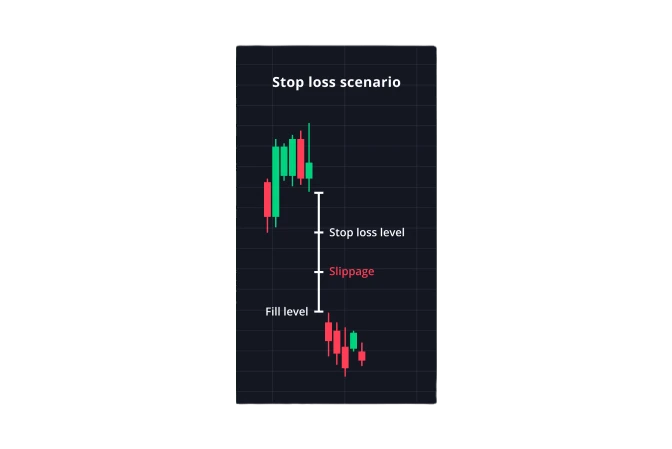

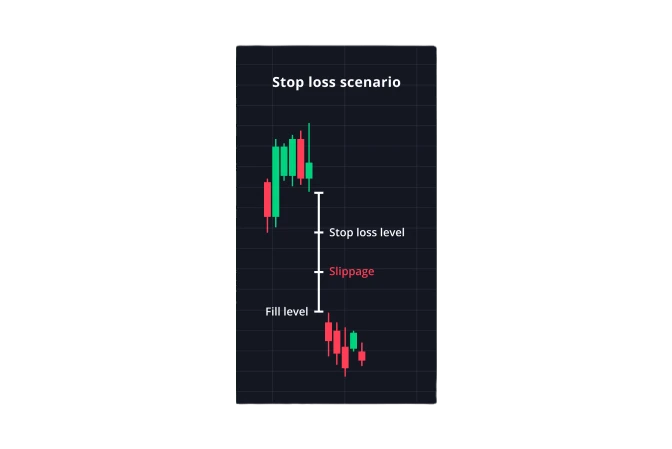

Market gapping occurs when prices move instantaneously from one price level to another, without trading at the levels in between. This can happen during periods of high market volatility and in between sessions of continuous trading. On weekends and public holidays when markets are closed for trading, for example.

As a result of this gapping, when the markets re-open, your stop-loss orders may be filled at a worse price level than the one you may have requested. This is known as “slippage”.

If a GSLO is placed far enough away from the market price so that the margin requirement of the GSLO would be greater than the standard margin (5% on FX CFDs), then the standard margin requirement is used instead.

GSLOs can protect your trades from this slippage. As seen in the chart above, the market gapped but the GSLO was still filled at the requested price level. Since the GSLO was triggered, a GSLO premium was charged.

If you had placed a stop loss-order, your trade would have been closed at the next available price when the markets re-opened for trading.

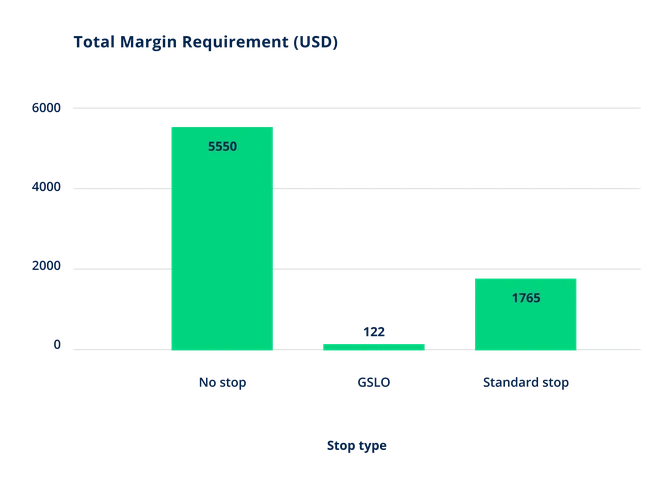

GSLOs can free up your capital by lowering the margin requirement^ of a position more so than a standard stop-loss order.

With a standard stop loss order (SL) (for all assets except cryptocurrencies*) your margin requirement will be limited to the amount at risk plus 30% of the standard margin. For example, if you place a trade of EUR/USD for 100,000 units with a SL 20 pips away from the market, your margin required would be $1700 ($200+ (30% x $5000)).

