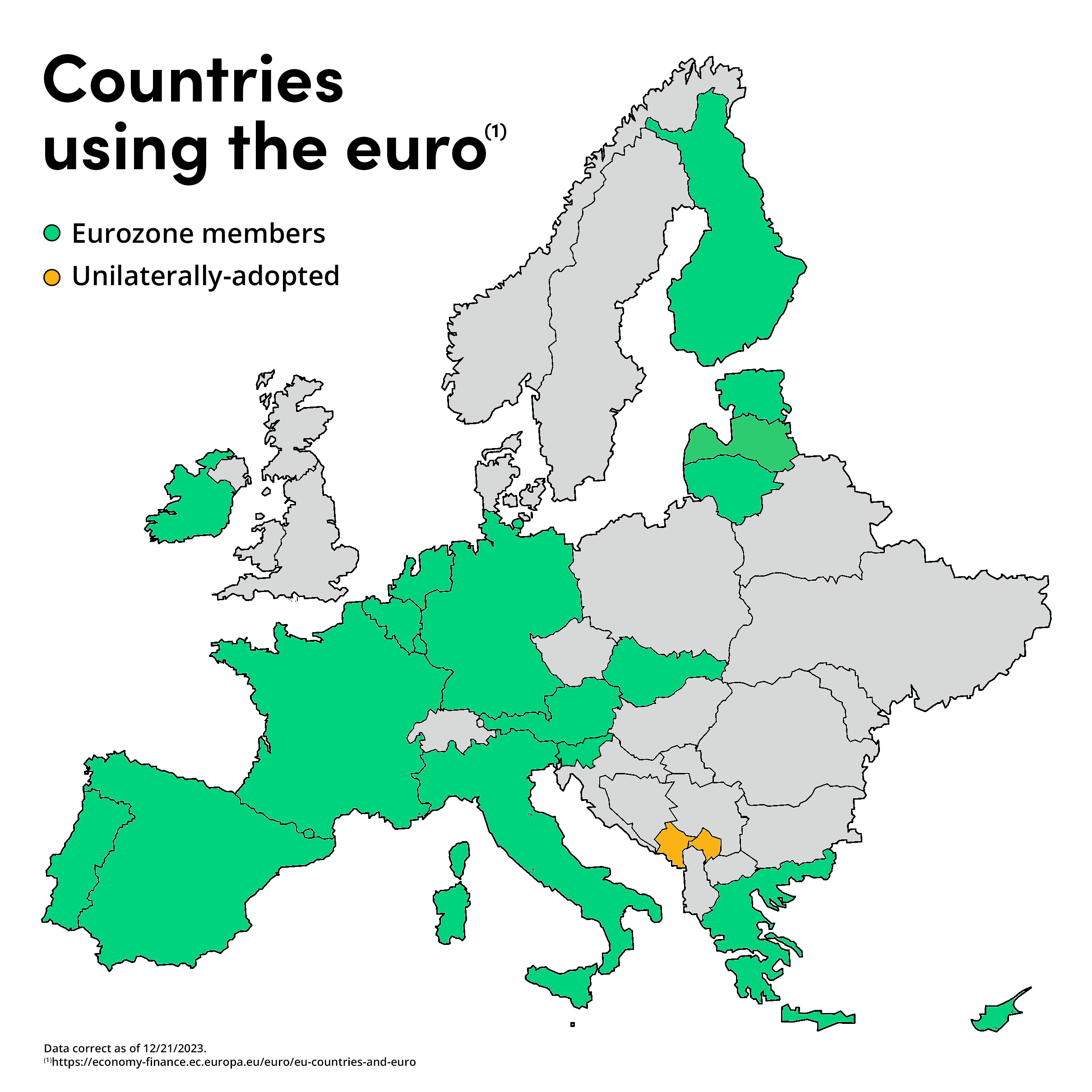

The official currency of twenty nations and with plans for further expansion, the euro is one of the most unique in modern-day currency history. Celebrating twenty-five years since it was formally introduced, we look back at some key moments. Learn more.

