Margin requirement will depend on the amount of leverage allowed. The maximum leverage allowed is determined by the regulators and may differ depending upon the instrument.

At certain times and in certain market conditions, our spreads could be wider than usual.

- This includes the opening and closing of markets

- Major international or geopolitical events which have an impact on the relevant market(s) in other particular circumstances

To ensure you can cover any losses you might incur on your positions, we require sufficient collateral. This collateral is typically referred to as margin.

Margin rates

We are regulated by the NFA and they set our margin and leverage rates.

Limits on leverage

The Commodity Futures Trading Commission (CFTC) limits leverage available to retail forex traders in the United States to 50:1 on major currency pairs and 20:1 for all others. See our regulatory and financial compliance section.

Profit and loss

When you trade on margin, you can leverage the funds in your account to potentially generate large profits relative to the amount invested. The downside of margin trading is that you can just as quickly incur potentially significant losses if the markets move against you.

Open an account in minutes.

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Rate volatility and changes in global market liquidity can result in large spread increases around market openings and closings, following news announcements, and during times of uncertainty. At such times, we widen our spreads to reflect market conditions.

If you leave trades open during the weekend or halted markets, you cannot close them until the markets reopen. Note that rates may change significantly or "gap" when trading resumes. If rates move against you, a margin closeout may be triggered when trading resumes.

Margin calls are an important aspect of leveraged trading. If the Net Asset Value (NAV) of your account falls to a level that is below the minimum regulatory margin requirement, a margin call will get triggered. If this happens, we could ask you to deposit more funds into your account to increase your account Net Asset Value or close open positions to return your margin closeout value to greater than your regulatory margin used.

If your margin closeout value is less than your regulatory margin used, you will receive a margin call alert by email. Margin call alert emails are sent at 3:45 p.m. (Eastern time) daily. Margin call emails will only be sent out if your account falls below the regulatory value.

When an account remains under-margined for two consecutive trading days, all open positions will be automatically closed using the current OANDA rates at the time of closing. If trading is unavailable for certain open positions at this time, they will be automatically closed using the current OANDA rates when the markets for those instruments re-open.

A margin closeout can also occur if the margin closeout percent reaches 100% at any time, resulting in the closure of all open trades in that account. If trading is unavailable for certain open positions at the time of the margin closeout, those positions will remain open and the OANDA platform will continue to monitor your margin requirements. When the markets reopen for the remaining open positions, another margin closeout may occur if your account remains under-margined.

You can avoid margin closeouts by reducing the amount of margin you are using. This can be done by closing some trades or by adding more funds to your trading account. Find out more about our margin closeout rules.

Note: In a fast-moving market, there may be little time between warnings, or there may not be sufficient time to warn you at all. Be mindful of the “margin closeout percent” field in the account summary of the OANDA user interface. The closer the margin closeout percent is to 100%, the closer you are to a margin closeout.

With over 25 years of experience, OANDA offers leading tools, powerful platforms and transparent pricing.

Trade more, get more

Earn cash rebates from US$5 to US$17 per million with our Elite Trader program. Designed exclusively for our high volume traders, this is the program that gives you more, the more you trade.

Calculating profit and loss

See how you can calculate profit and loss on your trades when you take a position with us.

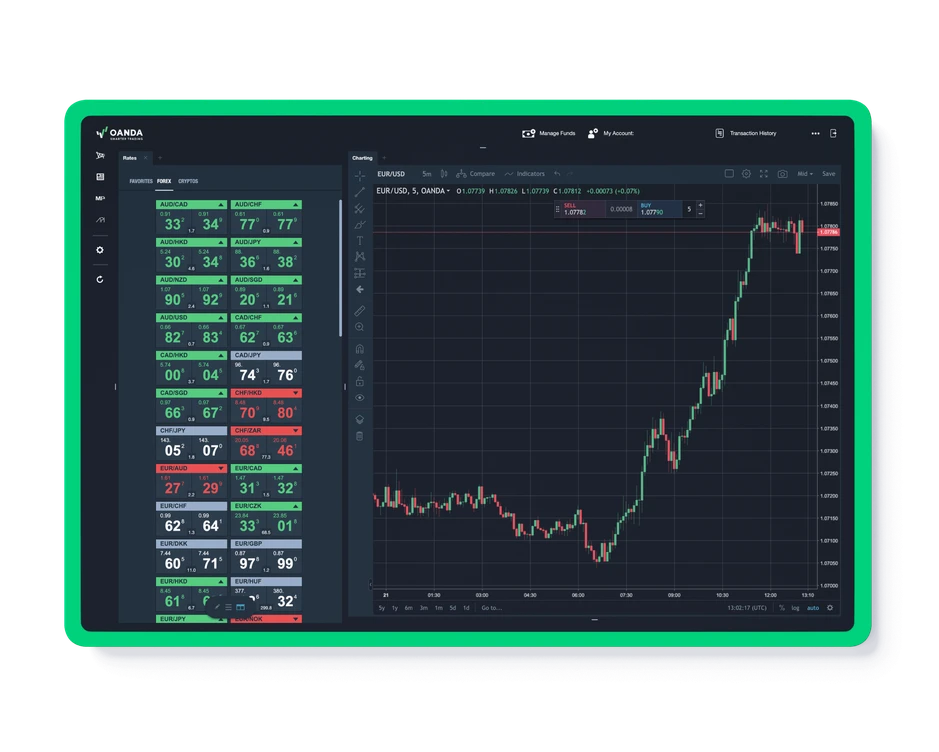

Trade forex with OANDA

We are a globally- recognized broker with over 25 years' experience in foreign exchange trading.