What is TradingView?

TradingView is a web-based platform, also available in a browser and as a mobile app, that offers a user-friendly interface with a wide range of customizable charts, drawing tools, and indicators. It allows you to analyze multiple markets, track price movements, and identify trading opportunities. Whether you are a beginner or an experienced trader, the tools of both OANDA and TradingView are a powerful combination to cater to your needs.

TradingView plans

TradingView offers four different account levels: Free, Essential, Plus and Premium. All levels of paid subscriptions allow TradingView API connection and order execution. Each account level unlocks additional features and benefits, which vary according to your TradingView pricing plan.

Benefits of paid account plans include:

- Essential accounts provide access to advanced features such as multiple charts, custom time intervals, and bar replay on intraday charts.

- Plus accounts offer even more features, including charts based on custom formulas and data exports.

- Premium accounts provide the highest level of access, with features like more indicators per chart and auto chart pattern detection.

Become an Elite Trader and get access to a monthly subscription of TradingView for free.1

Placing trades on your OANDA account through TradingView

With your OANDA account being connected with your TradingView account, you can use its interface to place trades directly from it.

Open the TradingView chart of the instrument you want to trade.

OANDA’s trading platform gives our clients access to all major forex pairs five days a week, 24 hours a day. Majors are the most traded forex pairs in the world, all involving the US dollar, such as the EURUSD.