On this day twenty-five years ago

Today is the 1st of January 2024, known to most only as New Year’s Day, but within the world of FX, it marks another kind of occasion.

As clocks struck midnight on this day twenty-five years ago, the euro formally came into existence as a currency, proving to be one of the most significant forex market milestones in modern times.

In this article, we look at some of the most pivotal moments in euro history and how it became the sole legal tender of twenty nations, the most of any currency in the world.

The euro is first introduced

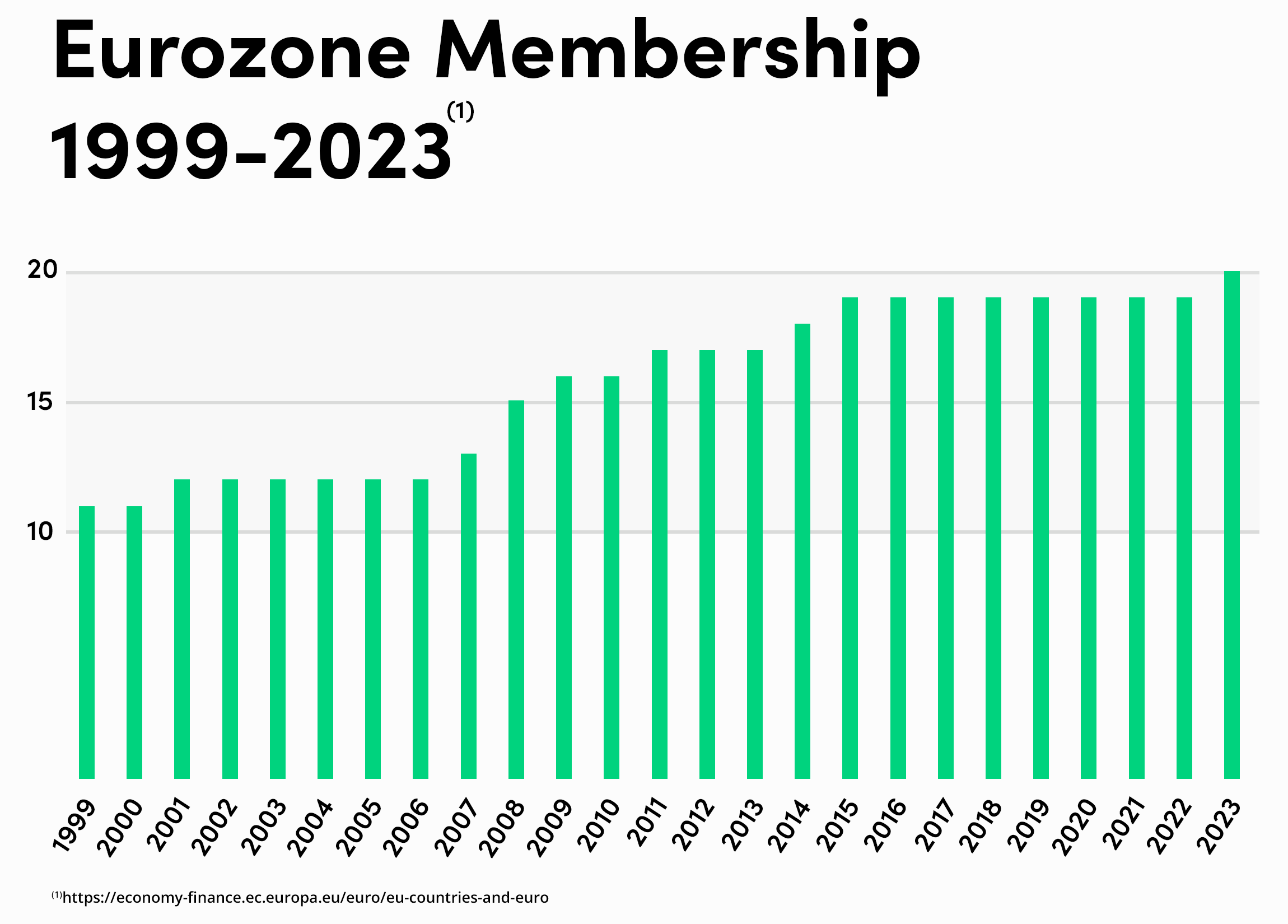

Twenty-five years ago, on the January 1st, 1999, the euro would be first introduced as an ‘invisible’ currency in 11 countries that met the ‘euro convergence criteria’:

- Austria

- Belgium

- Finland

- France

- Germany

- Ireland

- Italy

- Luxembourg

- The Netherlands

- Portugal

- Spain

Having formally made its’ virtual debut, across the next three years the currency would only be used for accounting and electronic payments, with an emphasis on gradual integration into the financial systems of Europe.

On January 1st, 2001, in the final moments of the three-year transitional period, Greece would become the twelfth country to officially adopt the euro as an accounting currency, bringing the total count to twelve.

Physical currency begins to circulate

Three years after its formal introduction as ‘book money’, on January 1st, 2002, the euro would become the sole legal tender of twelve EU countries, with physical banknotes and coins entering into circulation.

The Eurozone expands by three

Opting for a ‘big-bang’ changeover, meaning there would be little to no transition period, Slovenia officially adopted the euro on January 1st, 2007, five years after it first began to circulate as physical tender.

Having only recently joined the European Union, Slovenia holds the title of being the first to officially adopt the euro of the ten additions made to the EU in 2004.

Both Cyprus and Malta would follow suit a year later, on January 1st, 2008, expanding the Eurozone to 15.

