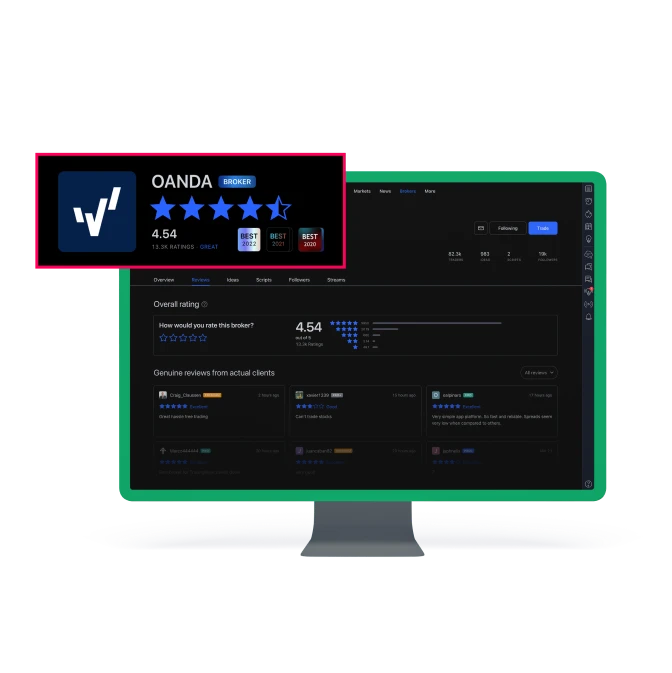

*Voted Best Broker 2023 (TradingView Broker Awards 2023). Voted most popular broker (TradingView Awards) three years in a row (2022, 2021, 2020). Also named highest for value for money and overall client satisfaction 2022, (Investment Trends Singapore Leverage Trading Report, Industry Analysis).

Go from application to trading in 3 easy steps:

Join the largest financial community on the web, with over 50 million active investors and thousands of trading ideas and custom indicators.

Find all your tools in 1 place

Exceptional charting

Trade on charts with drag-and-drop bracket orders

Our mobile app was voted Best Trading Tools winner (Online Personal Wealth Awards 2021).

Customisable interface

Alerts and price signal notifications

Mobile charting

Our powerful platform combines an intuitive interface, a suite of technical analysis tools, a sophisticated charting package and more.

React to fast moving prices during volatile periods with superior trading technology

Identify your trading strengths and weaknesses with behaviour patterns

Full suite of risk management orders

Our custom-built bridge combines OANDA’s pricing and execution with MT4’s charting and analysis.

Automated trading strategies

Proprietary MT4 plug-in

MT4 open order indicator

As a leading, regulated broker, your funds are safe with us. It is easy and straightforward to deposit, withdraw and transfer funds between your OANDA sub-accounts from your ‘My Funds’ page.

Cryptocurrencies are a digital form of currency that can be traded and used to pay for things. Their value is determined by supply and demand – which makes them highly speculative and unpredictable.

Cryptocurrencies were born out of a counter culture – the desire to trade in a currency that was neither regulated by any central bank, nor influenced by national currencies and major economic events. Cryptos use distributed ledger technology, or blockchain, to maintain a public record of all transactions. Tokens or coins can be bought and sold and are stored in a digital wallet, either online through an exchange like Binance, or offline ‘in cold storage’ on a server.

Whereas coins or tokens involve buying a fraction of, say, Bitcoin and holding that investment in a digital wallet until you want to sell, cryptocurrencies as CFDs are traded against the US dollar, much in the same way as you would trade forex CFDs. We offer 4 leading cryptocurrencies: Bitcoin (BTC/USD), Bitcoin Cash (BCH/USD), Ether (ETH/USD) and Litecoin (LTC USD).

Cryptocurrencies are highly volatile unregulated assets, which means they can move up or down in price at speed. So, if you are on the right side of the trade, it may indeed look easy to make money trading cryptos. What you must remember is that it’s equally easy to lose money on a crypto trade - and at tremendous speed. So, be sure to use a stop loss on all of your crypto trades.

Cryptocurrency pairs are assets that can be traded for each other or against a major currency such as the US dollar on an exchange — for example Bitcoin versus US dollar (BTC/USD) Bitcoin/Litecoin (BTC/LTC) and Ether/Bitcoin Cash (ETH/BCH). To trade a pair you need to have some knowledge about both currencies and their strength in the market.

We offer CFD trading in 4 cryptocurrencies: Bitcoin, Bitcoin Cash, Ether and Litecoin. When you trade these cryptos CFDs, you are trading them as pairs with the US dollar. This means you can go long or short. Consider starting by opening small positions to begin with, then scale up as you get to know the volatility of the pair you’ve chosen to trade.

Trading cryptocurrencies CFDs is usually understood to mean you are trading a crypto coin, or token, against the US dollar. As cryptos are highly volatile currencies, it is prudent to start with a small trade size, put a stop loss on your trade, and see how you go before scaling up.

When you invest in a crypto coin, you buy, then hold or sell that coin at a later date, usually some time in the distant future. As with a precious asset like gold, this is more like an investment, not a trade. When you trade cryptos CFDs as a spot pair - that’s to say as against the US dollar - you are speculating on the underlying asset as opposed to taking ownership of it. You can also short the pair.

This depends entirely on the behaviour of cryptocurrencies in general at the time you look to trade, as well as the crypto CFD pair you are interested in. That said, the 3 most popular cryptocurrency CFD pairs are listed below:

- BTC/USD - Bitcoin (BTC) against the US dollar

- ETH/USD - Ether (ETH) is the second biggest cryptocurrency after Bitcoin

- LTC/USD - Litecoin (LTC) is traded against the US dollar

There are lots of theories as to what moves the cryptocurrency market. It could be argued that Bitcoin and other cryptos were seen as a hedge against a depreciating dollar and a slump in the global economy due to the pandemic. The price of cryptos was also pushed to extremes by the media and retail traders piling in on the action.

When the price of Bitcoin was cut in half in 2021, pundits argued that now the world had a vaccine we could reasonably hope to see a speedy recovery - and so Bitcoin and other cryptocurrencies lost their appeal. It was also argued that the Chinese government’s antipathy toward Bitcoin contributed towards uncertainty in the crypto space. On the other hand, there was also the simple fact that Bitcoin’s price had climbed so high, it was only normal to expect a large sell-off as traders took profits.

You can trade the 4 big names in crypto — Bitcoin, Bitcoin Cash, Ether and Litecoin as CFDs — on MT4, TradingView as well as our award-winning* proprietary platform OANDA Trade web platform and mobile app. We offer customisable layouts, trade-through charts, a range of plug-ins, intuitive interface and more. Available to trade on live and demo accounts.

For more information see our learn section.

We are upfront about our charges and fees, so you always know exactly how much you are paying when you trade with us.

2 pricing models: spread-only and commission + core spreads

Commission + core spreads go as low as 0.00 pips†

Spread-only prices start from 0.2 pip.

†Spreads from 0.02 pips available on our commission + core spread pricing model.

Easy to deposit funds:

Key features of trading cryptocurrency CFDs:

You can go long and short

Trade without owning the coin you are trading

Volatility. Cryptocurrencies often move faster than traditional currencies

24/5 trading when the markets are open. See our hours of operations page for details

CFDs use leverage, which magnifies profit and loss

Risk management

Given that cryptocurrencies are highly volatile, you may consider protecting your profits and manage your risk with features such as stop losses. Keep an eye on your margin and be aware that leverage can also work against you at the same speed as it can work in your favour.