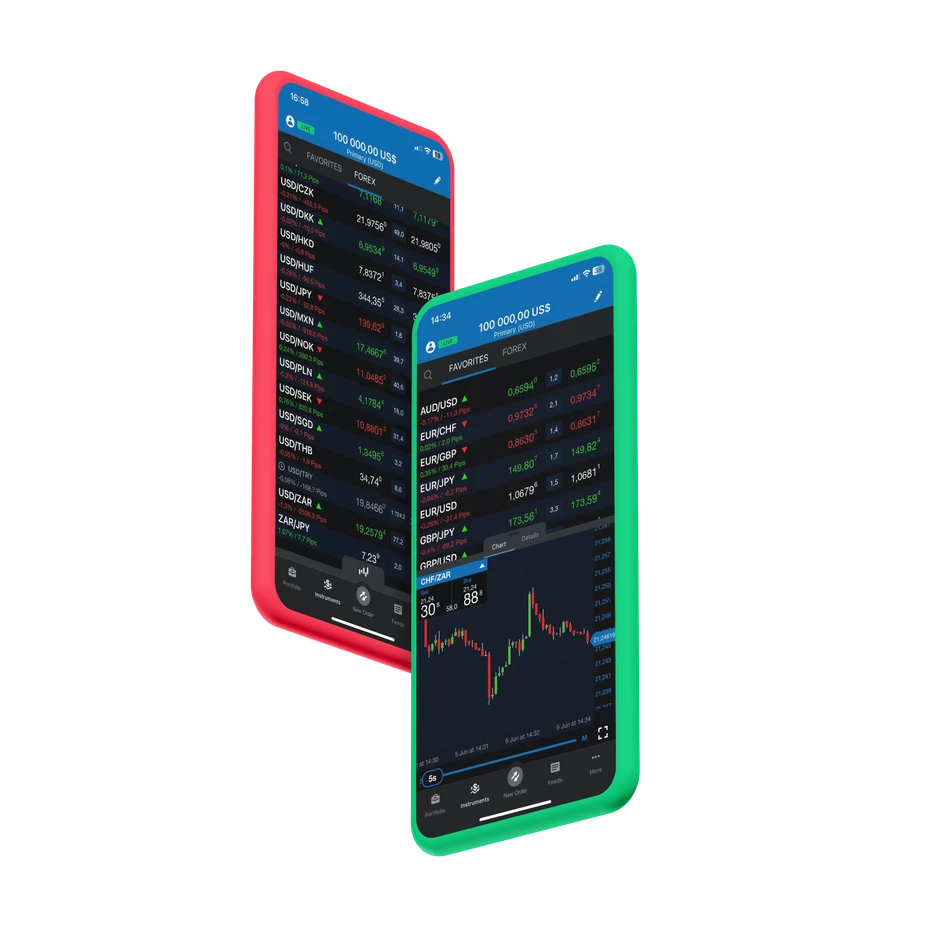

OANDA Mobile

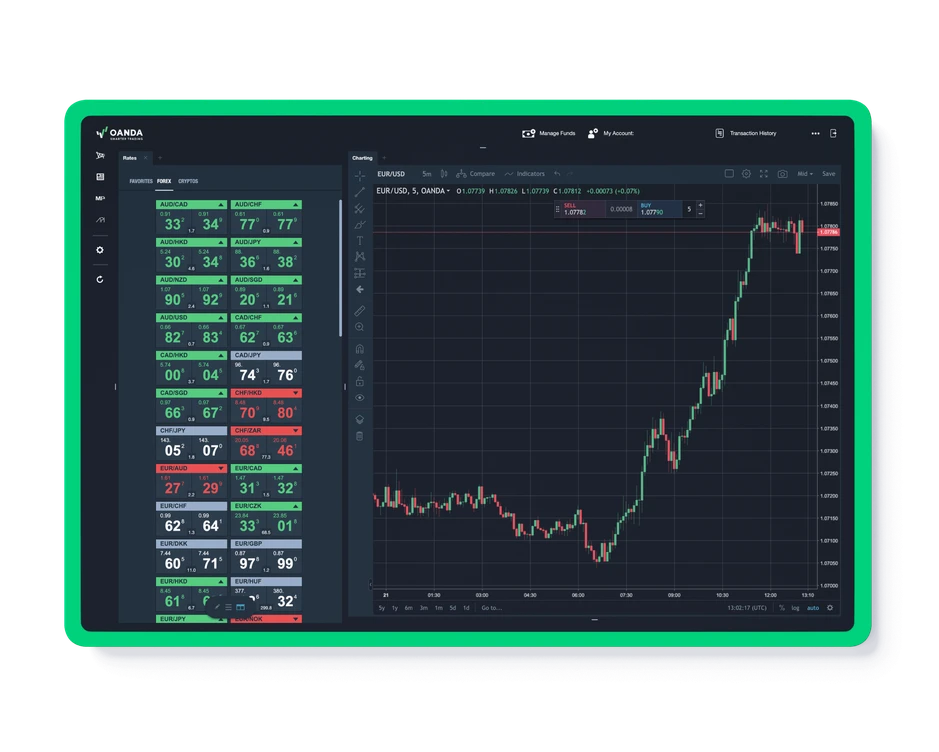

OANDA Web

TradingView

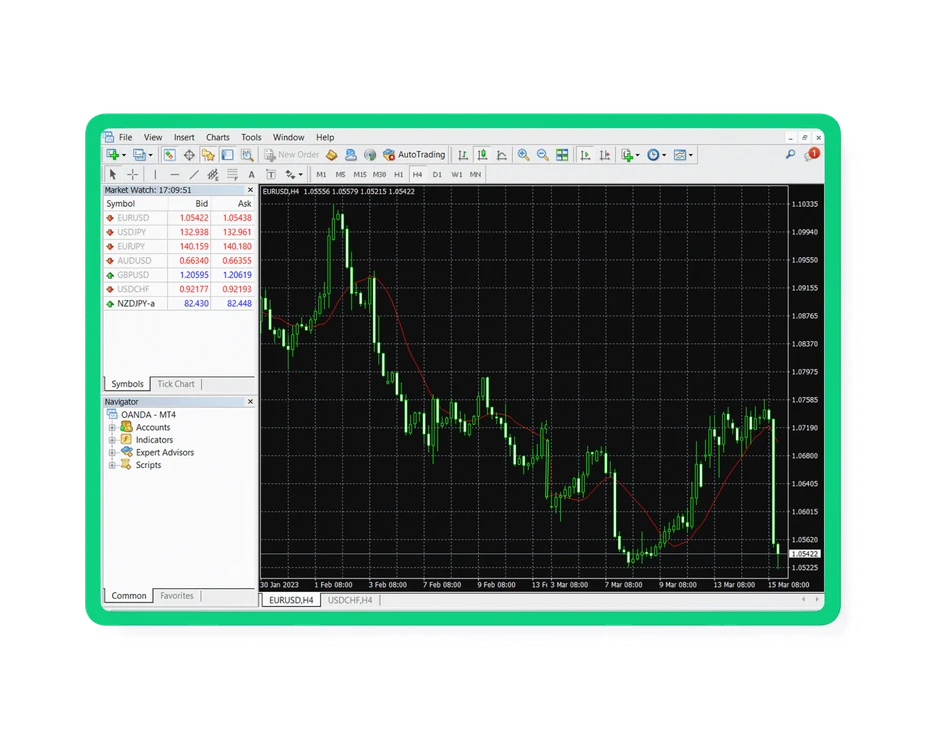

MT4

Our Android and iOS apps allow you to access our full range of Forex pairs. Our apps have the same functionality as our browser-based platform, so you have more control of your trades, even when you're on the move.

Trade smarter with your OANDA account on TradingView. Take advantage of supercharged charting tools, join the largest financial community on the web, and more.

Our platforms offer versatile features to help you trade smarter wherever you are. Here’s how our platforms compare.

| Platform | Instruments | Mobile trading | Price alerts | Advanced order types | Cost |

|---|---|---|---|---|---|

| OANDA Web | Forex | 𐄂 | 𐄂 | 𐄂 | Free |

| OANDA Mobile | Forex and crypto | ✓ | ✓ | 𐄂 | Free |

| TradingView | Forex | 𐄂 | ✓ | 𐄂 | Free with rebate** |

| MetaTrader 4 | Forex | ✓ | 𐄂 | MT4 Premium Tool Pack | Free |

**Cost of TradingView Essential plan is eligible for rebate when terms and conditions are met. More information about TradingView.

Go from application to trading in just three steps.

Apply

Get approved

Log in, fund and trade

Our more than 25 years of experience allow us to offer competitive spreads, excellent customer service, and effective tools and platforms.

Voted Most Popular Broker three years in a row (TradingView Awards 2022, 2021, 2020).

*Named Best in Class for Research and Ease of Use (ForexBrokers.com 2023 Annual Awards) Voted Best US Forex Broker (Compare Forex Brokers Awards 2023) Voted Best Low Cost Broker (ADVFN International Financial Awards 2023) Voted Best Forex Broker two years in a row (TradingView Broker Awards 2021, 2020) Awarded highest client satisfaction for mobile platform/app (Investment Trends 2021 US Leverage Trading Report, Margin Forex) Awarded highest overall client satisfaction (Investment Trends 2021 US Leverage Trading Report, Margin Forex)

*Best Trading Tools winner (Online Personal Wealth Awards 2021)

Our hours of operation are linked with the global financial markets. In the US, trading is available from approximately 5 p.m. Sunday to 5 p.m. Friday (New York time). Please note: these times are subject to change during daylight savings time.

