Effects of US elections on commodities

With the 2020 US election less than 90 days away, the world is waiting with bated breath. Will the American public re-elect Donald Trump or send Democratic candidate Joe Biden back to the White House, this time as President of the United States?

17th August 2020

Despite the uncertainty over which way the vote will swing after America goes to the polls, we know one thing for sure: the election will have a significant impact on the world’s financial markets. While the effects will, of course, be felt across all asset classes, potential trading opportunities could be revealed when it comes to commodities, in particular gold and oil.

Historical trends in gold

When attempting to forecast the extent to which the US election will impact commodities, it’s useful to take a look back over the years and better understand price movements during previous campaigns.

How presidential elections affect gold prices

When it comes to the gold market, one discernible pattern we’ve seen is that the yellow metal has shown gains over the entire election year not just during the campaign itself, starting with sharp gains in January:

January 2008 10.9%

January 2012 11.0%

January 2016 5.3%

Interestingly, the January following the election is also often a good month for gold:

January 2009: 5.3%

January 2017: 5.2%

So, with this in mind, how likely is it we’ll see a repeat performance with the 2020 US election? With gold price up more than 30% so far this year, there’s every chance it will continue to rise between now and the end of January. Of course, any predictions regarding US presidential election cycles are based on a small sample size.

Another factor to keep in mind is the effect of COVID-19 on global markets. Gains in gold prices this year and through to January 2021 could be reflective of the severe economic conditions and unprecedented amount of monetary and fiscal stimulus, rather than the presidential cycle, as the metal is a safe-haven asset and inflation hedge. Still, it’s certainly useful to look at historical trends and identify patterns that could repeat themselves.

The chart below indicates that historically, the post-election year is the worst performer, with gold prices experiencing average gains of just 2.27%. The second year of the presidency is the strongest for gold prices, with average gains of 12.82%; while the third year shows average gains of 11.2%. And finally, historical data suggests average gains of 8.9% during the election year itself.

Source: Sunshine Profits

With Biden bound for the White House, how will you trade?

Already have a live trading account? It is easy to fund your account using one of the following payment methods

A volatile year for oil

Gold isn’t the only commodity that will feel the effects of the US election. The oil market could also experience price fluctuations despite the fact that it remains relatively flat right now.

So far, 2020 has been extremely volatile when it comes to the price of oil. Brent Crude began the year at around USD67.00 a barrel but dropped as low as USD17.00 in April. Similarly, West Texas Intermediate started 2020 at around USD61.00 a barrel, bottoming out around USD11.00 in April.

The cause of this was clear. Thanks to the devastating effects of COVID-19, country after country shut down their economies, at the same time as Russia and Saudi Arabia embarked on a brutal oil price war, resulting in a sheer drop in the spring of this year. However, the price of oil has since recovered, and today Brent Crude is trading at around USD45.00 while WTI trades at approximately USD41.00 a barrel.

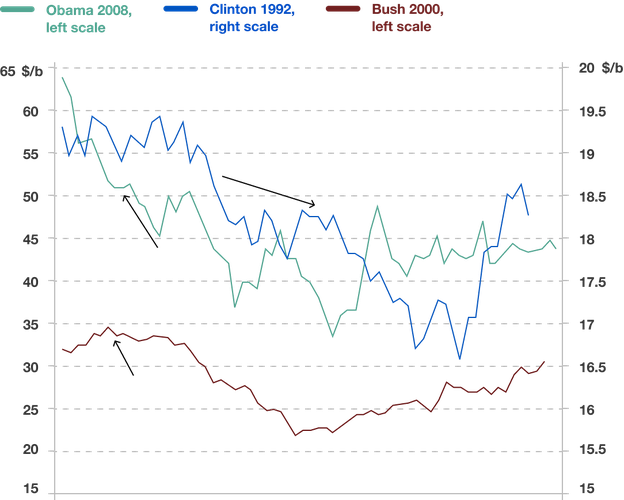

So how do oil prices typically move during a US presidential cycle? Although the trends may be more difficult to spot than gold, we can still identify patterns based on previous elections. The chart below indicates that oil prices drop in the weeks after Election Day, but then recover by the end of the following January.

Nov-early Feb Dated Brent Oil Price, 1992, 2000 and 2008

Source: S&P Global Platts

Trading opportunities arising from the election

At the end of the day, whoever is elected as the next US president will be faced with the monumental task of rebuilding the American economy after what can only be described as an extremely challenging year. What impact the election results will have on commodities prices is anyone’s guess at the moment. In the meantime, however, in order to take advantage of market volatility caused by the US election, it’s essential to remain nimble and continue to manage your risk. After all, the markets are not immune to political risk, and neither is your portfolio.

Disclaimer: This article is for general information purposes only and does not take into account your personal circumstances. This is not investment advice or an inducement to trade. The information shared is for illustrative purposes only and may not reflect current prices or offers from OANDA. Clients are solely responsible for determining whether trading or a particular transaction is suitable. We recommend you seek independent financial advice and ensure you fully understand the risks involved before trading. Leveraged trading is high risk and not suitable for all. Losses can exceed investments. Opinions are the authors; not necessarily that of OANDA Global Corporation or any of its affiliates, subsidiaries, officers or directors.

Kenneth Fisher

Market Analyst, OANDA

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth covers a broad range of markets including forex, equities and commodities. Based in Israel, his work has been published in Seeking Alpha, FXStreet and Investing.com.

Exclusive to OANDA

US election and the currency markets

Election impact on stock markets

Markets watch as election race heats up