How to spot trade cryptocurrencies through OANDA

Spot trading is a popular way of trading cryptocurrency due to its relative simplicity. The low barrier to entry means that even trading novices can get to grips with it quickly and easily. However, you need to be willing to take the risks involved with spot trades due to crypto’s high volatility.

We take a look at spot trading, including what it is, the advantages and disadvantages of this style of trading in regards to cryptocurrency and how you can spot trade cryptocurrencies through the OANDA app (powered by Paxos).

What is spot trading?

For those who are new to the world of trading and are wondering “what is a spot trade?”, a spot trade is when a trader buys or sells a commodity, financial instrument, or foreign currency at the current market rate (also known as spot price) with the intention of acquiring the associated asset in the exchange immediately. Traders buy assets in a spot market, also known as a physical or cash market, with the hope that the asset will increase in value, at which point they can sell and make a profit. Unlike other types of trading, such as spot forex and margin trading, a spot crypto trade can only be completed with money that you currently have due to the immediacy of the trade.

What is crypto spot trading?

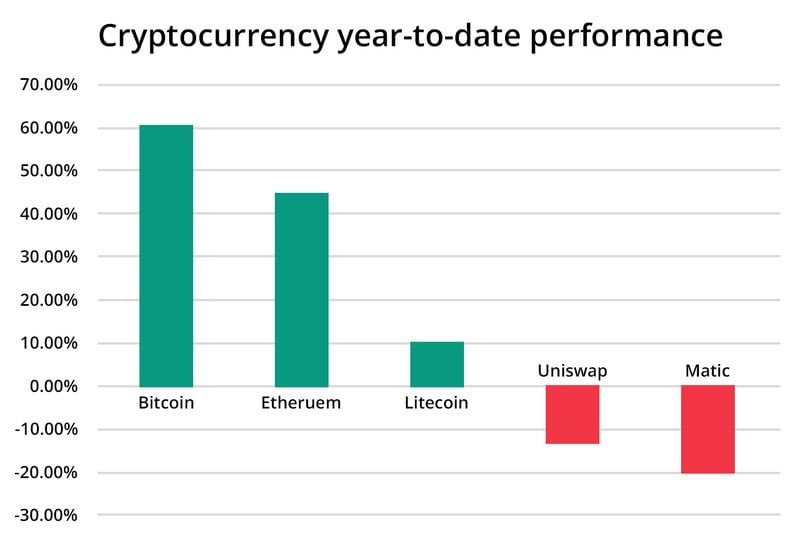

Crypto spot trading is simply a spot trade for cryptocurrencies such as Bitcoin, Ethereum, PAX Gold and Litecoin. However, crypto spot trading can be considered a short term trade and differs from most crypto trades that are considered medium- to long-term. Most people will acquire crypto and then hold (or HODL, which means Hold on for Dear Life) onto the crypto with the hope that its value will greatly increase over that period and then sell.

The advantages and disadvantages of crypto spot trading

If you have any questions about cryptocurrency spot trading and its pros and cons, take a look at our list of some of the advantages and disadvantages here:

Advantages

1. Spot trading is easy to learn making it ideal for new traders who are learning how to trade cryptocurrency

2. It can be used as a short to long-term trading method

3. It’s easy to take advantage of opportunities as they arise

4. Ability to trade Cryptos backed by commodities such as Pax Gold

5. It provides access to trade many different types of cryptocurrencies

6. Trading is open when other markets are closed including weekends

Disadvantages

1. There is no leverage and full margin is required

2. The cryptocurrency market is largely unregulated

3. Inability to initiate short or speculate on Crypto currencies decline, traders can only sell their existing holdings.

4. Wild, sudden swings in the cryptocurrency market make it harder to predict and increase the risk of loss

5. Due to the volatility of cryptocurrency, this type of trading is high risk and may not be suitable for all traders

What are the prerequisites to trading through OANDA?

We hope our lists above helped answer some of the common questions about cryptocurrency spot trading. If you want to spot trade cryptocurrencies, you can only do so through our mobile app (powered by Paxos). Unfortunately, spot trading of crypto is not available on desktop, web, MT4 or third-party platforms. You will need to download or upgrade to the latest version of OANDA’s fxTrade app on your Android or iOS device. The fxTrade app is only compatible with Android 5.0 or iOS 14 or higher operating systems.