The Euro suffers its worst ever performance

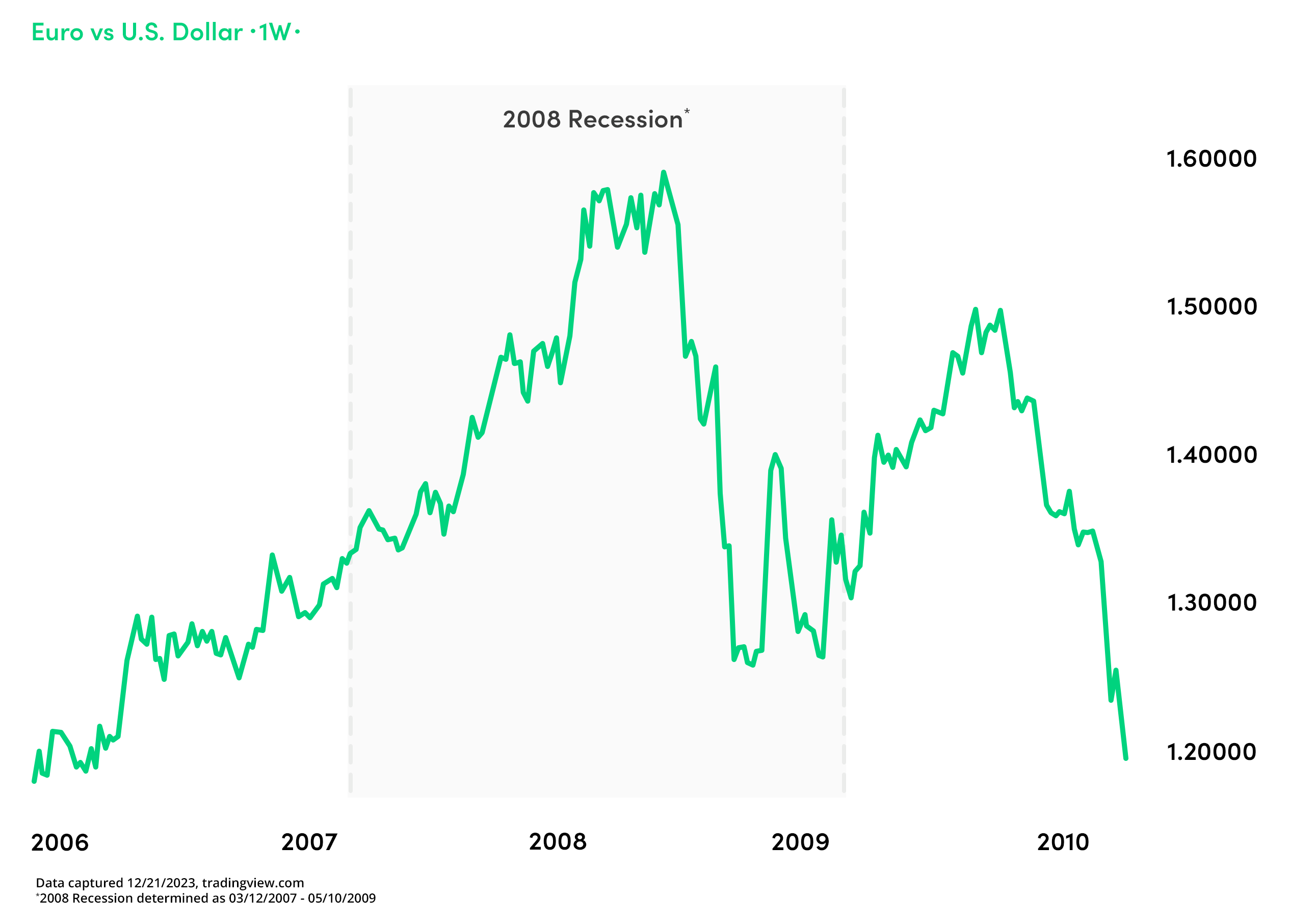

Having achieved historic all-time highs just four months prior at around 1.59000, in 2008 the euro would record its worst-ever performance to date versus the U.S. dollar.

Coming under pressure at the height of the 2008 recession, the market looked away from the euro to buy so-called 'safe-haven' currencies, causing EUR/USD to tumble in excess of 20% across a 14-week period.

In the same timeframe, the DAX 40, one of the largest European stock indexes, would also fall over 30%.

Slovakia adopts the euro

Undeterred by an ongoing global recession, Slovakia officially adopted the euro on January 1st, 2009.

Already having spent over 3 years participating in the Exchange Rate Mechanism (ERM II), often a key part of the ‘euro adoption process’, the Slovak koruna would be replaced by the euro, and Slovakia would become the sixteenth country to officially adopt the currency.

Baltic states join the Eurozone

Having regained their independence from the Soviet Union in the early nineties, Estonia, Latvia, and Lithuania would become members of the European Union in 2004.

Uniquely linked economically, their entrance into the EU would signal a substantial political shift from previous history.

Once able to meet ‘euro convergence criteria’, Estonia, Latvia, and Lithuania would formally adopt the euro on New Year’s Day of 2011, 2014, and 2015, respectively.

