BTC/USD Volatility

Traders are navigating between optimistic headlines projecting further highs for Bitcoin and cautionary ones suggesting a potential overbought scenario. The speculation surrounding Bitcoin's post-event price trajectory has led to heightened volatility, with Bitcoin trading within the range of $61,500 to $72,100. While this may appear as a wide trading range, it's relatively common in cryptocurrencies.

The volatility of BTC/USD was notably influenced by the recent upswings in US Inflation data. Bitcoin has shown sensitivity to the US Consumer Price Index (US CPI), and the US Producer Price Index (US PPI). The chart image below under technical analysis overview illustrates the decline in Bitcoin's price following the release of higher-than-expected US CPI and US PPI data in March and April 2024.

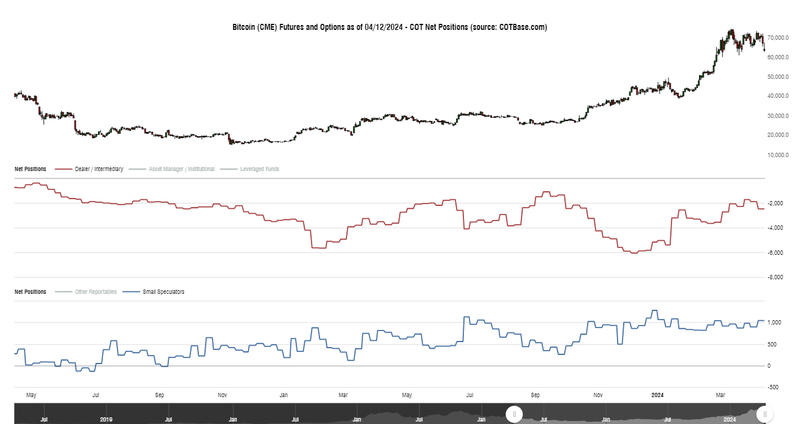

COT Chart

Commitment of Traders Report - COT Report Analysis

The Commitment of Traders report (COT) for the week ending on April 12th, 2024 (Including data up to the end of day Tuesday, April 9th, 2024) reflects the following.

The Dealer/Intermediary category's long position levels are at a 4-year extreme, suggesting a potential change in sentiment; the same applies to the Small Speculators category, whose long position levels are at a 2-year extreme.

BTC/USD Daily Chart

Technical Analysis Overview - Daily Chart

Price action traded within a triple top formation from early March till Friday, April 11th, 2024. It broke and closed below the formation baseline (Purple line) and is currently attempting a pullback to the breakout level near $67200.

Price broke and closed below multiple moving averages, SMA 9, EMA 9, and the SMA 20; however, it found support at its intersection with the SMA 50, and its annual R2 standard calculation resistance turned support near $62600 as it attempted the pullback. Price action also broke and closed below its monthly and weekly pivot points.

The stochastic Indicator is in oversold territory, and the %K line has just crossed above the %D line on the daily timeframe.

Conclusion

Price action is currently attempting a reversal after the breakout; if this materializes, the reversal is heading to a confluence of resistance represented by the breakout level (Purple line), multiple moving averages, monthly and weekly pivots, the confluence of resistance lies within the 68273.00 to the 66215 range. If price action successfully breaks above and remains above the resistance level, it could be positive for BTC/USD.

On the other hand, a break below the confluence of support represented by the monthly support level S1, weekly Support S2, the SMA 50, and annual R2 could be damaging for the cryptocurrency; the confluence of support lies within the range of $60516.10 to $ 62618.10.

Disclaimer

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.