US elections and the currency markets

The US presidential election is one of the most important events on this year’s economic calendar.

Updated: 2nd November, 2020

Published: 17th August, 2020

With the 3 November 2020 election upon us, it would not be unusual to expect the US dollar and other currencies to be reacting to election news and developments on a daily basis at this stage. Tuesday is the last day Americans can vote in person or get their ballots into the mail, and with record voter turnouts already recorded, the outcome is still anyone's guess.

We are not living in ordinary times. COVID-19 has severely curtailed global economic activity. With the US economy struggling due to the pandemic, many Americans – including investors and traders – have been focused on COVID instead of the presidential election, which seems to have garnered much less attention than we would typically expect.

But what does this mean for the currency markets as the election saga unfolds? Will historical election year trends be reliable enough to guide your FX trading strategy when the US economy is not functioning normally? The election provides an excellent opportunity to examine the data and trends from previous elections and look for patterns that could repeat themselves.

Presidential election cycle

The presidential election cycle theory examines the connection between the US presidential election, which is held every four years, and patterns in the financial markets.

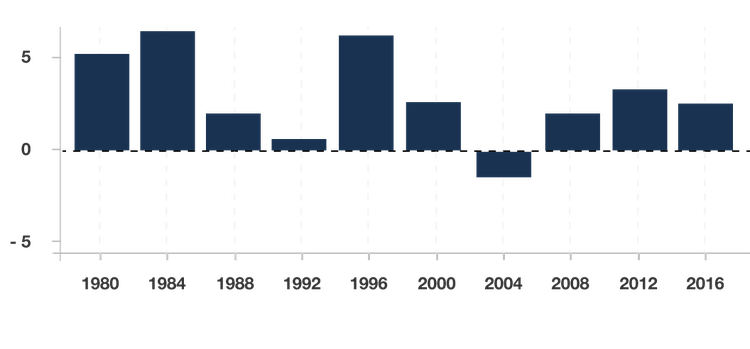

An examination of the association between US exchange rates and presidential cycles indicates a significant economic and statistical relationship. Research suggests the US dollar has shown greater gains when a Democratic president holds the highest office compared with a Republican White House.*

The researchers found the US dollar appreciated during the term of a Democratic president but depreciated over the four-year term of a Republican president. This conclusion was based on a review of the years 1957-2016, using the exchange rate of the US dollar against several major currencies.

One explanation of this phenomenon is that Democratic presidents often implement policies that stimulate short-term economic growth and higher consumption, which causes the US dollar to appreciate. A Republican administration, however, is usually identified with a pro-business agenda, which may result in a weaker dollar. President Donald Trump has often said that he wants to see a lower US dollar in order to make US exports more competitive and has not hesitated to criticise the Federal Reserve for not reducing interest rates, which would cause the greenback to depreciate.

Impact of the election on EUR/USD

When we talk about US dollar performance, we are talking about a currency pairing, so let’s examine two of the most important currency pairs in forex trading. The first one is EUR/USD - the most popular pair.

According to the theory we explored earlier, a significant change in the value of the US dollar on the day after election day is unlikely, but whether it will appreciate or depreciate in the months after the polls will be largely dependent on which candidate wins. If Trump wins, the impact on the euro (EUR/USD) would be a lower US dollar.

With Biden bound for the White House, how will you trade?

Already have a live trading account? It is easy to fund your account using one of the following payment methods

Impact of election on USD/CAD

USD/CAD is the fifth-most traded currency pair. Similar to EUR/USD, Trump winning could result in a lower US dollar against the Canadian dollar. Conversely, the US dollar would appreciate if Joe Biden becomes president, according to this theory. As such, traders could expect to see the effect of the election on the greenback, either way.

Will the US dollar strengthen in 2020?

Over the past few months, the US dollar has retreated against the major currencies. Although the US dollar is considered a safe-haven currency, investors have not been afraid to buy riskier assets, despite the severe economic conditions caused by COVID-19. This has meant that minor currencies such as the Canadian and Australian dollars have appreciated against the greenback in recent months.

EUR/USD is up 4.9% so far in 2020, and while USD/CAD has appreciated in 2020, the pair has fallen 5.7% since April. If this trend continues, we can expect to see the US dollar turn in a losing year in 2020.

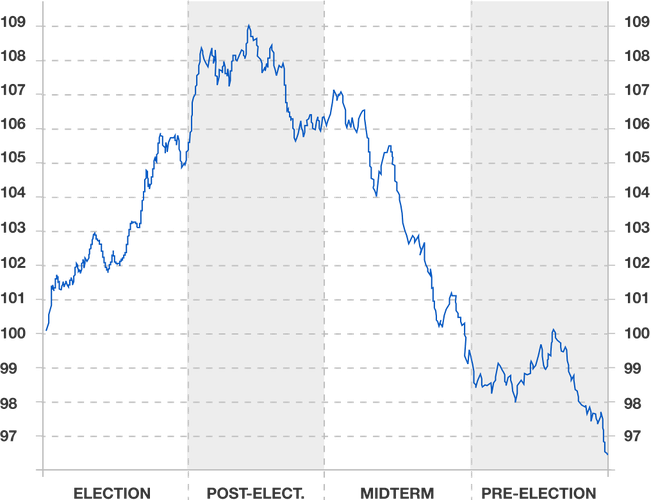

The following charts show the movement of the US dollar in recent election years:

US Dollar-Index Election Cycle

The US may elect Democrat Joe Biden to the White House, however, given the current state of the economy with only one month before year’s end, it’s unlikely that this event alone would dramatically reverse the downward movement of the US dollar, despite the theories we’ve explored. And while it’s always difficult to predict currency movements, the euro and the Canadian dollar could end the year with gains against the dollar.

Disclaimer: This article is for general information purposes only and does not take into account your personal circumstances. This is not investment advice or an inducement to trade. The information shared is for illustrative purposes only and may not reflect current prices or offers from OANDA. Clients are solely responsible for determining whether trading or a particular transaction is suitable. We recommend you seek independent financial advice and ensure you fully understand the risks involved before trading. Leveraged trading is high risk and not suitable for all. Losses can exceed investments. Opinions are the authors; not necessarily that of OANDA Global Corporation or any of its affiliates, subsidiaries, officers or directors.

Kenneth Fisher

Market Analyst, OANDA

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth covers a broad range of markets including forex, equities and commodities. Based in Israel, his work has been published in Seeking Alpha, FXStreet and Investing.com.

* Ashour, Rakowski and Sakar, Review of Financial Economics, May 2018

Exclusive to OANDA

Election impact on stock markets

Commodities and the US election

How to trade during the US election