Understanding and using order types in leverage trading

Knowing which order to place to achieve the best entry point can significantly improve your risk to reward trading with margin.

Knowing which order to place to achieve the best entry point can significantly improve your risk to reward trading with margin.

In this article you will learn:

- What the different order types are

- How to gain better control of entry and exit points of your trades

- How to place orders using the OANDA web platform

- How the spread affects orders

Order types explained

In trading, different types of orders serve different functions. Depending on the order you choose, you can achieve different results. This includes the point at which your order will be executed, how long the order can remain active or whether an order gets closed by another order.

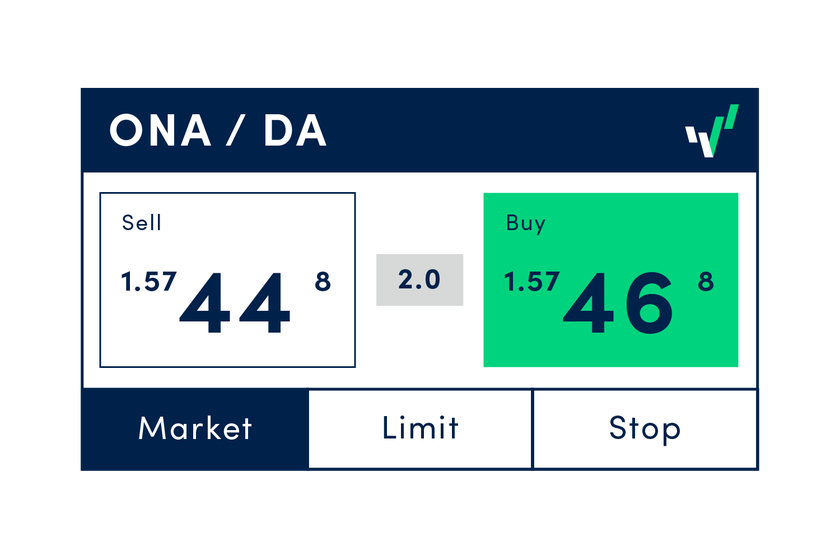

The trade ticket (or order window) , is the sell/buy (or bid/ask) window on your instrument of interest. If you click on buy or sell, the window opens up to give you a ticket. With this open, you can choose the kind of order you want to place.

Let’s go through the different types of orders and see how they could be applied to different entry and exit strategies in your trading:

Entering the trade

Finding the right moment to open a trade is one of the most important aspects of trading. Compared to typical transactions﹣such as buying a product in the grocery store for the displayed offer price﹣financial markets offer more options to decide when and at what price to trade.

Market orders explained: Entering a trade with the market price

What is a market order? A market order is an order that executes at the next available price after you click the submit button. There is no waiting for any other conditions to be met. You simply fill in the details of the order you want to place and OANDA will fill your order at the next available price.

To place a market order, you must first click on the buy/sell window on your chart. A ticket will open at the default setting of market order. Having decided the unit size you want to trade, you can include certain conditions to the order that will instruct your OANDA trading platform when you want to close that order.

Limit orders explained: Entering the market on a set price

What is a limit order? A limit order is an order to buy or sell at a price entered by you, the trader. If you select the limit order ticket, you will see a set of windows that require you to fill in certain values for when you want your order to be filled and when you want it to be closed.

Limit orders can only be placed below the market price when buying and above the market price when selling. When inputting a limit order to buy the price must be below the prevailing sell price, while respectively, for a sell trade the price must be above the current buy price. Limit order does not suffer from negative slippage (that's to say, you always get your requested price or better).

In this image, representing the interface of our web platform, the middle of the ticket shows you the price and expiry. For price, you put in the price at which you want your trade to be filled. If you prefer to limit your price to a time period, you would fill in the value for expiry, for example one day (from now). Otherwise you can select no expiry. Until the conditions you have entered are met, the order is pending and does not affect your account total or margin calculation. If your limit order gets filled, all those values you have provided will attach to your order.