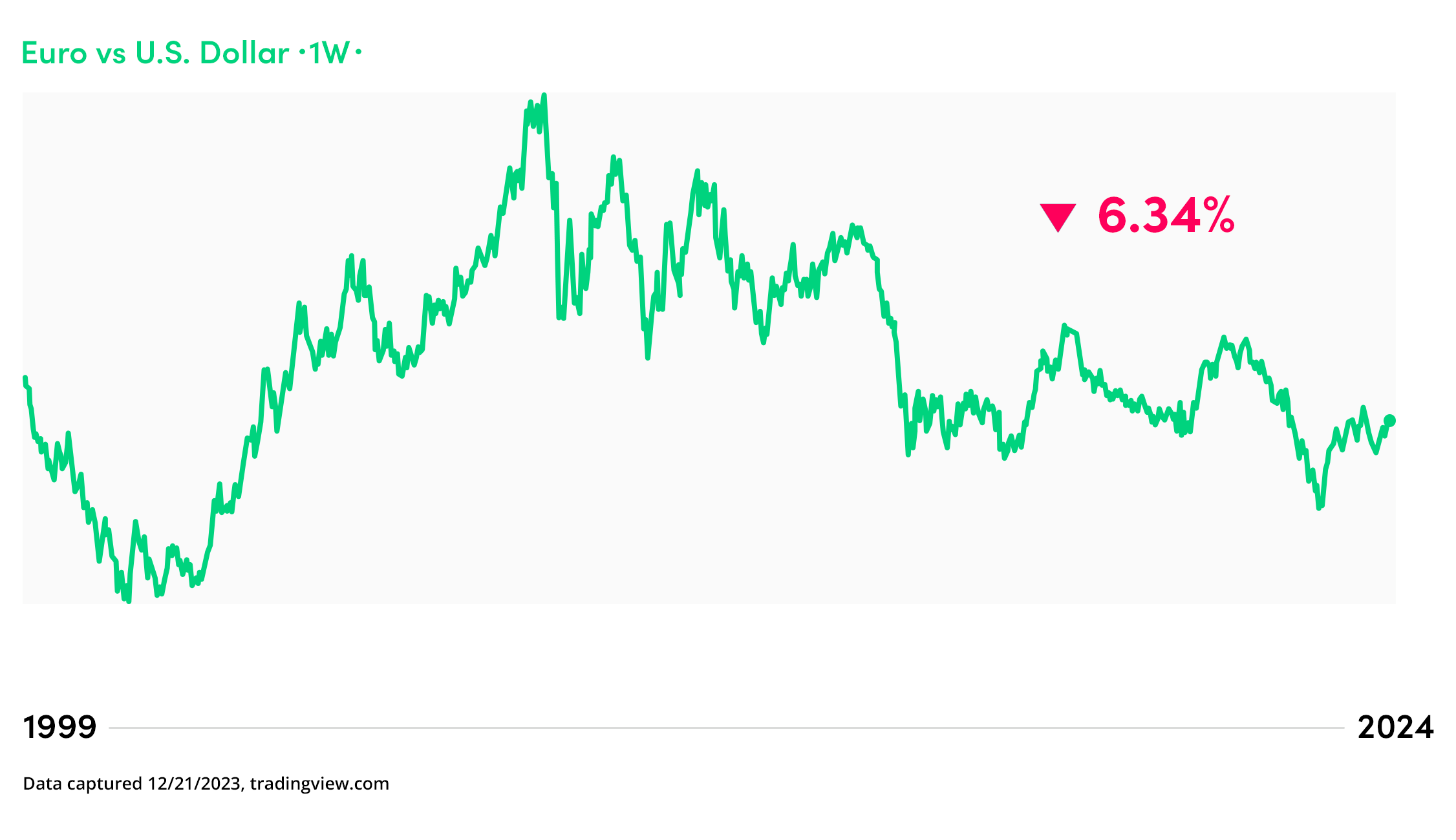

EUR/USD falls to a 20-year low

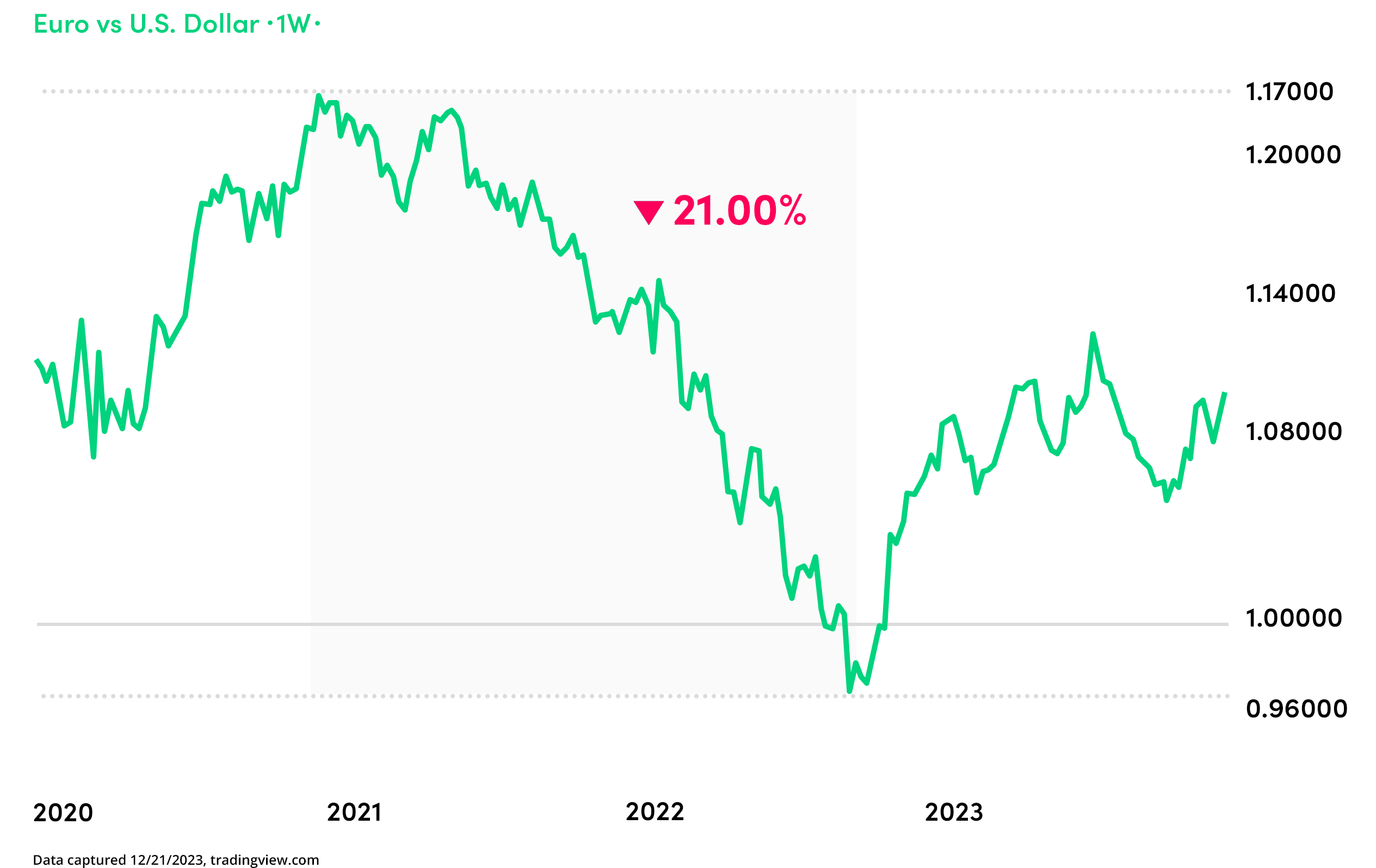

Continuing a poor yearly performance, August 2022 would see the euro fall to parity with the U.S. dollar, a phenomenon not seen for the past two decades.

In the months that followed, EUR/USD would continue to slide, trading as low as 0.97000, meaning one euro would only buy ninety-seven American cents - its lowest exchange rate since 2002.

Croatia becomes the 20th Eurozone member

On January 1st, 2023, Croatia would become the twentieth nation to officially adopt the euro, eight years after the likes of Lithuania.

Although formally introduced last year, the euro had been used as an unofficial reserve currency in Croatia for many years before fully replacing the Croatian kuna in 2023.

Future expansion and outlook

The Euro, as a modern-day concept, is unique in many ways, but no less in its scope for expansion to more world economies.

At the time of writing, Bulgaria looks poised to be the next addition to the Eurozone, with a newly revised target of January 1st, 2025, planned for full-scale adoption.