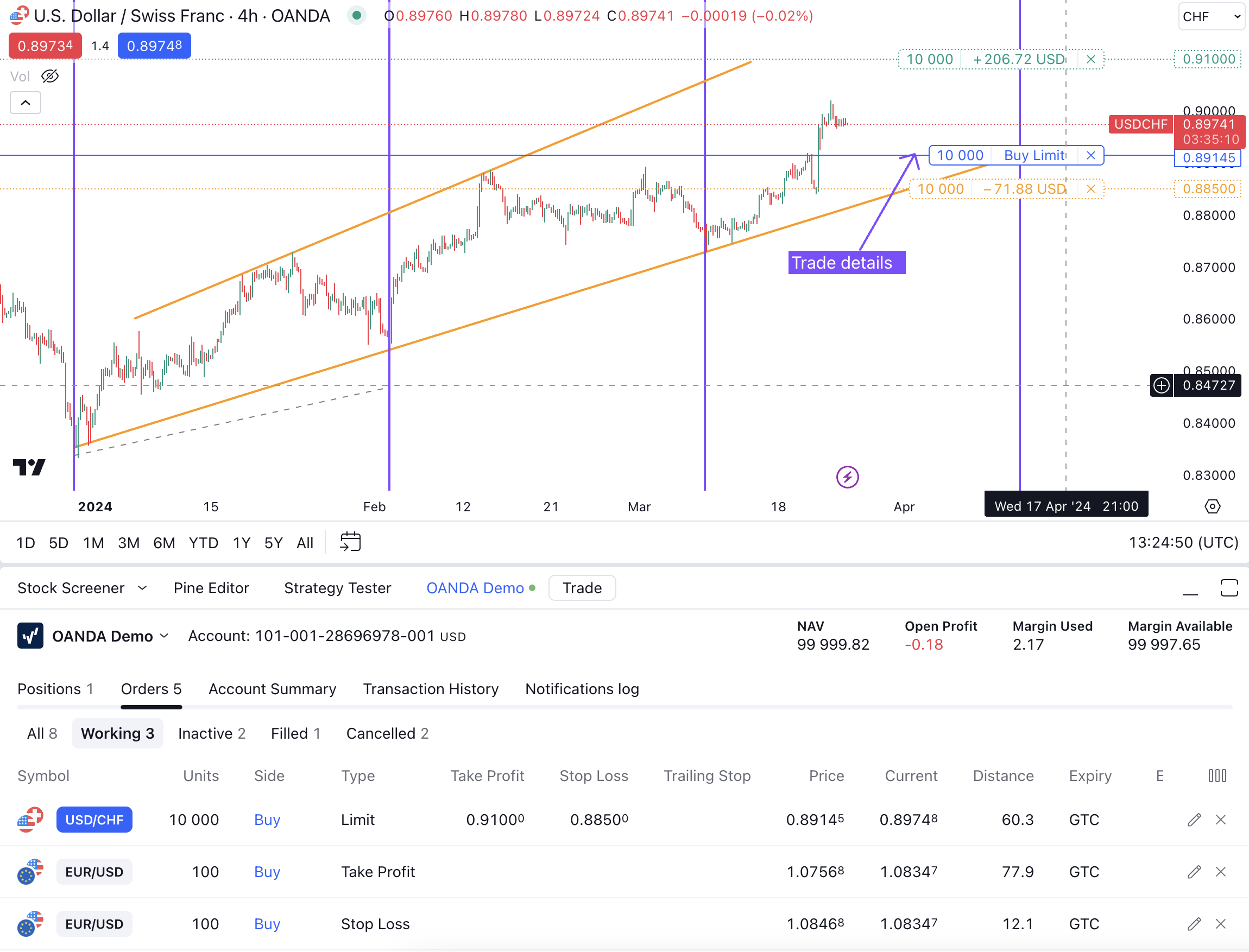

Use the various TradingView charting tools and indicators to analyze the market and identify potential entry and exit points.

TradingView offers 12+ chart types and 50+ drawing tools with adjustable settings. For this example, we’ll focus on a simple support trend line and a cycle.

Let’s say you have spotted a support trend line that appears to be cyclical and driving the USD/CHF uptrend. You believe that around April 15th, the price will drop to the price indicated by the trend line, and you want to place a long position hoping for the cycle to continue.2

Let’s walk through how a trader can make a trade with the stop loss and take profit levels activated.

Decide whether you would like to open a long or short position.

Once you have determined your trading strategy, click on the “Buy” or “Sell” prices located on the chart and the order ticket will appear. The difference between the buy and sell price is the trading cost.

OANDA is one of the largest brokers in the world and, as a result, we are able to offer you extremely competitive spreads on all of our products. This keeps your costs as a trader down. The sell price on the left is the prevailing market price at which you can sell immediately. The buy price on the right is the prevailing price for immediate purchase. Select whether you want to buy or sell.

