How the FX market interrelates with stocks, bonds, and commodities

In trading, correlations can be made between different assets and data points on the basis of how they perform in relation to the other. This can be in either a similar or opposite direction respectively, with price moving up or down.

Correlations come and go, but some have performed better throughout various different cycles. Some correlations might perform better during times of heightened volatility, while others might trade better during typical expansion or recessionary periods. If you trade equities, bonds, or commodities, you can find a wide range of instruments that have correlations with multiple currency pairs.

Depending on the instrument you choose to trade, there's different correlations you need to be aware of. Here's a few examples.

Stock traders getting into FX

When the US stock market crashed in the fall of 2008 or in the spring of 2020, many traders were struggling. Should they become short sellers on individual stocks or the S&P 500 futures contract? Others were deciding whether it made sense to abandon ship and get back in at a lower price. For active traders, many were drawn to some of the massive moves that came out of FX.

In the 1990s, many traders focused on the EUR/USD and US stock market correlation. The Dow Jones Industrial Average, which has a much longer historical comparison than some of the younger stock indexes, was closely watched in comparison to the dollar. The BIS reported:

“The first episode occurred around the October 1987 stock market crash, when falling equity prices were accompanied by a weakening dollar. The second took place in autumn 1991 and was characterized by a strong and negative co-movement, as US stock markets rallied while the dollar depreciated.”

The dollar remains the world’s reserve currency, and following the past few recessions, it has a stronger tendency to behave as a safe-haven.

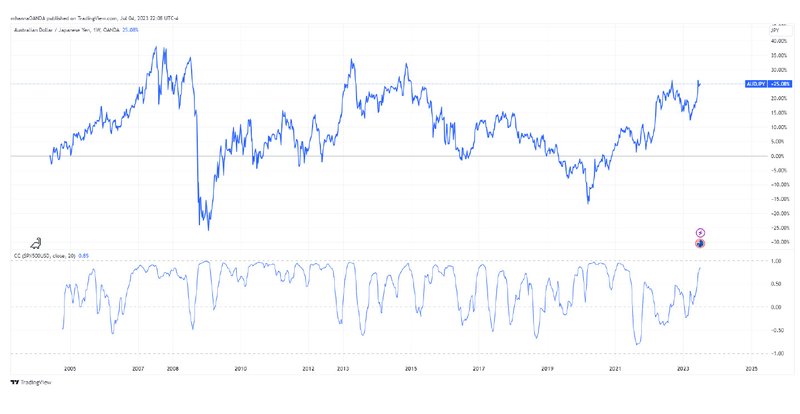

As another example, the Australian dollar-Japanese yen correlation with global stock markets has been closely followed over the past couple of decades. With the Australian economy benefiting from China’s economic growth story, the Chinese economy has posted the fastest growth in the world since the 1980s, with everything clicking from 2002 until the COVID pandemic.

Fixed Income and FX

The bond market has a reputation on Wall Street as being the smart money, as they have a strong handle on what is happening with the economy and what the outlook is for economic growth, inflation, and central bank policies. Bond traders typically have an understanding of their goals and risk tolerance. Bond investors who are in the market for a short time might focus on short-term Treasuries, while long-term investors might trade Treasuries or munis. Some fixed income traders might find short-term intermediate-term international developed-market bonds appealing, but they should understand the risk that comes when a sovereign nation’s credit rating gets slashed.

Bond traders also closely follow central banks and especially inflation, as some trade “Treasury Inflation-Protected Securities” (TIPS). Widening interest rate differentials can possibly lead to some attractive FX opportunities.

Commodity traders

Commodity traders are often aware of global macro drivers and try to take advantage of market moves that stem from market-moving events like mining protests, natural disasters, extreme weather, supply disruptions, and military conflicts.

Oil Traders

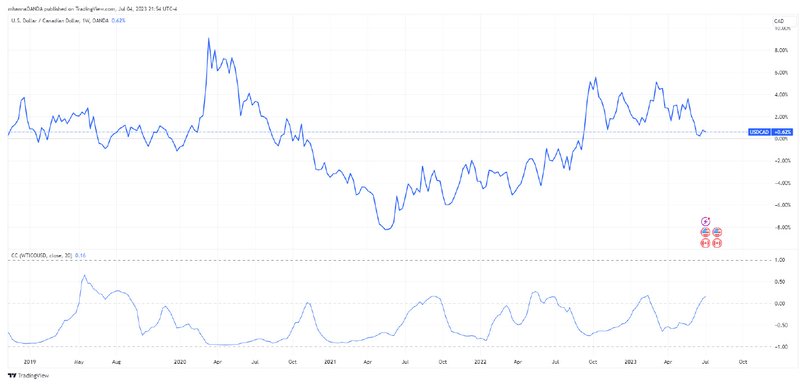

Oil traders are aware of the crude demand outlooks of major crude importers, such as China, Japan, India, and the US. The world runs on oil for now, and if prices are stable, that could be considered good for economic growth and reduce inflation expectations. Canada, Norway, and Russia are major oil-producing countries that can often see a correlation between the price of crude and their respective currencies.

Gold Traders

Gold traders focus on central bank purchases, jewelry demand from China and India, and the overall health of the global economic outlook, which includes all the potential systemic risks.

Precious metal traders have their hands full following a plethora of drivers that stem from safe-haven demand, fixed income volatility with real yields, mining projects, and demand outlooks. For gold, Fed policy has been the primary driver, which post-pandemic has unleashed a tightening cycle that rivals what we saw in the 1970s and 1980s.

Gold traders are often drawn to the Australian dollar as it is one of the top three gold producers, following China and Russia.

Copper Traders

While some might think that copper prices will have the biggest impact on countries with top reserves, such as Chile, Australia, Peru, Russia, and Mexico, copper traders focus on major economies that have strong demand for electrical wiring, specifically used in pipes and wires, and industrial machinery.

Copper demand from Chinese factory activity can greatly influence copper prices, as can production guidance from miners.

Base Metals

Many base metal traders follow supply and demand trends globally. During times of serious economic expansion, robust investment could lead to strong demand that is driven by infrastructure spending commitments or for new cycles, such as electrification demand, which is driving all the interest in electric vehicle batteries.

Understanding the impact of industrial and manufacturing activity can provide a backdrop to the health and outlook of many emerging markets and their currencies.

The Bottom Line

You have many markets you can trade and now you can discover how your current strategic trading strategies hold up in the FX market. Test your strategies by using OANDA’s demo account. You can also learn how OANDA’s plethora of tools can help you with your market analysis.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.