How to use stop-loss orders in forex trading

A stop-loss order enables you to get you out of a losing position at a predetermined price.

A stop-loss order enables you to get you out of a losing position at a predetermined price.

Trading can be an emotional business and it’s the lack of discipline that causes most traders to fail. One of the surest ways of containing your emotions is to know your level of risk and work with a tool that limits risk. That’s where a stop loss comes in.

A stop loss is an order associated with an open position in the market. It’s designed to get you out of a losing position at an amount that you, as a trader, have set as the maximum risk you are comfortable with taking on that trade. If you don’t use a stop loss, you have no control over your risk, and that’s when emotions can take over. In trading, being led by emotions could lead to heavy losses.

What is a stop loss order?

Before you open a trade, you want to factor in how much risk you are willing to take. Most professional traders will not risk more than 2% of their available margin on any one trade. So how do you make sure you don’t lose any more than you are prepared to risk? You can do this by adding a stop loss.

A stop loss is simply a means of setting a price point that cuts off your losses at the risk you set out to take before entering the market. You could, if you wanted, open a position and then later set your stop loss. This isn’t recommended, however, because price can move quickly and suddenly and catch you out. This could result in losses that could quickly get out of control.

What is a take-profit order?

Your take profit is the price at which you want to close the trade when it’s been moving in your favor. For instance, let’s say you decide to buy GBP/USD and your analysis suggests you stand a high probability of making 40 pips before the next significant dip. In such a scenario, a take profit order could be set at a price that is 40 pips above the entry price.

How to set up a stop loss

Setting a stop loss (SL) at the time of opening your trade is sometimes referred to as a stop loss order, not to be confused with stop order, which we will come to in a moment. As well as setting a stop loss, you could also calculate your exit point. For this, you would set a take profit price, or TP for short. Once you’ve bracketed your trade this way, you are ready to click buy or sell. Now you can leave the trade knowing that, worst comes to worst, your stop loss will prevent you from losing any more than the amount you decided to risk at the time of opening your trade.

Just occasionally, in a fast moving market, there is so much buying and selling going on that your stop loss may not get triggered at the price you requested. Let’s say you were holding a buy GBP/USD and some major event occurred to shake confidence in the UK economy. This might cause a sudden rush of panic-selling of that currency across multiple pairs. If the selling was very fast, as it was during Brexit for instance, there would likely be fewer potential buyers than usual. In this case there would be a chance your stop loss order wouldn’t be filled at the price you requested.A similar scenario can happen when, over the weekend, the currency pair you are trading gaps up on the Monday. If that move is fast enough it may cut through your stop loss. If the automatic stop fails to work, any open trade can be closed manually.

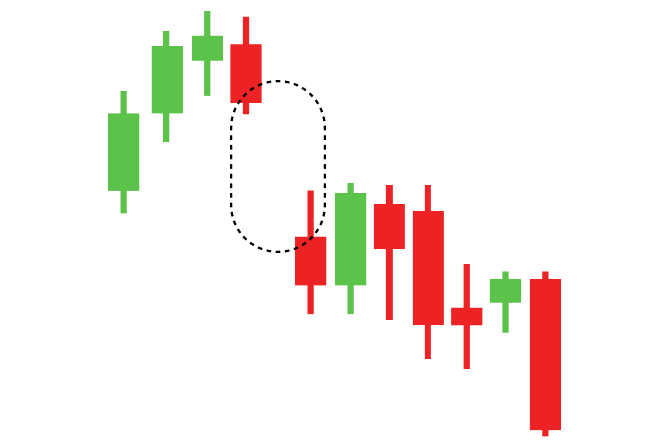

Slippage, gap up and gap down

Sudden moves in price, shown on a chart as a sizable gap between candles, are known as a gap up or gap down. If a trade is open and there is a price gap against the trade’s direction, the stop-loss would be triggered at the next available price point. In such a situation there may be a difference between the point at which a stop-loss order was set, and the price at which it actually was executed. This difference is commonly referred to as slippage and is an unavoidable risk of trading.