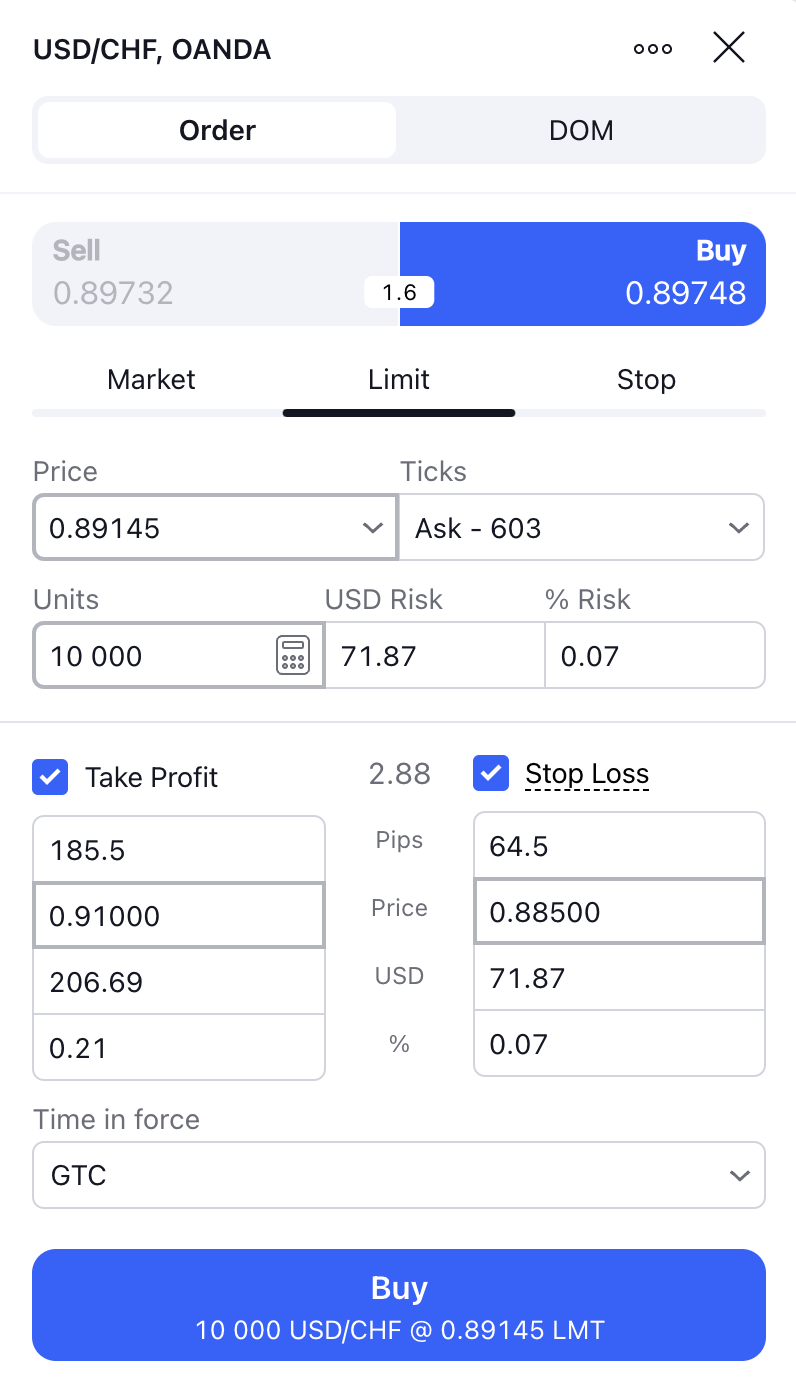

For this USD/CHF example, we’ll place a buy limit order.

In the charting panel, you will notice the instrument and the buy and sell price.

Click the price on the right, highlighted in blue, to bring up the “buy ticket” dialog on the screen.

Choose your order type and decide how to enter the market.

On the order ticket, you have the option of choosing the order type. A Market order is for immediate entry, Limit order is to enter the market at a later time when the price indicated as entry is met. You will find options to enter the units or size of your USD/CHF buy order and the contingent orders associated such as take profit level and stop loss.

Place your trade

Double-check your trade parameters and ensure they align with your trading strategy. Once you are satisfied, click the "Buy" button to rapidly transmit the trade.

TradingView will then transmit the trade details to OANDA’s trading platform, which is engineered for reliability and speed. At that point, the market order will be rapidly executed in your OANDA account and the order will be visible in your TradingView account.

How to use TradingView to monitor and modify your trades

Now that you have an open order in your account, you can monitor it via TradingView or through one of OANDA’s trading platforms. Additionally, if you are on the go, you can monitor your account with OANDA’s native apps for Android, iPhone, and tablet devices. It is very easy to stay connected with your trades and monitor them via the same OANDA account login.

Referring back to the USD/CHF example, you can monitor your open positions, place orders and manage them directly from TradingView too, including modifying stop-loss levels, taking profits, or closing positions.

