If you have an open position on your account at the end of each trading day (5pm ET), the position is considered to be held overnight and subject to either a financing charge or credit to reflect the cost of funding your position (in relation to the margin utilised). This charge or credit is based on the interbank rate.

The financing cost is calculated on a per position basis and may be a charge or a credit to your account, depending on whether you hold a buy/long position or a sell/short position, and after also taking into account the impact of our admin fee.

FX, gold and silver: Daily financing charge or credit = size of position x applicable funding rate/365

Indices: Daily financing charge or credit = value of position* x applicable funding rate/365

*where value of position = size of position x price at the end of trading day (5pm ET)

Funding rates (or ‘swap rates’ for FX products) vary depending on the instrument and may change on a daily basis. These are quoted as an annual rate. Each instrument has two quoted rates: one for a buy/long position and the other for a sell/short position.

A negative funding rate will result in a charge being debited from your account, and a positive funding rate results in a credit to your account.

The daily financing charge or credit will be claimed/passed from/to your account each day, and will be visible in your transaction history accessible via your account portal.

Simply select the instrument you wish to trade and it will calculate both the annualized funding rate (including the specific admin fee) and anticipated daily financing cost based on prevailing rates. Additionally, you will also see historic funding rates.

Rates are based on a blend of underlying liquidity providers’ tom-next SWAP rates, adjusted by the instrument specific admin fee, and annualized.

Rates include an admin fee of 2.5%, plus the relevant* alternative reference rate, annualized. This is represented by a negative rate, and hence a charge.

When the relevant* alternative reference rate is greater than our 2.5% admin fee, the rate used will be the difference between the two, annualized. This is represented by a positive rate, and therefore a credit.

When the relevant* alternative reference rate is lower than our 2.5% admin fee, the rate used will be the difference between the two, annualized. This is represented by a negative rate, and therefore a charge.

*Rate used in the country whose currency is the instruments’ quote currency using the table below.

| Index | Reference rate |

|---|---|

| Australia 200 | AONIA |

| China A50 | SOFR |

| Germany 30 | ESTR |

| Europe 50 | ESTR |

| France 40 | ESTR |

| Hong Kong 33 | HKD DEPOSIT 1WK |

| Japan 225 | SOFR |

| US Nas 100 | SOFR |

| Netherlands 25 | ESTR |

| Singapore 30 | SORA |

| US SPX 500 | SOFR |

| Taiwan Index | SOFR |

| UK 100 | SONIA |

| US Russell 2000 | SOFR |

| US Wall St 30 | SOFR |

| Spain 35 | ESTR |

| Switzerland 20 | SARON |

| ChinaH Shares | HKD DEPOSIT 1WK |

| Japan 225 (JPY) | TONA |

| Instrument | Admin fee |

|---|---|

| TRY pairs | 4.00% |

| CZK, HUF, SAR, THB, ZAR pairs | 2.00% |

| Other pairs | 1.00% |

Different asset classes settle on different days.

FX, gold, and silver trades typically settle on a T+2 basis, which effectively means that weekend financing is usually applied two days earlier on Wednesdays (tripling the usual daily rate), although this timeline is similarly impacted by public holidays.

Indices typically factor in weekend financing on a Friday (tripling the usual daily rate), although this timeline is also similarly impacted by public holidays.

Accordingly, the actual funding rate on any given day may reflect more than one day’s costs.

No financing charges or credits are applied to clients’ accounts over the weekend. See our FAQs for examples of financing costs.