Note: you can always cancel your limit order at any time before it is filled.

or set the expiry date for it. If the order isn’t triggered and market conditions change since you set your limit order, it is best to cancel it as soon as you can because otherwise it will remain in your account and may be triggered at a later date when the markets are behaving quite differently.

When should I consider placing a limit order?

Let’s say the price is moving between two strong levels of support and resistance. You’ve decided you don’t want to enter the trade now, because it looks like the price will drop in about an hour’s time. If it does, you foresee that it is likely to head back down to the next strong level of support and then head back up. You decide that if this happens, you would like to place a trade.

The problem is, you don’t want to sit at your computer all morning waiting to see if this will happen. A limit order can help you place your trade now at a specific price and let you see if your theory was correct. This can be done by filling in the price you want to see triggered, together with your trade size, and all the other order types related to your exit strategy when you place your order.

If the price should drop as you had predicted and reach your price limit, your order will be filled at that price or the next best available price and your order will be live.

Stop orders explained: Entering the market with prevailing price

What is a stop order? A stop order is an order to place a trade in an instrument when that instrument reaches a specified price: to either sell below the current price (for sell-stop order) or to buy above the current price (a buy-stop order). You can opt for a sell-stop order or a buy-stop order. As before, you can set the values you want for your order in terms of price, and trade closeout.

The main difference between a limit order and stop order is that the limit order will only be filled at the specified limit price or better. In comparison, a stop order will be filled at the prevailing price in the market, and therefore, at a price that is significantly different from the set price. So if the market went up or down in a direction that is unfavourable to your stop order price, you would be subjected to an execution at a worse price than the stop price specified.

In short, stop orders can suffer from negative slippage, which means you will get either your requested price or worse.

Using upper and lower bounds to avoid price slippage and sudden moves

When preparing to place an order, you can further lock in the price you want by providing values for the upper bound (situated at the bottom of the order ticket), so that your order is filled at a price that is within the bounds t of your price tolerance

For example, let’s assume you see an opportunity to buy EUR/USD at 1.1390. You create an order at that price, and by the time OANDA executes the order, the rate has changed to 1.1395. If you had set an upper bound price at 1.1394, the trade order would not have been filled.

You can also make use of lower bounds if you are selling: the same process but in reverse.

Exiting the trade: managing position close with order types

The most basic way of exiting your trade is to manually close it out at the next available market price. This is very convenient if you are constantly monitoring your trades or you want to quickly terminate your position.

As much as it is recommended to monitor your trades constantly, it is simply impossible. You will never be able to watch your trades constantly ﹣ and sometimes the price can move in the blink of an eye.

Another reason why many traders choose to rely on orders for existing trades is maintaining a trading regime: even experienced traders can get caught out by exposure, instincts and biases.

How to set a take-profit order

Take-profit orders (T/P) specify the exact price at which an open position should be closed for a profit. If the price does not reach the set level, the take-profit order will not be filled.

Let’s say, for example, that you want to buy GBP/USD at the market at 1.2038 and believe and believe that the market will safely climb another 40 pips. You can add this pip value to the take-profit window. Alternatively, you can type in the price ‘1.2078’ at which you would like to take your profit.

Setting a profit goal upfront can also help manage greed ﹣many traders can’t control their appetite and end up keeping the position open longer than they originally planned in the hope that it will bring more profit. In fact, trends do often reverse and a profitable trade can easily turn into a sudden loss. Setting a take-profit order may help with sticking to a planned exit strategy.

How to set a stop-loss order

Stop-loss orders (S/L) are orders to close out a position at the market price when it reaches a certain price set by the trader. This order type is primarily used to limit loss and control exposure to risk.

Expanding on the example used in the take-profit order above, let’s say you have already set your take-profit price. You still want to manage the risk attached to this trade in case your price action expectations are wrong.