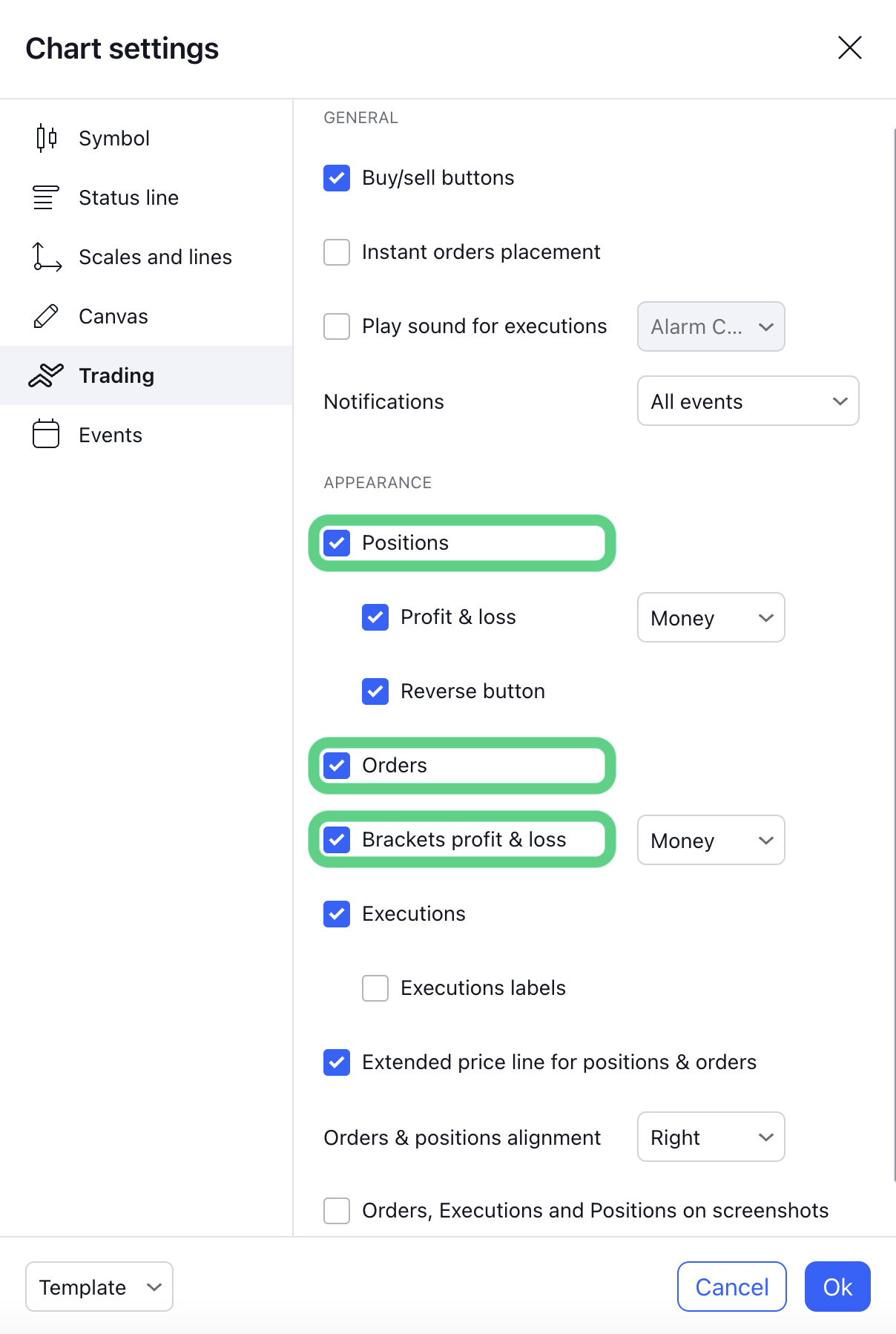

First, you should be able to see the limit order entry price, take profit, and stop loss level as horizontal lines in your chart. If you don’t see them, customize your TradingView chart by right-clicking anywhere on the chart and selecting “Settings”. Then, navigate to the “Trading” tab and make sure “Positions”, “Orders”, and “Brackets profit & loss” have a checkmark next to them.

Also, TradingView allows you to make adjustments from the charts.

In this USD/CHF example, you might want to move the stop loss up, closer to the trend line, to tighten the risk. You can simply left-click on the line you want to modify and move it to where you want to place the order.

On the TradingView chart, you can move any stop loss, take profit, limit entry, or stop entry orders by using the left-click function.

TradingView charts are powerful and allow the creation of multiple different types of chart layouts depending on a trader’s individual needs. You can find here some examples of intermarket analysis utilizing TradingView charts.

TradingView with OANDA, the partnership that makes your trading easy

By linking your TradingView account to your OANDA account, you can seamlessly execute trades and access real-time market data. With OANDA and TradingView combined, you can unlock new possibilities and take your trading to the next level.

Learn more about the OANDA x TradingView partnership, explore how to link it with your OANDA account, and read through the most frequently asked questions.

1 TradingView plan reimbursement is one of the many benefits for those who meet the criteria of the Elite Trader Program. Reimbursement varies per monthly volume traded. Limited-time offer. Terms and conditions apply.

2 The USD/CHF price and charts as observed on March 25th, 2024. For illustration purposes only, not a trade recommendation.

Disclaimer

Past performance is not indicative of future results.

This article is not investment advice or a solution to buy or sell instruments. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.