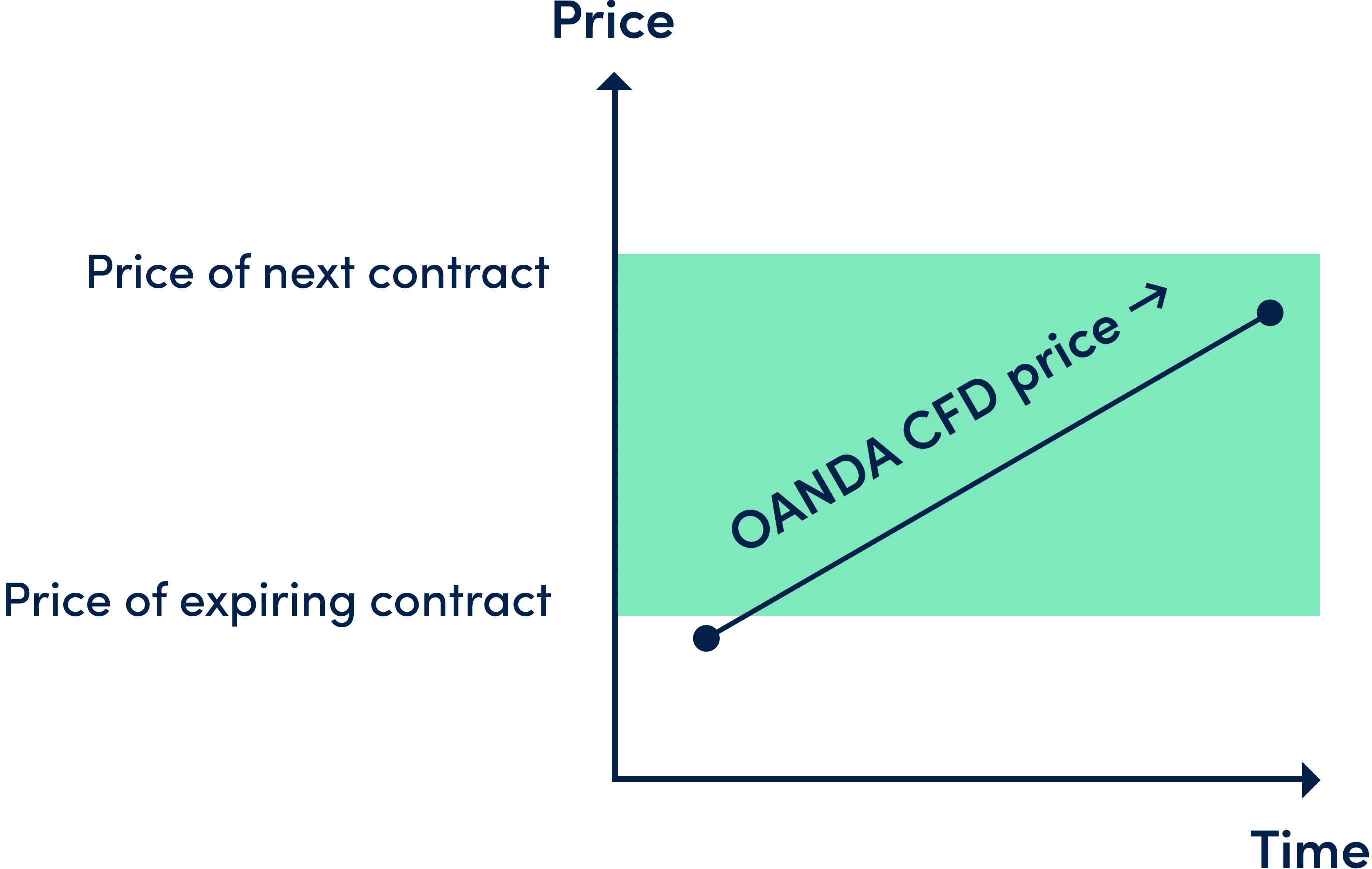

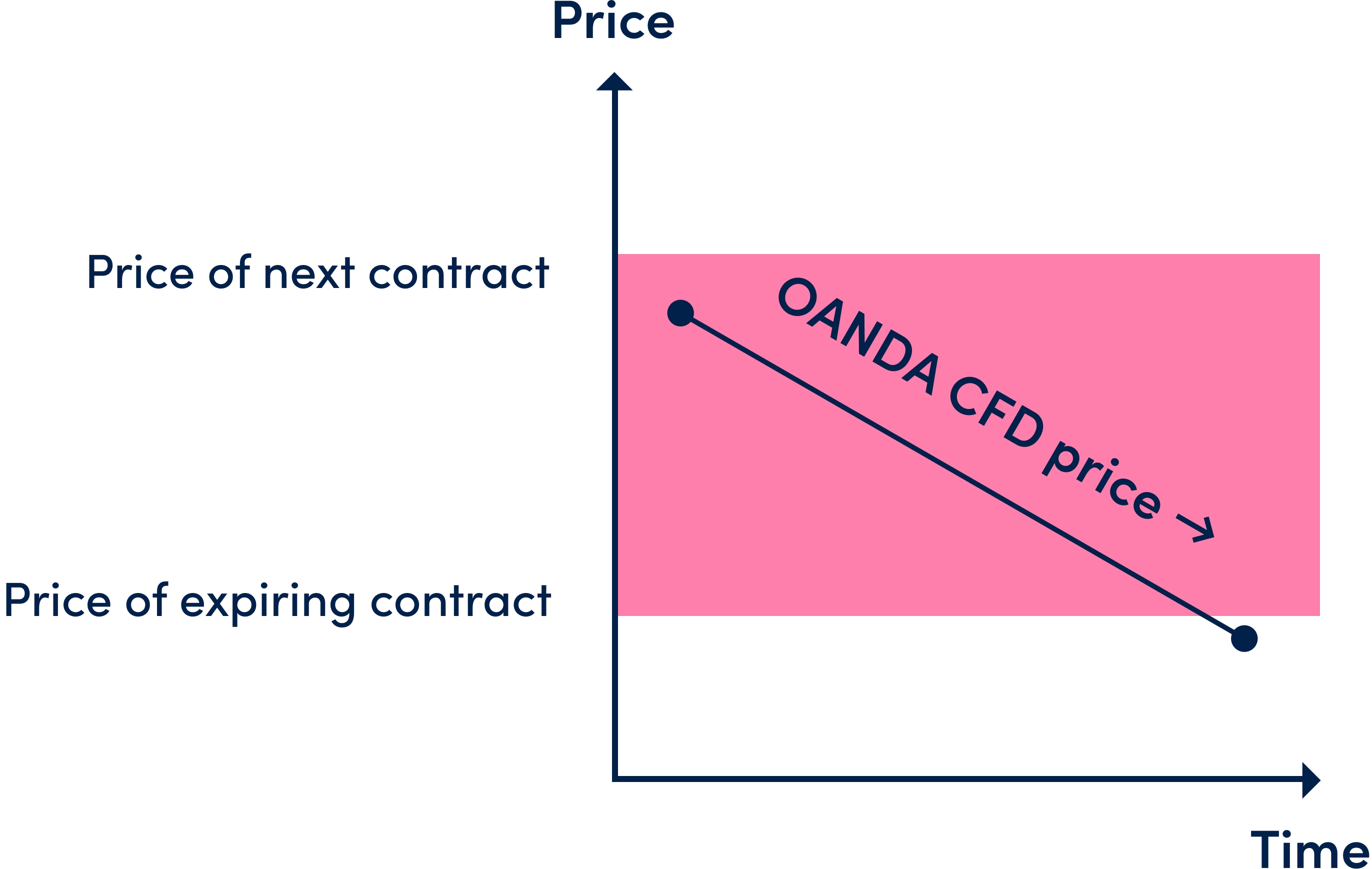

The prices of our commodity, metal (excluding gold and silver) and bond CFDs are based on underlying futures contracts. When an underlying futures contract is near expiry, we calculate the basis rate, which represents the difference in price between the expiring futures contract and the next futures contract.

From that point forward, our CFD price is calculated as the present value of the price of the next futures contract, using the basis rate for the present value calculation. The present value is calculated continuously, second-by-second.

When the basis rate is positive, the CFD price will tend to move upwards towards the contract price

When the basis rate is negative, the CFD price will tend to move downwards towards the contract price

Financing costs on commodity, metal (excluding gold and silver) and bond CFDs are therefore calculated on a continuous second-by-second basis.

For the duration of the trade the resultant financing charge/credit is debited/credited at the end of each day (5pm ET), including weekends and public holidays, and when the trade is closed.

Financing charges or credits are calculated as follows:

Financing charge or credit = size of position x applicable funding rate x [trade duration (in days) / 360] x conversion rate to account currency.

OANDA charges financing on commodity, metal (excluding gold and silver) and bond CFDs using the basis rate with a % admin fee applied. The basis rate portion of the financing amount is intended to offset the price movements caused by the present value calculation.

For long positions, your account will be debited the basis rate plus a 1% admin fee. For short positions, your account will be credited the basis rate minus a 1% admin fee (which could result in a charge where the basis rate is less than the admin fee).

Rates and costs for today's date are approximate and will not be finalized until 5 pm ET.

*Long financing charge = the financing charge on a long position of the given instrument

^Short financing charge = the financing charge on a short position of the given instrument

(Financing charges are based on positions of 100,000 units for FX, 1 unit for Indices, 10 units for gold and silver, and 100 units for commodities, metals & bonds)

†Copper is included within commodities

It's easy to fund your account using one of the following payment methods.

With over 25 years of experience, the OANDA Group offers leading tools, powerful platforms and transparent pricing.

Transparent trading costs

We are upfront about our fees, so you know how much you are paying when you trade with us.

CFD trading

We offer a wide range of global CFD instruments, including indices, forex, commodities, metals and bonds.

Trading with OANDA

Our operation hours coincide with the global financial markets. Find out when you can trade with us.