Let’s assume you are not willing to risk a loss larger than 20 pips. You can add this pip value to the stop-loss window, or specify the price corresponding to the 20-pip loss (whichever you prefer) to define the stop-loss. Once that price has been reached, this order would cause your position to be automatically closed at the market price to prevent further loss.

Without the stop-loss, you might continue to run with the losing trade, hoping for it to recover. This phenomenon is called a ‘sunk-cost effect’: a tendency to continue an endeavour once an investment in money, effort, or time has been made. This is one of many cognitive biases which could be countered with proper definition of your trading strategy, including the use of stop-loss orders.

Guaranteed stop-loss orders

Guaranteed stop loss orders (GSLO) are a type of stop-loss order. GSLOs get executed exactly at the price level you define, regardless of volatility and slippage. Regular stop-loss orders work just fine most of the time. Due to volatility, the spread of affected instruments can sometimes widen severely and execute a regular stop-loss order at an unfavourable level in the process. The unfavourable closing price can also be a result of slippage or gapping (executing the close order at the next market price).

GSLOs work the same as standard stop-loss orders, however, your exit point is guaranteed. GSLOs incur a fee (or GSLO premium), but this is only charged if the GSLO is triggered.

This could be really useful during high market volatility and increased slippage, for instance around the time of macroeconomic data releases.

Setting trailing stops to lock in profit or limit loss

Trailing stop (TS) pre-set the order at a specific distance away from the market price when the market swings. Trailing stops are designed to lock in profits or limit losses as a trade moves in the direction you want it to move.

A trailing stop will only move if the price continues to move in your favour. As soon as it moves against you, the stop will cease moving. If the market continues to go against you, a stop loss will trigger and close your trade. If the market should continue in the direction you want it to go, the trailing stop will resume moving in the same direction.

The trailing stop is a useful tool to have, especially in a trade with strong momentum to the upside or downside. It is, however, less useful in a sideways or ranging market when your trailing stop is more prone to being triggered by the whipsaw action of the market.

Managing the risk/reward ratio using various order types

Trading the financial markets carries a degree of risk and you aim to be rewarded if you're going to take that risk. Of course, each individual trader has their own level or risk they are willing to accept, and nobody is placing trades assuming their trades will bring loss.

Losing trades are inevitable and the way to deal with them is to be very conscious about your own risk appetite and your risk/reward ratio. Using risk management measures is good practice. It helps to understand and limit risk, by setting the stop-loss, as well as fight against the appetite for unrealistic gains with take-profit orders.

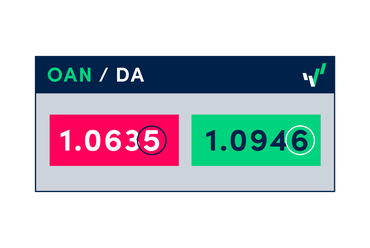

What is a spread and how does it affect my order?

The difference between the buy and sell price is called the spread and represents a cost of trading.

Once you press the buy or sell button, a market order will get you in at the best available market price. If you were to immediately close your trade, you would have to do it at the opposite price. If buying, you would close on the sell price, for example. So if the market price for GBP/USD is 1.3333 to buy and the spread is 6 pips, your order would be filled at 1.3333, but the price you could immediately sell at would be 1.3327 (1.3333-0.0006 = 1.3327).

Key takeaways

- A market order either to buy or sell a forex pair will enable you to enter the market immediately at the current price available to you.

- You can use a limit order when you wish to place an order that will be executed at a specific price that is either above (if selling) or below the current market price (if buying).

- A limit order allows you to trade when you’re not tracking your charts. For instance, it could get triggered in the future when perhaps you are too busy to trade.

- A stop order is an order that is triggered when the price of a forex pair moves past a specific price point you have chosen. Once triggered, it becomes a market order that is filled at the best available price.

- A stop order is used to limit losses with a stop-loss, or secure profits using a trailing stop.

Don’t know the difference between different order types? Read about the basics of fundamental and technical analysis in trading. Once you’ve opened a live or demo account, you can start implementing some of the trading strategies we cover in our learn section.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more