How is fundamental analysis used in forex?

Get to know the basics of fundamental analysis in trading the markets.

Get to know the basics of fundamental analysis in trading the markets.

How is fundamental analysis used in forex?

Fundamental analysis can be understood as a methodology for assessing an instrument’s strength over a period of time and into the future by examining related economic and financial factors, including a country’s interest rate, inflation, microeconomic indicators, and consumer behavior. Traders who use fundamental analysis in their forex strategy are looking for catalysts that signal a sudden jump in demand of a currency pair, either strengthening a trend or bringing about a reversal or breakout.

Difference between fundamental and technical analysis

Traders who trade ‘the technicals’ - using technical analysis - are essentially trading what they see on their charts. They will use indicators, volume and various other tools available to them from a trading platform to identify potentially smart entry and exit points for a trade idea.

Some traders prefer only to trade the technicals - they refer to fundamentals and news as ‘noise’. For them, the chart tells them all they need to know about an instrument’s direction in the market. Similarly, there are those traders who only trade off big decisions being made by banks and governments or even natural disasters.

And then there are traders, who look for confluence between fundamentals and technicals. There is no right or wrong way - the best traders will tell you it’s up to you which discipline suits your personality and gets you the best results.

Why fundamental analysis is important

A trading chart can tell you a lot about a currency pair - its direction, momentum, support and resistance areas and so on. But when you trade only from a chart, with a deaf ear to major economic shifts, you run the risk of missing major reversals in price.

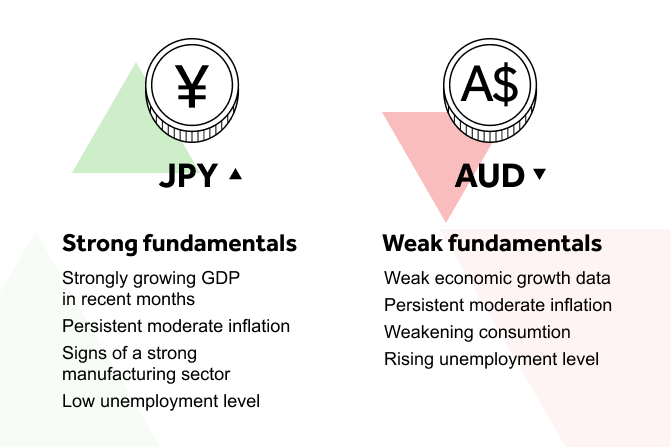

Simply put, when a country reports poor economic data or even a perceived major weakness in the economy over the next six to 12 months, financial institutions around the world will tend to re-evaluate their perception of that country’s currency in an unfavorable way. In other words, that country’s currency will weaken or become bearish. Why is that? Because foreign businesses will become more cautious about investing in assets in a country with a weakening economy - as they would need that country’s foreign currency in order to operate there, they will buy less of that country’s currency and, so, with a fall in demand, price will drop.

When the UK voted to leave the EU, for instance, confidence in the pound was shaken and many GBP pairs were hit as a consequence. Against the US dollar the pound dropped almost 20% in value over the following weeks before it began to retrace. Traders who kept up with the news could have seen potential in shorting the pound against the US dollar. Then, when the uncertainty over Brexit negotiations began to wane, the pound returned to favour and, since spring 2020 has been on an up-trend against most major currencies.

Types of fundamental analysis

When using fundamental analysis you may choose to look at a very narrow range of factors impacting the price of a currency pair, or go much broader. It largely comes down to knowledge, the time you can afford to spend on doing some research and the size of your trade. Generally speaking, what traders look for is the correlation of one instrument to another. So, for example, a spike in interest rates in the US may push up prices and, as commodities are priced in dollars, this is likely to strengthen the dollar. This is because on the world market, commodities are paid for in dollars. A strengthening dollar will therefore affect dollar pairs.

Top-down analysis

A top-down analysis approach to fundamentals means you start by analyzing macroeconomic factors and identifying how events may impact a currency pair you have your eye on.