Margin trading allows you to leverage the funds in your account to generate larger profits by depositing just a fraction of the total value of your trade. This means you can enter into positions larger than your account balance. The downside is that you can potentially incur significant losses if the trade moves against you.

Below are the three most common reasons why your trade was not successful:

- The ‘Bid’ or ‘ask’ price did not reach your specified target

Your trade was not executed because the applicable market price did not reach the specified price. Depending on your chart settings, the chart you are viewing may not be showing the type of price appropriate to your trade.

Many charts on our trading platform use the average price, meaning an average between the ‘bid’ and ‘ask’ prices, so they don’t consider the spread. The spread is the difference between a financial product's actual buy and sell price at any given time.

A long (buy) trade will open at the ‘ask’ and close at the ‘bid’ price. A short (sell) trade will open at the ‘bid’ and close at the ‘ask’ price. With our mobile app, you can see the full range of prices by adding a ‘low bid’ or ‘high ask’ price overlay to the chart by selecting Overlays, then the Min Overlay to show the lowest bid and Max Overlay to show the ‘highest ask’ price.

With our web platform, you can choose to have your candles drawn by the ‘mid’, ‘ask’, or ‘bid’ price.

Note: the MT4 platform only shows the ‘bid’ price. To see the historical ‘low/high’ and ‘ask/bid’, go to the OANDA trading platform and follow the above mentioned steps. - Insufficient funds

On your trade ticket (new order window), you can type in the size of the trade you wish to open to see the margin needed to open that trade. If you place a market order, our platform will tell you immediately if you need more margin (available funds) to place the trade. If you are trying to place an entry order, our platform will not stop you from placing the order if you do not have the necessary current margin (available funds). Still, the order will fail to execute if you have not increased the funds available in your account when the pre-specified entry price is reached. - Take profit or stop loss was set too close to your order price

The third reason your order likely did not trigger is that your take profit or stop loss was too close to your order price. A valid take profit and stop loss must be placed farther away than the current spread on your trading financial instrument. As spread is dynamic and can increase during news events or volatile market hours, we recommend your take profit and stop loss always be set at a range farther away than the maximum spread for any instrument. Review our historical OANDA spreads to determine your take profit and stop loss levels. Be sure to click' Maximum' in the top-right corner of the spread chart (please see below).

We’re here to help whenever you have questions about your trades or orders. Below is information that will help you with this process.

Please submit all the relevant information about your trades or orders so we can investigate and provide you with a detailed analysis. You can do this by clicking on and filling out the Trade enquiries form. Once you have downloaded and completed it, you can email it back to us.

Please submit the form using the following format:

- Email the form to frontdesk@oanda.com

- In the subject line, include "Trade investigation" followed by the instrument involved, such as EUR/USD, BCO/USD, UK100/GBP, or XAU/USD. Attach the corresponding form.

To ensure accurate and speedy processing, please provide as much information as possible about your trades or orders, such as those listed below:

- Your username and account ID number (for example, 001-001-1234567-001) or MT4 account ID (e.g.,7654321)

- The trading platform used at the time (such as fxTrade or MT4). Also, which medium you used to access the platforms (such as desktop, mobile, web, or any third-party system)

- The ticket number or transaction ID of the trades or orders involved

- The instrument(s) involved

- The time and date of the transaction

- Please describe the issue with your trades or orders

- Screenshots of your platform regarding the trades or order

- What remediation or assistance you would like us to provide

Trade inquiries vary in complexity, so the time it takes to respond to them also varies, but you should receive a response in two to five business days.

See our complete list of frequently asked questions.

**The placing of stop-loss orders or other risk management orders intended to limit losses to specific amounts may be ineffective because market conditions may make it impossible to execute such orders.

^Competitive spreads are available on our core pricing account, where clients can enjoy low spreads with a commission.

25 years of experience has created cutting-edge tools and powerful platforms with transparent pricing.

Globally recognized forex broker

We offer 70 major and minor currency pairs, a user-friendly app, and a range of forex trading platforms, including the OANDA Trade platform, MT4, and TradingView. Through our partnership with Paxos, you can spot trade eight popular cryptocurrencies using our crypto trading platform.

Powerful partner tools and APIs

Identify potential trading opportunities using our powerful analysis tools and partner APIs.

TradingView partnership

Benefit from OANDA’s pricing and execution when trading on TradingView’s social platform.