price changes.

- An increase/decrease in demand

Prices rise due to increased demand or fall due to decreased demand. - An increase/decrease in cost

Prices change due to the rise or fall of resource prices, changes in foreign exchange, increases or decreases in personnel costs, etc.

We can expect monetary policy to affect price changes caused by ①, while its effect on price changes caused by ② is limited.

However, there have also been cases in the past, such as in Japan, where demand has not increased despite continued quantitative easing while deflation has persisted. This is not a textbook outcome and has troubled central bankers.

The relationship between interest rates and exchange rates

In general, in a stable economy, investment funds tend to flow into countries with higher interest rates.

This is because they seek greater returns in countries with higher interest rates.

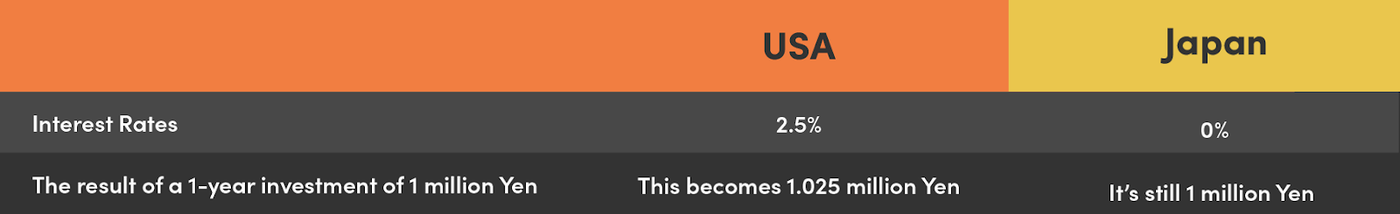

Let’s look at this simple scenario of depositing money in a bank.

For example, suppose the interest rate in the United States is 2.5%, and the annual interest rate for savings in Japan is 0%. In that case, the result of the investment in USD will be 1.025 million Yen after one year, while the investment in Yen will remain 1 million Yen.

Where will you invest your money?

More people will choose the USD.

As a result, the number of people who want to invest more in the USA than in Japan will increase, and investment funds will flow to the USA.

And what will happen if Japanese interest rates stay the same while those in the US keep rising?

You can expect more people to invest in the USA for higher returns.

Similarly, in the FX market, JPY sales with lower interest rates and USD purchases with higher interest rates will also increase.

As mentioned above, investment funds flow to countries with higher interest rates.

However, when the economy is depressed and the market is unstable, the trend of investment funds may also reverse.

In other words, the funds previously invested in pursuit of high interest rates will flow back.

And in fact, the market repeatedly shows this "buying JPY to avoid risk" behavior.

While such trades are sometimes shorter and smaller, there were instances before the Lehman Crisis when JPY carry trade was used to unwind prominent positions.

Analyse why interest rates are rising

Since money tends to flow to countries with higher interest rates, is it possible to make money by selling currencies with lower interest rates and buying currencies with higher interest rates in forex trading? Let’s see, because it gets more complex than that.

Interest rate hikes can be healthy or unhealthy.

A healthy interest rate hike is aimed at curbing economic overheating due to rising prices resulting from rising demand in a healthy economy.

In this case, as the economy remains robust even if the interest rate is raised, the recession will be limited and more people will want to invest money in the country, which is good news for the local currency.

However, in developing economies we often see unhealthy rate hikes to curb the price rise resulting from rising resource prices or a falling currency.

Under these circumstances, it does not mean that the economy is good. It isn't!

Raising interest rates in a bad economy poses a high risk of leading to a recession, and fewer people will invest in the country. Moreover, more people will feel uneasy and decide to withdraw funds, which will negatively impact the currency, causing the exchange rate to decline further and fall into a negative spiral.

Therefore, a rate hike does not necessarily mean that traders will buy the currency; it is necessary to confirm whether the rate hike is healthy or unhealthy first.

To decide whether the rate hike is healthy or unhealthy, watch if the CPI increase rate is too high, if the country's economic conditions can withstand it, or if it already bears the impact of the rate hikes.

When the economy is stable, investment funds flow into countries with higher interest rates.

Rate hikes can be healthy or unhealthy.

Exchange rates may change dramatically around CPI release

As mentioned above, the CPI is an economic indicator significantly impacting the central bank's monetary policy decisions. It therefore receives much attention from the market, and volatility can increase upon its release.

In addition, FX spreads tend to widen before or after the release, so traders might not close a satisfactory deal.

It is crucial to note that you should not hold on to your positions around the release of critical economic indicators.

Before trading, confirm in advance what economic indicators are scheduled to be released so that you will be aware of swift price changes in response to the data.

The CPI in summary

Let’s recapitulate what we have learned today about the CPI.

- The CPI is an economic index used to monitor price changes

- Monetary policy has a significant influence on the exchange rate

- It is important to note that the exchange rate may change dramatically around the release of the CPI

The CPI is not the only economic indicator that affects exchange rates.

There are also other key economic indicators, such as the GDP and various employment surveys.