Q4 '25 earnings preview: Mag 7, AI monetisation, and market risks analysed

Examining the S&P 500's valuation test, the critical shift from "AI promise" to "AI monetisation," and detailed outlooks for NVIDIA, Apple, Alphabet, Tesla, Meta, Amazon, and Microsoft.

Examining the S&P 500's valuation test, the critical shift from "AI promise" to "AI monetisation," and detailed outlooks for NVIDIA, Apple, Alphabet, Tesla, Meta, Amazon, and Microsoft.

Global equity and US markets are entering 2026 at a critical inflection point. The transition from 2025, a year defined by the speculative frenzy surrounding generative Artificial Intelligence (AI) and the resilience of the US consumer, to 2026 brings a new set of demands from market participants. The narrative is shifting from "AI promise" to "AI monetisation," and from "inflation resilience" to "margin preservation".

The fourth quarter 2025 earnings season serves as the first major test of this new paradigm. With the S&P 500 trading at elevated valuation multiples, specifically a forward 12-month price-to-earnings (P/E) ratio of 22.2x, well above the 10-year average of 18.7x, the market appears to have priced in a "soft landing" scenario characterised by sustained growth and disinflation.

Market participants are grappling with unusual new risks coming from rising political tensions between the US and Nordic countries regarding Greenland.

Let us take a deeper look at the key factors and themes heading into Q4 earnings season.

The macroeconomic framework and valuation context

The biggest challenge for market participants in January 2026 is determining whether high share prices are actually justified by how much money companies are making. With the current expensive market, companies need to deliver excellent results to justify these costs; otherwise, stock prices could become unstable.

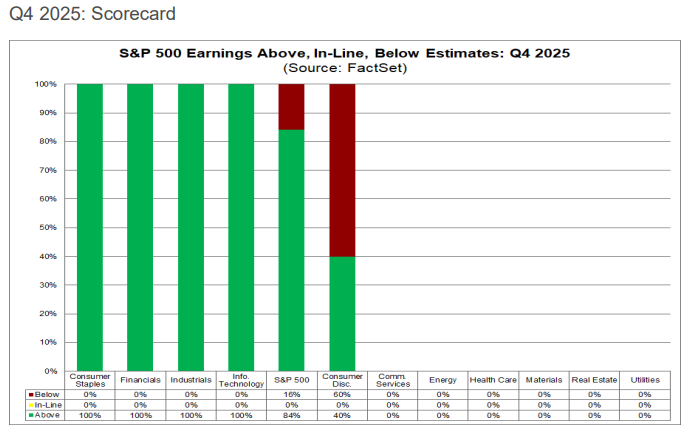

Market participants are expecting that overall profits for the S&P 500 grew by 8.3% YoY in the last quarter of 2025, which would mark the tenth straight quarter of growth.

However, this success is not being shared equally. While the massive tech giants known as the "Magnificent Seven" are expected to see huge profit jumps of nearly 23% (market expectations based on Factset data), the vast majority of other companies are growing at a much slower rate.¹

This valuation premium implies that any disappointment in forward guidance, particularly regarding the pace of AI adoption or consumer spending, could lead to a sharp compression in multiples.

The "Magnificent Seven" – assessing the AI thesis

The performance of the S&P 500 in 2025 was dominated by the "Magnificent Seven" (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, Tesla), which returned an average of 27.5% compared to the index's 17.5%. Q4 2025 earnings are a sort of referendum on whether these companies can transition from the "AI training phase" to the "AI deployment phase".

NVIDIA (NVDA): The hardware hegemon

Projected reporting date: 25 February 2026.

NVIDIA remains the undisputed leader of the AI infrastructure buildout. The stock returned 40.9% in 2025, a deceleration from previous years but still robust.

Blackwell architecture: The focus for Q4 is the ramp of the Blackwell chip. Despite early reports of overheating (which were resolved), production is running at full capacity.

Demand dynamics: Hyperscaler capital expenditures (CapEx) reached $400 billion in 2025, with projections hitting $520 billion in 2026. This spending flows directly to NVIDIA. The consensus Q4 revenue estimate is approximately $61.3 billion to $61.6 billion.

Competitive risks: The emergence of "DeepSeek," a Chinese AI model offering high-performance reasoning at a lower compute cost, sparked a temporary sell-off. However, NVIDIA CEO Jensen Huang has argued that efficient models expand the Total Addressable Market (TAM) for inference, ultimately sustaining demand for GPUs.²

Guidance: Any guidance below the $60 billion mark for the upcoming quarter may be viewed as a significant disappointment and could potentially weigh on the share price.

Apple (AAPL): The supercycle returns

Reporting date: 29 January 2026.

Apple is positioned for potentially its strongest quarter ever, driven by the iPhone 17 cycle.

Revenue estimates: Analysts forecast Fiscal Q1 2026 revenue to reach approximately $138 billion, representing 10-12% year-over-year growth. (Factset, LSEG Data)

The iPhone 17 effect: The integration of "Apple Intelligence" and hardware upgrades (including the new "iPhone Air" form factor) has triggered a massive upgrade cycle. Crucially, early data indicate Apple has regained the #1 market share position in China, reversing previous declines.³

Services: The high-margin services division continues to grow, setting records for revenue.

Risk: The stock underperformed the Mag 7 average in 2025 (returning 8.8%). The market requires a substantial beat to re-rate the multiple.