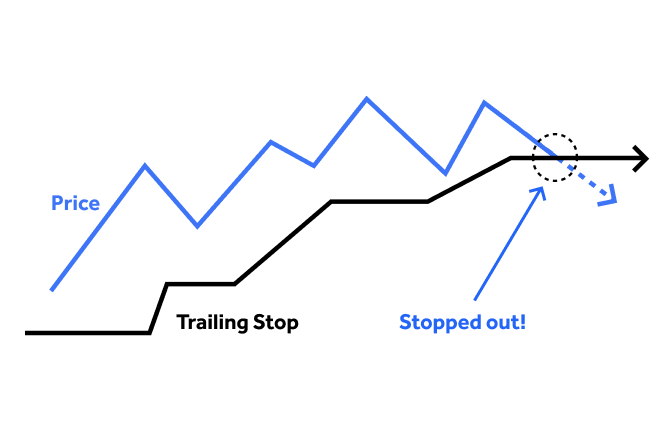

Trailing stop-loss orders

The key feature of a trailing stop is that it automatically follows a trade as long as the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance.

Let’s say you take a ‘buy’ trade, going long GBP/USD. With a trailing stop in place, your trade will stay open as long as price moves in your favor, but if the market moves down, your stop loss will lock at that latest high point. If price continues moving against you, your trailing stop, now fixed, will close out your trade at the price it reached before the downward move.

If you’d opened a short position and set a trailing stop, your stop loss would effectively freeze the moment price went against you. If price continued to climb up you would be stopped out at the price where your stop loss ‘froze’. The advantage of using a trailing stop is that it effectively works like an auto stop loss that serves to minimise your risk and maximize your RR (risk reward ratio).

Where to set stop-loss targets in forex trading

Where you place your stop loss may be governed by the amount of risk you are prepared to take on any given trade. One place to set your stop loss would be at a point where you don’t expect to get stopped out.

Before you click buy or sell, you could use a top down analysis by looking at the next two or three time frames above the main timeframe you’re trading on. So, for example, if you're trading on the one hour timeframe, you may be looking for confirmation that you are trading in the right direction by taking a look at the two-hour, four-hour and daily timeframes. If you were trading on the 15-minute timeframe, you would look for confirmation on the one-hour and four-hour timeframes.

Before settling on a set-up, experienced traders will map out key levels of support and resistance on the chart they are interested in, having in mind the support and resistance levels of higher time frames like the day are more frequently respected than lower timeframes.

A good rule of thumb is to place a stop loss just above or beneath the nearest major resistance or support level. The thinking behind this is that if price were to move beyond this point, it’s highly probable it will continue going against you; by placing a stop loss on the other side of resistance or support helps reduce the risk of getting stopped out too soon by a sudden spike in supply or demand.

Using the Fibonacci tool to determine stop-loss

Some traders use Fibonacci Retracement levels to identify areas of support and resistance, and then place their stop loss on one side of these levels by, say, 30 pips. You can find this tool on any of the OANDA trading platforms.

Key takeaways

- A stop-loss order is an order that specifies you want to sell your open position at a certain price, and is usually placed just below or above the open price of your trade

- A stop-loss order is designed to limit losses

- The brokerage uses the prevailing market price to fill your stop-loss order and close your position

- Sudden wild swings in price can trigger a stop-loss order.

- If the market is moving at speed against you, your stop loss may not be triggered exactly where you placed it, but rather at the next available price.

Frequently asked questions

What is a stop-loss order?

A stop-loss order is an order that specifies you want to sell your open position at a certain price, and is usually placed just below or above the open price of your trade.

What is slippage in forex trading?

Not all trades are executed at the price you have set your order for. In some cases, usually when the market is highly volatile, there is a slight discrepancy between the price you chose and the price your order is executed. This is typically referred to as slippage.

What is a trailing stop loss?

A trailing stop is a stop loss that automatically follows a trade as long as the market price moves in a favourable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance.

Where do you set a stop loss?

A good rule of thumb is to put a stop loss on the other side of resistance or support to minimise the risk of getting stopped out too soon by a sudden spike in supply or demand or an unforeseen reversal.

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more