What is a Bitcoin halving?

A Bitcoin halving, sometimes referred to as a ‘halvening’, is a unique event in which the reward for mining new blocks is halved, meaning that for the same amount of machine labor, miners receive 50% fewer Bitcoins as a reward.

By design, a halving event limits the available new supply of Bitcoin, which is typically seen as a positive development for the coin.

Bitcoin halving has been considered by our analysts as one of the events potentially shaping the markets in 2024.

Blockchain basics: How does Bitcoin halving work?

The underlying technology of Bitcoin, the blockchain, is made of a network of over 56,000 nodes¹, which are used to run Bitcoin’s software.

Of some 56,000~ nodes, many of which are ‘dedicated miners’ that are set up to use their machine’s individual processing power to validate Bitcoin payment transactions packaged as ‘blocks’.

Once a block has been completed and all transaction information confirmed as legitimate through mining, a block is then complete, with miners receiving a payment of a set number of bitcoins per block completed.

On this basis, a Bitcoin halving event refers to the amount of Bitcoin made as payment on the completion of a block being cut in half, with miners receiving less for the same amount of machine labor.

Why does the reward for mining Bitcoin keep halving?

The halving mechanism built into Bitcoin’s design exists for many reasons; here are three examples:

- Inflation

Within the realm of traditional fiat currencies, the purchasing power of any given currency declines over time by way of inflation as more money is printed and enters circulation.

As an example, $132,053.62 in today’s money has the same purchasing power as $10,000 seventy-four years ago in 1950, representing a decrease in purchasing power of over 1220%².

In an obvious bid to differentiate from the world of fiat, Bitcoin’s halving mechanism hopes to counteract any inflationary effects by maintaining a finite supply and therefore scarcity.

- Supply vs. Demand

In line with one of the most fundamental of economic principles, if the available supply of Bitcoin decreases but demand maintains the same, the price of Bitcoin will rise, assuming all other variables remain unchanged.

The halving mechanism synonymous with Bitcoin helps maintain a healthy level of demand for the cryptocurrency, keeping prices stable.

- Investment Interest

With the promise that the available supply of Bitcoin will decrease over time, this offers a unique proposition to those looking at Bitcoin as both an investment and a store of wealth.

When compared to fiat currencies, which are shown to devalue overtime by way of inflation, Bitcoin’s halving events pose an attractive proposition to investors alike, helping keep the price of Bitcoin buoyant.

How have previous halvings affected Bitcoin pricing?