Microsoft (MSFT): The Cloud battleground

Reporting date: 28 January 2026.

Microsoft's earnings will be scrutinised for the durability of its Azure cloud growth relative to Amazon's AWS.

Azure growth: Analysts project Azure revenue growth of roughly 28.6% for 2025, outpacing AWS (16.8%) and Google Cloud (25.3%). Maintaining this premium is essential to the valuation.

Capacity constraints: Microsoft has previously noted that the demand for AI exceeds supply. Updates on data center capacity coming online in 2026 will be critical for modeling future growth.

Copilot adoption: Investors need evidence that the massive AI investment is yielding software revenue via Microsoft 365 Copilot subscriptions.

Tesla (TSLA): A year of transition

Reporting date: 28 January 2026.

Tesla faces the most complex narrative. While the stock remains a retail favourite, fundamentals are mixed.

Delivery volumes: Q4 2025 delivery consensus is approximately 422,850 vehicles, implying a year-over-year decline. The company is in a "gap" period between the Model Y peak and the ramp of next-gen vehicles.

Margins: With volumes stagnant, margin preservation is paramount. The market is increasingly valuing Tesla on its AI/Robotaxi potential rather than current auto sales, but poor automotive margins could still drag the stock down.

Alphabet (GOOGL): The value play

Reporting date: 3 February 2026.

Alphabet was the top-performing Mag 7 stock in late 2025 (+65.8% YTD).

Cloud profitability: Google Cloud has become a legitimate profit engine, not just a revenue line.

Search defence: Despite fears of AI eroding search, Alphabet has successfully integrated AI overviews (Gemini) without destroying ad margins.

Antitrust: The DOJ cases remain a long-term risk, but the market has largely discounted this for the near-term earnings cycle.

Meta Platforms (META): The CapEx question

Reporting date: 2 February 2026.

Meta's core ad business is robust, but spending remains the key friction point.

Ad revenue: AI tools like "Advantage+" have improved ad targeting, driving revenue growth.

Reality labs & AI spend: Meta plans "notably larger" CapEx in 2026 to fund AI infrastructure. CEO Mark Zuckerberg must convince investors that this spending is disciplined and will yield returns, avoiding the "year of efficiency" reversals of the past.⁴

Amazon (AMZN): AWS and retail efficiency

Reporting date: 2 February 2026.

Amazon has lagged slightly due to AWS growth concerns.

AWS acceleration: The partnership with OpenAI and increased GPU supply might help AWS re-accelerate growth.

Retail margins: The "regionalisation" of the US fulfillment network has structurally improved retail margins, it will be intriguing to see if this is reflected in the Q4 results.

The Federal Reserve and interest rate dynamics

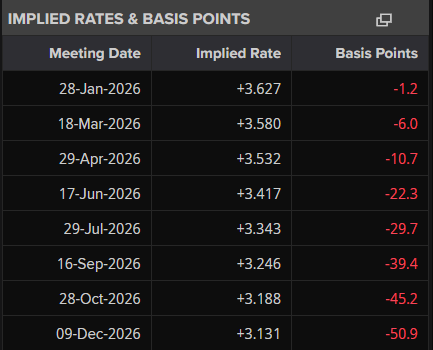

The Federal Reserve has officially shifted its strategy, cutting interest rates by 75 bps late last year with two more 25 bp rate cuts expected in 2026 based on the latest LSEG data.

This move could theoretically help the market in several ways: it makes future profits more valuable today, which specifically boosts tech stock prices, and it lowers loan payments for companies with heavy debt, like those in real estate.

Crucially, market participants currently view these cuts as "good news", a reward for bringing inflation down rather than a desperate attempt to save a crashing economy. Since consumer spending and economic growth remain strong, the market sees these lower rates as a healthy support for continued growth rather than a warning sign of a recession.

Q4 numbers arrive amid stubborn cost pressure and a shaky economy, therefore, market participants may push aside the raw sales total, asking themselves if the profit margin can truly hold and if the company can maintain strategic discipline.

The Federal Reserve decision will thus play a major role as it will be released just as the “Magnificent Seven” earnings releases are in full swing. The rate decision and Fed meeting will take place.

Conclusion

The Q4 2025 earnings season is a validation test for a market priced for perfection. The S&P 500, trading at over 22x forward earnings, leaves little room for error. The transition from "AI Promise" to "AI Reality" is the dominant theme.

Strategic takeaways:

Monetisation is mandatory: Market participants may look to prioritize companies demonstrating tangible revenue from AI (e.g., Microsoft Copilot, Meta Advantage+) over those merely spending on infrastructure.

Bank bifurcation: Differentiate between banks benefiting from capital markets revival (GS, MS) and those exposed to consumer credit stress (WFC, C).

Consumer caution: Be wary of the "tariff pull-forward" effect in retail. Strong Q4 numbers may mask a weak H1 2026 outlook.

Footnotes:

2 - https://www.cnbc.com/2025/10/08/jensen-huang-nvidia-computing-demand.html

4 - https://www.datacenterdynamics.com/en/news/meta-plans-notably-larger-capex-spend-on-ai-data-centers-in-2026-compute-expectations-already-higher-than-last-quarter-prediction/, https://www.reuters.com/business/metas-profit-hit-by-16-billion-one-time-tax-charge-2025-10-29/

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_moreStrategies for trading individual instruments and asset classes

expand_less expand_more