Cryptocurrency trading accounts are opened with Paxos Trust Company LLC, our crypto services partner which provides you with direct pricing from Paxos's itBit exchange. You must activate this account from the HUB or the mobile app.

Before starting trading cryptocurrencies, learn more about crypto technical analysis and key techniques, indicators, and applications.

Activate your spot crypto account

There are three steps to complete before you can start trading with your account:

- 1. Open an OANDA forex trading account on OANDA.com

- 2. Add a Crypto trading sub account through your OANDA HuB with Paxos Trust Company LLC.

- 3. After you have opened the account, it will need to be reviewed for approval. Timings can vary, but the approval process can be as quick as 15 minutes. If your account is approved, you only need to tap Complete Application.

- 4. Deposit funds into your OANDA primary account. Once your account is credited, you can then transfer funds internally to your crypto account and you can start trading.

How to spot trade cryptocurrencies through OANDA

Follow these steps to complete an order once you have opened an account:

- 1. Select the three dots icon and open the spot crypto sub-account.

- 2. From the bottom bar on the main screen, navigate to Cryptocurrencies. Select BUY or SELL for any instrument depending on what you wish to do.

Note: Short selling is not permitted. If you do not have existing holdings of a given cryptocurrency, you will not be able to sell.

- 3. You can also find buy and sell options in the Portfolio tab. Open the Portfolio tab in the bottom bar. Then, from the Holdings tab, a list of cryptocurrencies will be available. The cryptocurrency you can trade on our platform includes Bitcoin, Bitcoin Cash, Ethereum, Pax Gold, Litecoin, Aave, Chainlink, Matic, Uniswap and Solana (subject to regulatory changes). Tap on your cryptocurrency you want to buy or sell.

- 4. Optional: Tap the i icon next to the instrument name. This will bring up information on the instrument. After you have reviewed the data, tap Close. The step, minimum trade size, maximum trade size and maximum position size conditions are displayed in this window. You can use this information to help you decide the volume you can buy or sell.

- 5. Analyze the prices on the chart. You can change the time frame of the chart by tapping on the interval icon. It will be listed as one of the following:

• 1M (1 min) - • 5M (5 min)

- • 1H (1 hour)

- • 4H (4 hours)

- • 1D (1 day)

Note: All price lists and charts use the server timezone (GMT+2 Standard Time or GMT+3 Daylight Savings Time) and not the device local time. The device local time (in the app settings) affects the trade execution and expiry time which is shown in the Portfolio section. The chart only shows the history of the bid prices, not the ask prices. - 6. Input the volume in cryptocurrency units or in USD. Entering one value for cryptocurrency or one value for USD will automatically calculate the volume of the other.

Note: When trading cryptocurrency, you can place Quick, Limit and Stop orders. Here are the quick order options:

- • Quick order to buy: This order type is similar to a market order, except that it will be limited to a maximum of 10% above the current ask price in order to reduce potential price slippage.

- • Quick order to sell: This order type is the same as a market order and can be used to sell/liquidate your holdings.

- • Limit order to buy: Limit orders can be set at a specific price level, once the order is triggered, it is converted into a quick order to buy at market.

- • Stop order to sell: Only Sell Stop orders can be placed and can be used to liquidate holdings.

Quick orders are processed in USD, which is an estimated value based on the volume entered.

- 7. Your order may be fully filled, partially filled, or rejected. You will notice the fee applied on executed orders. Tap on DONE to proceed.

Note: Some orders may be filled immediately, but some orders may be placed but not filled. It is important to check the order history for their status.

- 8. To check your order status, go to the Portfolio tab on the main screen and then open the Order History tab.

Trade crypto and more on our platform

OANDA has been providing forex trading services in the US and globally for over 25 years. Our secure platform is equipped to handle trades for a variety of financial instruments, including currency pairs, commodities, indices, CFDs and cryptocurrencies. If you are interested in trading crypto and want to find out more, you can learn about our cryptocurrency trading services here.

FAQs

If you’d like more details, check out our step-by-step guide on how to trade spot crypto through your OANDA account (powered by Paxos).

Disclaimer

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.