A position protected by a GSLO however will have a margin requirement limited to the amount of capital at risk, plus a 10% buffer and any fees. For example, if you place a trade of EUR/USD for 100,000 units, your margin required would typically be $5000 (5%). If you add a GSLO to the trade, 20 pips away from the market, your margin required would be reduced to approximately $230 ($200 risk amount + 10% of $200 + 1 pip premium). In this example, 1 pip is equal to $10 when you trade 100,000 units of this instrument.

If a GSLO is placed far enough away from the market price so that the margin requirement of the GSLO would be greater than the standard margin (5% on FX CFDs), then the standard margin requirement is used instead.

*For cryptocurrencies CFDs standard margin applies

Please note: Successful adjustment to a GSLO will impact the amount of margin required to hold the position. This will be reflected on the Trades tab under ‘Margin’.

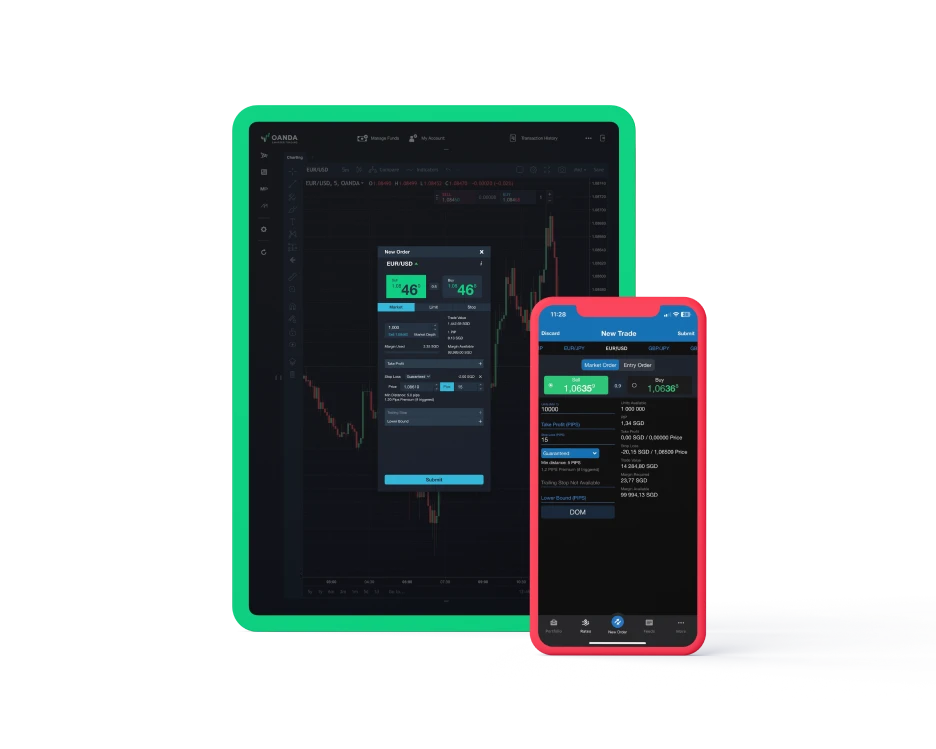

As a leading, regulated broker, your funds are safe with us. It is easy and straightforward to deposit, withdraw and transfer funds between your OANDA sub-accounts from your ‘My Funds’ page.

Go from application to trading in 3 easy steps:

Let’s say you open one unit of a long CFD position on the Australia 200 Index at 7000 and place your guaranteed stop 50 points away at 6950 as you are concerned about market volatility.

1. The premium being charged if the GSLO is triggered is 2 pips.

If the index gaps down 100 points to 6900, your position would automatically be closed out at your GSLO level of 6950 and you will realise a loss.

(order size x stop distance) + (order size x premium fee) = loss

(1 x 50) + (1 x 2) = AUD52

If you hadn't placed the guaranteed stop on your position, but instead used a standard stop loss at 6950, your trade would have closed at 6900, resulting in a loss of AUD100.

2. Using the same example, the GSLO for Australia 200 index is at 6950. Let’s say there was a dividend adjustment of 2 points, the GSLO price will then be adjusted by 2 points to 6948.

Margin used before dividend adjustment:

(order size x stop distance between market price and GSLO price) + 10% buffer + (order size x premium fee) =

(1 x (7000 - 6950)) + 10% + (1 x 2) = AUD 57

Assume price of Australia 200 goes to 7050

Margin used after dividend adjustment:

(order size x stop distance between market price and GSLO price) + 10% buffer + (order size x premium fee) =

(1 x (7050 - 6948)) + 10% + (1 x 2) = AUD 114.20

If you hadn't placed the guaranteed stop on your position, but instead used a standard stop loss, dividend adjustment will not impact margin used.