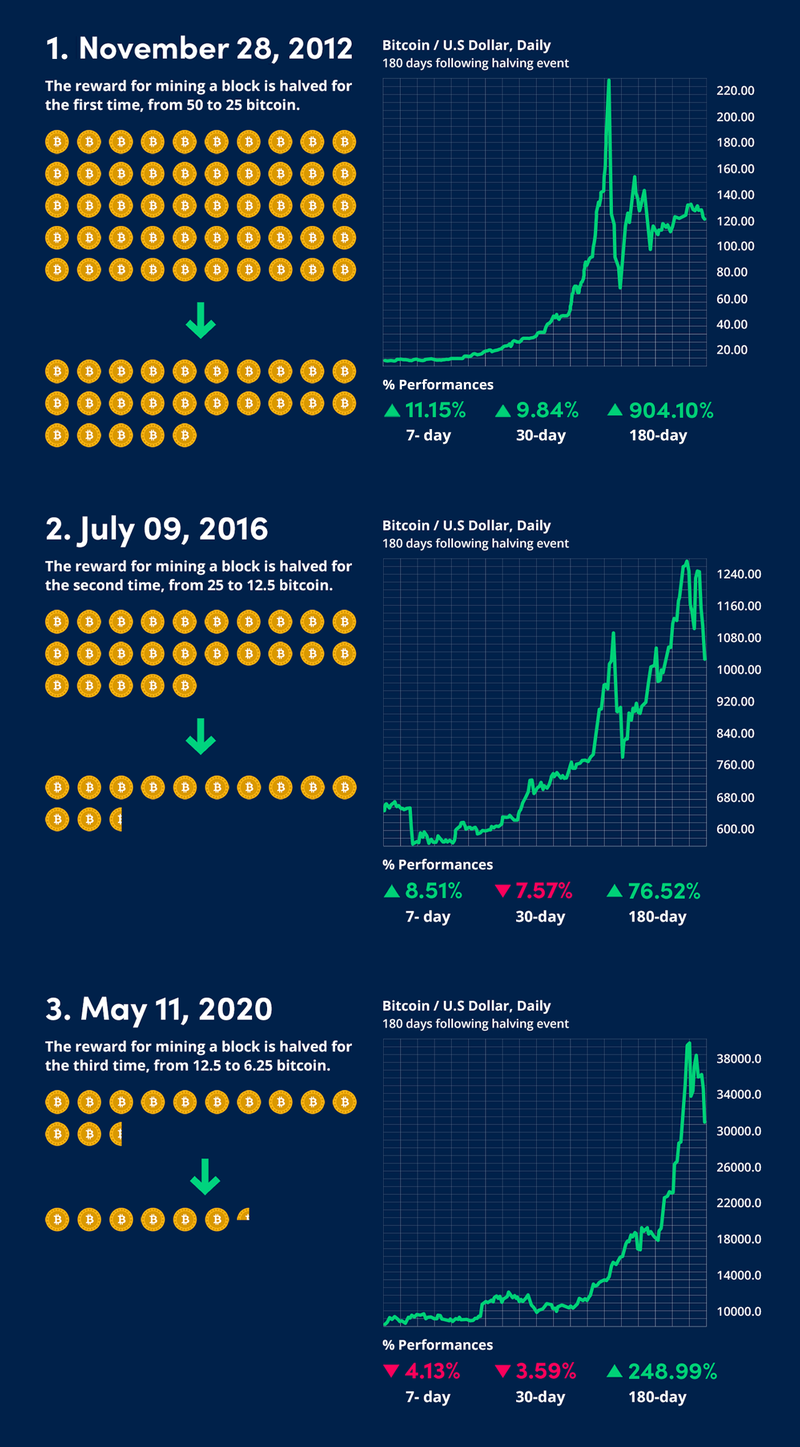

At the time of writing, the reward for mining Bitcoin has been halved three times so far:

As shown, Bitcoin has historically performed positively following previous halvings, especially when considering the 180-day post-event period.

It’s worth noting, however, that the price of Bitcoin has risen over 1300000% (one million, three hundred thousand!) since the start of 2012 in general³; how much halving events have affected this total is unclear.

Want to brush up on your trading skills ahead of the halving event? Read more on the basics of BTC/USD technical analysis.

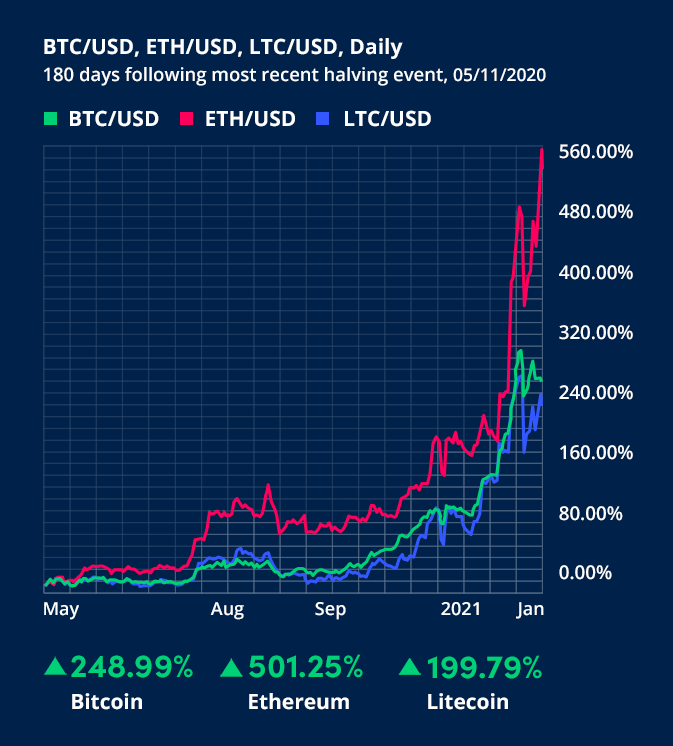

How have previous Bitcoin halving events affected other cryptocurrencies?

