Financing costs

Find out how we calculate our financing costs, so you can better understand the financing charge or financing credit and other associated potential charges when you trade with us.

CFDs on FX, indices and commodities

If you have an open position on your account at the end of each trading day (5pm ET), the position is considered to be held overnight and subject to either a financing charge or credit to reflect the cost of funding your position (in relation to the margin utilised).

The financing cost is calculated on a per position basis and may be a charge or a credit to your account, depending on whether you hold a buy/long position or a sell/short position. The financing charge or credit also takes into account the impact of our admin fee.

Funding rates for CFD positions

FX and metal (except copper):

Daily financing charge or credit = size of position x applicable funding rate/DAYS**.

Indices and commodities (including copper):

Daily financing charge or credit = value of position^ x applicable funding rate/DAYS**.

Funding rates (or ‘swap rates’ for FX products) vary depending on the instrument and may change on a daily basis. These are quoted as an annual rate. Each instrument has two quoted rates: one for a buy/long position and the other for a sell/short position.

A negative funding rate will result in a charge being debited from your account, and a positive funding rate results in a credit into your account.

How we calculate funding rates

The below table shows how we calculate funding rates for our FX, metals and indices CFDs.

| Funding rates (long/buy positions) | Funding rates (short/sell positions) | |

|---|---|---|

| FX and metals (excluding copper) |

Rates are based on a blend of underlying liquidity providers’ tom-next SWAP rates, adjusted by the instrument-specific admin fee, and annualised. On our financing costs webpage, you can select the instrument that you wish to trade and it will calculate both the annualised funding rate (including the specific admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. |

Rates are based on a blend of underlying liquidity providers’ tom-next SWAP rates, adjusted by the instrument-specific admin fee, and annualised. On our financing costs webpage, you can select the instrument that you wish to trade and it will calculate both the annualised funding rate (including the specific admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. |

| Indices |

Rates are admin fee of 2.5% plus relevant* annualised funding rate, annualised. Represented by a negative rate, and hence a charge. *rate used in the country whose currency is the instruments’ quote currency using the table below. On our financing costs webpage, you can select the instrument that you wish to trade and it will calculate both the annualised funding rate (including the admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. |

When the relevant* one month annualised funding rate is greater than our 2.5% admin fee, the rate used will be the difference between the two, annualised. This is represented by a positive rate, and therefore a credit. When the relevant* annualised funding rate is lower than our 2.5% admin fee, the rate used will be the difference between the two, annualised. This is represented by a negative rate, and therefore a charge. *rate used in the country whose currency is the instruments’ quote currency using the table below. On our financing costs webpage, you can select the instrument that you wish to trade and it will calculate both the annualised funding rate (including the admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates. |

| Index | Reference rate |

|---|---|

| Australia 200 | AONIA |

| China A50 | SOFR |

| Germany 30 | ESTR |

| Europe 50 | ESTR |

| France 40 | ESTR |

| Hong Kong 33 | HKD DEPOSIT 1WK |

| Japan 225 | SOFR |

| US Nas 100 | SOFR |

| Netherlands 25 | ESTR |

| Singapore 30 | SORA |

| US SPX 500 | SOFR |

| Taiwan Index | SOFR |

| UK 100 | SONIA |

| US Russell 2000 | SOFR |

| US Wall St 30 | SOFR |

| Spain 35 | ESTR |

| Switzerland 20 | SARON |

| ChinaH Shares | HKD DEPOSIT 1WK |

| Japan 225 (JPY) | TONA |

Admin fee table

| Instrument | Admin fee |

|---|---|

| ZAR pairs | 2.00% |

| Other pairs | 1.00% |

Financing costs affected by holidays and weekends

Different asset classes settle on different days.

FX and metal (except copper) trades typically settle on a T+2 basis, which effectively means that weekend financing is usually applied two days earlier on Wednesdays (tripling the usual daily rate), although this timeline is similarly impacted by public holidays. Please note that USD/CAD settles on a T+1 basis and therefore has its three-day financing applied on a Thursday.

Indices and commodities (including copper) typically factor in weekend financing on a Friday (tripling the usual daily rate), although this timeline is also similarly impacted by public holidays.

Accordingly, the actual funding rate on any given day may reflect more than one day’s costs.

No financing charges or credits are applied to clients’ accounts over the weekend.

See our FAQs for examples of financing costs for CFD positions.

CFDs on commodities (plus copper)

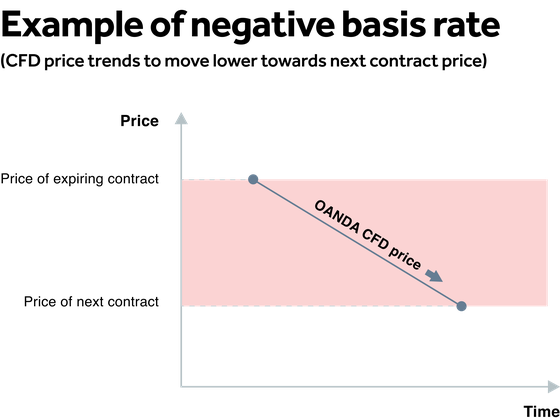

OANDA’s commodity CFDs (including copper) do not have an expiry date. To achieve this, OANDA generates its commodity CFD price by applying a premium or discount rate (called the "basis rate") to the price of the underlying active futures contract.

When a futures contract is near its expiry, the basis rate for the next contract is calculated using the prices of the expiring contract and the next contract. This application of the basis rate causes the CFD price to converge towards the active future contract price as the active futures contract approaches its expiration date by moving the CFD price either higher or lower. The direction of this movement is determined by the price of the active futures contract and the CFD price. For example, if the price of the active futures contract is higher than the CFD price, the application of the basis rate will cause the CFD price to move higher to converge towards the active futures contract.

The funding rate applied on commodities at the end of the trading day (5pm ET) is intended to offset the price movements created by this pricing methodology, and as such could be a credit or debit depending on whether you are long or short and whether the price movement is positive or negative and the impact of the additional admin fee.

Financing charges or credits are calculated as follows:

Financing charge or credit = size of position x applicable funding rate x [trade duration (in days) / DAYS**] x conversion rate to account currency.

OANDA charges financing on commodity (including copper) CFDs using the basis rate with a % admin fee applied.

For long positions, your account will be debited the basis rate plus a 2.5% admin fee. For short positions, your account will be credited the basis rate minus a 2.5% admin fee (which could result in a charge where the basis rate is less than the admin fee).

CFDs on cryptocurrencies

The financing charges for cryptocurrencies CFDs are as below:

Daily financing charge = (position size x funding rate) x 1/DAYS**

1 day financing will be charged Monday to Thursday; with 3 days financing charged on Friday.

The funding rate for all crypto CFDs will be as follows:

Long positions = - 25% - SOFR

Short positions = - 25% + SOFR

Rates and costs for today's date are approximate and will not be finalised until 5 pm ET.

*Long financing charge = the financing charge on a long position of the given instrument

**DAYS for MT4 = 360 and for MT5 = 365

^where value of position = size of position x price at the end of the trading day (5pm ET).

^^Short financing charge = the financing charge on a short position of the given instrument

Financing charges are based on positions of 100,000 units for FX, 100 units for Share CFDs, 1 unit for Indices, 10 units for Metals excluding Copper and 100 units for Commodities including Copper.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Transparent trading costs

We are upfront about our fees so you know how much you are paying when you trade with us.

What are financing costs?

Financing costs can affect your cost of trading, so it's important to understand how financing works.

When can I trade with OANDA?

Our operation hours coincide with the global financial markets. Find out when you can trade with us.