Bottom-up analysis

Conversely, this type of analysis starts with analyzing the currency pair working upwards to see how it is affected by the broader economic climate.

Balance of trade and interest rates

These factors are key drivers for currencies. If a country has a trade surplus, this implies there is a high demand for its goods and services and, consequently, a high demand for its currency. The higher the demand, the more buyers will be in the market. Similarly, higher relative interest rates lead to cash inflows, which will also push up the value of a currency.

Forces driving demand and supply

During the pandemic many commodities have been in short supply, which has pushed up their prices dramatically. As the world begins to ‘return to work’ the price of oil has been rising steeply. Basically, any major event that changes supply or demand will affect price.

How to trade using fundamentals

You can receive updates on important economic announcements and events directly from your OANDA Trade platform. Global economic overview, customizable view, reference results and more. This is also available on OANDA’s practice or demo accounts.

Here are some starting points for using fundamental analysis in your trading:

Gross domestic product (GDP)

As GDP measures the total value of all goods and services produced by a country during the reporting period, an increase in GDP indicates a growing economy, and potentially a strong currency for that country.

Consumer price index (CPI)

The CPI measures the cost to buy a defined basket of goods and services. It is expressed as an index based on a starting value of 100. A CPI of 112 means that it now costs 12% more to buy the same basket of goods and services today than it did when the starting index value was first determined.

By comparing results from one period to the next, it’s possible to measure changes in consumer buying power and the effects of inflation. While inflation by its very definition suggests economic growth, inflation that occurs too rapidly will weaken consumer buying power and push a country into recession. With higher inflation, there also comes the expectation that governments will raise interest rates. When interest rates go up, investors tend to move out of stocks into safer assets, such as bonds. During the pandemic, recurring fears that interest rates would be pushed higher to curtail inflation has on occasion caused sell-offs on the stock market.

Producer price index (PPI)

Whereas the CPI measures prices from the perspective of consumers, the PPI measures costs from the viewpoint of industries that make the products. When it comes to money there is always a trade-off: individuals can save money and earn interest, or they can spend money immediately and forgo any interest payments. If PPI is on the rise, the government may step in to raise the interest rates to curtail demand. In turn those higher interest rates can lead to more buying of that currency, effectively sending traders a potential buy signal for that currency.

Employment rates

Employment reports can have an impact on currencies because employment levels directly affect current and future spending habits. An increase in unemployment is a negative indicator since it shows there is likely to be a drop in consumer spending and productivity.

Interest rates

Central banks set a “base rate”, which is the rate at which banks and lenders pay when borrowing directly from the central bank. These banks and lenders will then pass on the rates they are charged to their own customers, propagating any central bank’s interest rate changes to the wider economy. If a country’s interest rate goes up relative to another country’s, the base currency for that pair is likely to strengthen, assuming all other major fundamental factors remain equal, because the higher interest rate it comes with will attract investors.

Central banks also engage in the purchase of assets such as government or mortgage debt in order to reduce the interest rate charged on these securities and thereby stimulate the economy and provide additional liquidity to markets.

Yield curve

Yield is the interest on fixed-income securities, such as government bonds. Referred to as "fixed" income because the payment stream (the yield) remains constant until maturity. For example, a simple 5-year bond with a 3 percent annual yield, would pay $300 a year for the next five years on an initial $10,000 investment. The yield curve shows the relationship between the yield, and the time to maturity. When dealing with fixed-income securities, investors want to ensure that the fixed yield remains profitable right up until maturity.

As an investor you may be happy with a 5 percent return when the basic lending rate is 2 percent. However, if short-term interest rates rise and the lending rate jumps to 6 percent, your 5 percent return is no longer so attractive, and there are probably other options that could generate more income for your investment.

Trade balance

If a country’s balance of trade shows a surplus or declining deficit, there may be an increased demand for the currency. If the report shows a growing deficit, together with a drop in demand for the exporting currency, the government may step in to devalue the currency in a bid to boost exports.

If you’re interested in using fundamentals in your trading, be sure to check out the tools on the OANDA Trading platform.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more