What it means to trade ‘long’ or ‘short’ | OANDA

What it means to be ‘long’ or ‘short’. Our article describes the differences between the two position types and explains how they relate to asset ownership.

What it means to be ‘long’ or ‘short’. Our article describes the differences between the two position types and explains how they relate to asset ownership.

In this article you will learn:

- The story of “buy low, sell high”

- Introduction to “short” and “long” positions

- Key differences between short and long positions

Buy low, sell high

It is often believed that 'buy low and sell high' is the key to investing. This statement is based on the belief that in order to sell something, you have to own it first.

For example, in the past this would be applicable to a gold, wheat or cotton trader, who wanted to achieve the best possible return by ensuring these commodities were bought when supply was high and price was low. Selling these when conditions flipped allowed traders to make profits. For example the price went up due to demand being high or supply reduced.

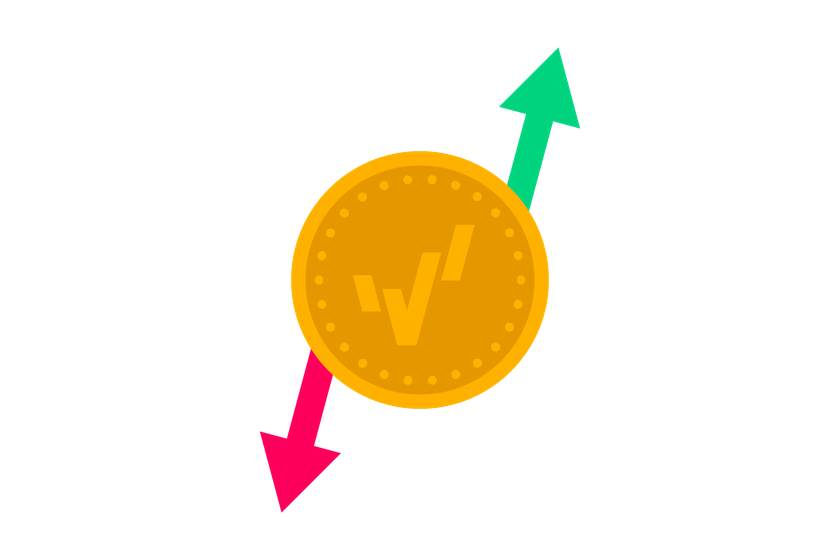

Entering a position that will profit from a rise in price is known as taking a ‘long position’.

As trading evolved and new financial instruments, such as shares, were created, traders wanted to be able to profit in both rising and declining markets.

This led to the concept of ‘short positions’.

What does it mean to ‘go long’ or to ‘go short’?

Taking a long position by buying an asset that you hope to gain in value is very natural, however taking a short position by selling an asset you do not own that you hope to fall in value is a little bit less intuitive.

Long position

If you think the price will rise you would take a ‘long position’ by buying the asset with the aim to sell later at a higher price.

Short position

If you think the price will fall you would take a ‘short position’ by selling the asset with the aim to buy later at a lower price.

The concept of going ‘short’ is often difficult for many people to grasp but it's actually relatively simple. Essentially taking a ‘short position’ is the selling of a borrowed asset that has to be returned to the owner when the ‘short position’ is bought back.

Derivatives

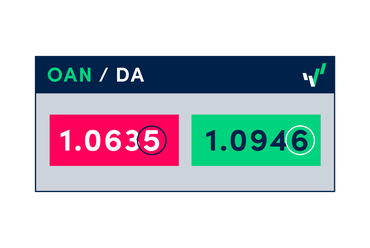

When you trade with OANDA you are trading derivatives, meaning that you can speculate on price movements without owning the underlying assets.

The nature of these derivatives allow you to enter short positions on a variety of products without having to worry about borrowing the underlying asset.

Key differences between long and short trading

A quick recap:

| Long position | Short position |

|---|---|

| You buy to open a position. | You sell to open a position. |

| You make a profit when the price moves up. If the price moves down, however, you would make a loss. | You make a profit when the price moves down. If the price moves up, you would make a loss. |

| Aim to sell the asset at a higher price. | Aim to buy the asset at a lower price and return it back to the lender at the time of closure. |

Leveraged trading requires good trading education. Now that you know the difference between going long and short, why not find out about the different order types available at OANDA? Once you’ve opened a live or demo account, you can start implementing some of the trading strategies covered in our learn section.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more