Despite a relatively poor euro performance in 2023, many countries still continue to maintain commitment to joining the Eurozone like Czechia, Hungary, Poland and Romania – so the plan for expansion won’t be slowing down for the foreseeable future.

Key insights and takeaways

1. From its introduction in 1999 to the present day, the euro trades 6.34% lower versus the U.S. dollar.

2. The euro traded at its highest level in 2008, over 30% higher than current day values.

3. At the turn of the millennium, the euro traded at its lowest level, around 33% lower than prices today.

Trade euro pairs with OANDA

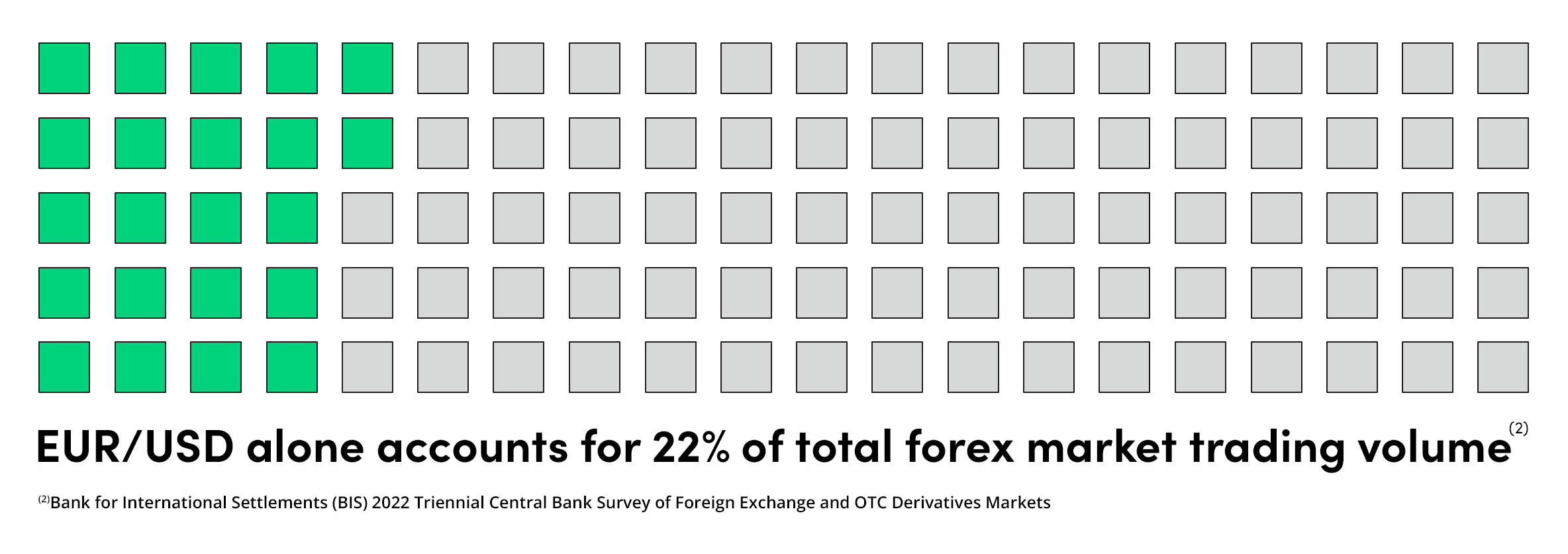

The euro, being one of the major world currencies, plays an important role in the forex market, which has the highest daily trading volume of any market globally at upwards of $6 trillion.

Disclaimer: OANDA customers do not have access to the interbank-market.

If you’re interested in buying and selling major currency pairs, like EUR/USD, EUR/JPY, and EUR/GBP, apply for a demo account at OANDA today and determine whether online forex trading is the right choice for you.

The OANDA Trade platform includes a suite of trading tools, powerful charting features, expert trader analysis, and market news to help support you in your trading.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

Opinions are the author's; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.