Depth of market

Access low spreads on a range of instruments with depth of market (DoM).

Depth of market pricing lets you take advantage of competitive spreads for typical EUR/USD order sizes. With depth of market, the smaller the size of your trade, the tighter the spread we can offer you.

Benefits of depth of market

- Take advantage of competitive spreads for typical trade sizes on EUR/USD

- Trade large sizes in one transaction

- Transparency of pricing and spread

Accessing depth of market

Depth of market is available on OANDA Trade web and mobile, and as a plug-in with MT4.

The size and prices available with market depth can be viewed on the order tickets of the OANDA web platform and mobile app.

When you enter the number of units on the order ticket, the sell and buy prices at the top of the ticket dynamically update to show the entry price and spread for the requested number of units.

If the requested number of units is greater than the first level of depth, the system will look down the depth of market to calculate the entry price. You can view depth of market by clicking on market depth (or by tapping DOM on mobile) on the order ticket.

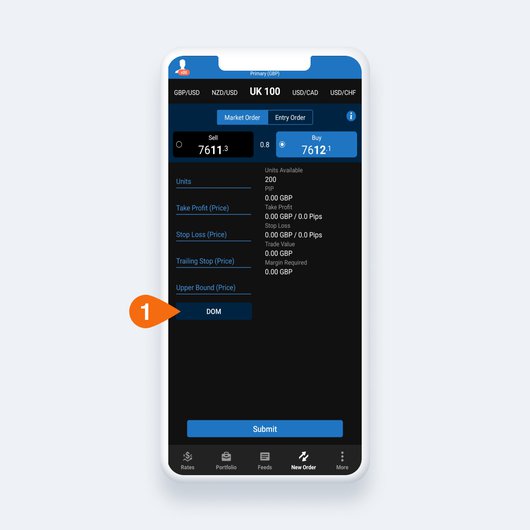

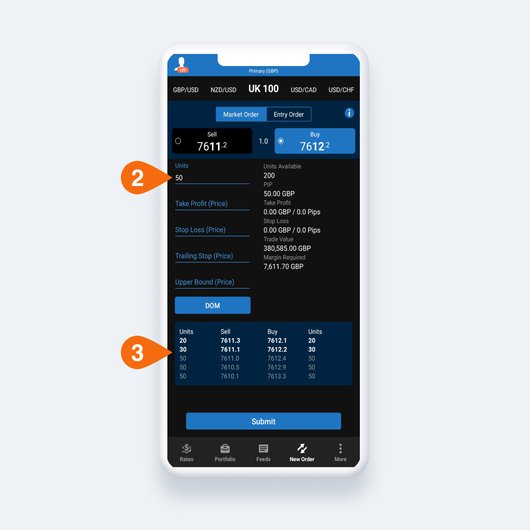

Mobile

Tapping on the highlighted area opens market depth

After entering a number of units greater than available on level 1, the market depth highlights according to the number of units entered

This will show a list of prices and the number of units available at each price. If you enter an order where the number of units is greater than the number of units available on the first level (we will execute the maximum number of units available at the first level), the next portion of the order’s units over the first level price will be calculated from the subsequent price level.

This could include multiple levels, depending on the size of the order. The range of levels being used will be highlighted by the order ticket.

If the next level’s number of units is still not sufficient to fill the entire order, the process will repeat, filing down the depth of market until the entirety of the order’s number of units has been filled. If the order being submitted is larger than the total number of units available across all the price levels, the order will be rejected.

For example, if there is a first level with 1000 available units and an order for 1100 units is submitted, the first 1000 units of the order will use the first level price, while the remaining 100 units of the order will use the second level price.

This means that the price of an order filling at depth will be calculated as a “Volume Weighted Average Price” (or VWAP), using prices from the depth of market. Each level being used in the calculation will contribute to the order’s price, weighted by the number of units being filled at each level.

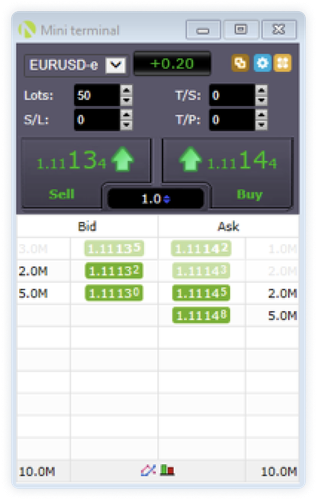

Depth of market is available via the MT4 mini terminal.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Frequently asked questions

Getting started

Does depth of market apply to all order types?

Yes, depth of market can be applied to all available order types. This includes entry (market, limit and stop) and exit (stop-loss, trailing stop-loss and take-profit) orders.

How does depth of market affect order execution on pending orders?

If an order is submitted with a number of units greater than the number available on the first level, then the pending order will only trigger upon the applicable sell/buy price reaching the depth of market price, instead of the top of book level.