Remaining steadfast as the #1 crypto by market capitalization by some distance⁴, moves within the Bitcoin market are likely to affect other cryptocurrencies, for better or for worse, with halving events being no exception.

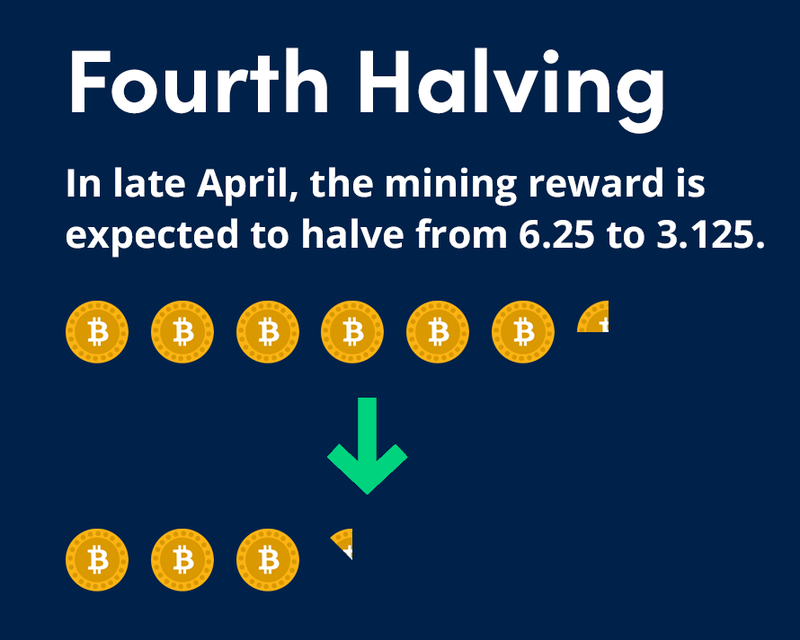

When is the next halving event?

In short; no one knows for certain.

Within Bitcoin’s programming, a halving of the mining reward is set to happen either every four years or when 210,000 blocks have been mined since the last halving event, whichever is to happen first.

At the current rate of mining, 210,000 blocks are expected to be completed late next week, estimated for the 19th of April⁵, but naturally, this is subject to change.

In conclusion

The world of crypto is certainly unique, and perhaps this is made most apparent with the existence of mechanisms such as halving events.

With Bitcoin’s fourth halving expected in the relatively near future, how will such events help secure poll position for the coin in the years to come? Only time will tell.

FAQs

What is Bitcoin halving?

A Bitcoin halving is a unique event where the per block reward for mining Bitcoin is cut in half, meaning that for the same amount of machine labor, miners receive 50% fewer Bitcoins as a reward.

When is Bitcoin halving?

No one knows for certain, but in line with expectations according to the current rate of mining, the next Bitcoin halving is expected around the 19th of April⁵, but mileage may vary.

What is the point of Bitcoin halving?

As a mechanism built into Bitcoin’s code, halving events protect against cryptocurrency inflation, as well as help manage supply and demand levels.

How has the price of Bitcoin changed after previous halving events?

Historically, the three previous halving events have been positive for the price of Bitcoin, up an average of 409.87% in the 180-day period following³

Footnotes

¹https://bitnodes.io/nodes/all/

²https://www.bls.gov/data/inflation_calculator.htm

⁵https://watcher.guru/bitcoin-halving

Disclaimer

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.