Which asset classes does depth of market apply to?

The depth of market functionality applies to all asset classes, but the levels of depth will vary across instruments – some may only have one level. You can view the current market depth for an instrument by opening the order ticket and clicking on the Market Depth/DOM window.

How can I calculate a price for an order filled at depth?

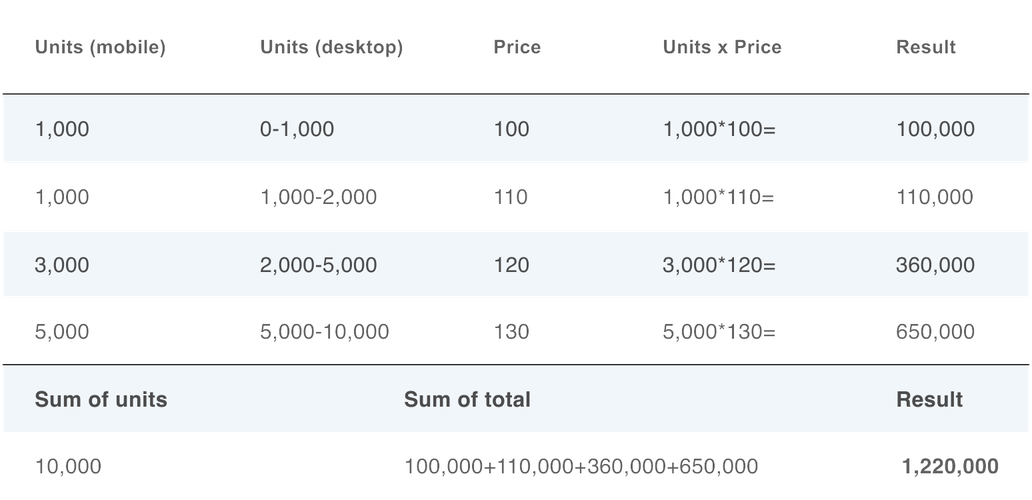

Let’s say an order for 10,000 is being submitted. The depth of market window highlights the applicable levels.

- To calculate the resulting Volume Weighted Average Price for this order, first multiply each level’s price by the number of units at that level. Continue down the depth until all of the order quantity has been filled and then sum up the total. In this example, we do not need to use the fifth level, (price 140), as the requested number of units is satisfied from the first four levels.

This results in a notional value of 1,220,000 for the order.

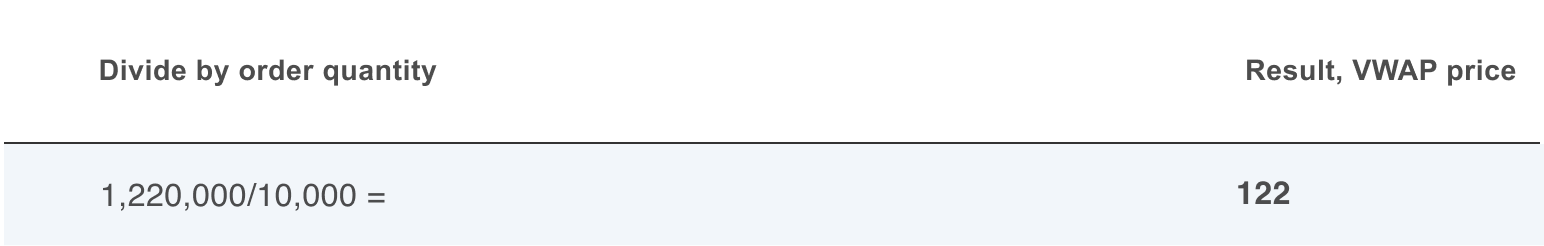

2. Next, divide the notional value by the quantity of units of the order to obtain a VWAP price. In this case, it’s 10,000:

This gives an order “VWAP” price of 122.

Is depth of market available on MT4?

The basic version of MT4 does not support depth of market. This means that if the size of the order is greater than the first level, the sell/buy prices on the order ticket will be different to the price at which it is executed.

In order to view depth, you'll need to use the MT4 Mini terminal, which comes with the OANDA MT4 plug-in. Depth of market can be viewed by clicking on the spread on the “mini-terminal”, rather than from the standard MT4 order ticket. The levels at each depth will be highlighted to show which prices are being used for execution, while the sell/buy prices will update to reflect the order quantity being filled at depth:

How are Upper Bounds affected by Market Depth?

If an Upper Bound is applied to an order, the Upper Bound will take the Market Depth price into account and use it for the basis of the Upper Bound calculation.

Can I break one order into multiple smaller orders?

If multiple orders are triggered at once when the combination of the orders would require executing at depth, the orders are executed on the same basis as if they were combined as one order. So the first order would consume a portion of the depth of market, the second order would carry on from where the first order concluded and so on for each of the orders.