Beginners guide to forex trading

Beginners guide to help you place your first trade.

Beginners guide to help you place your first trade.

What is forex trading?

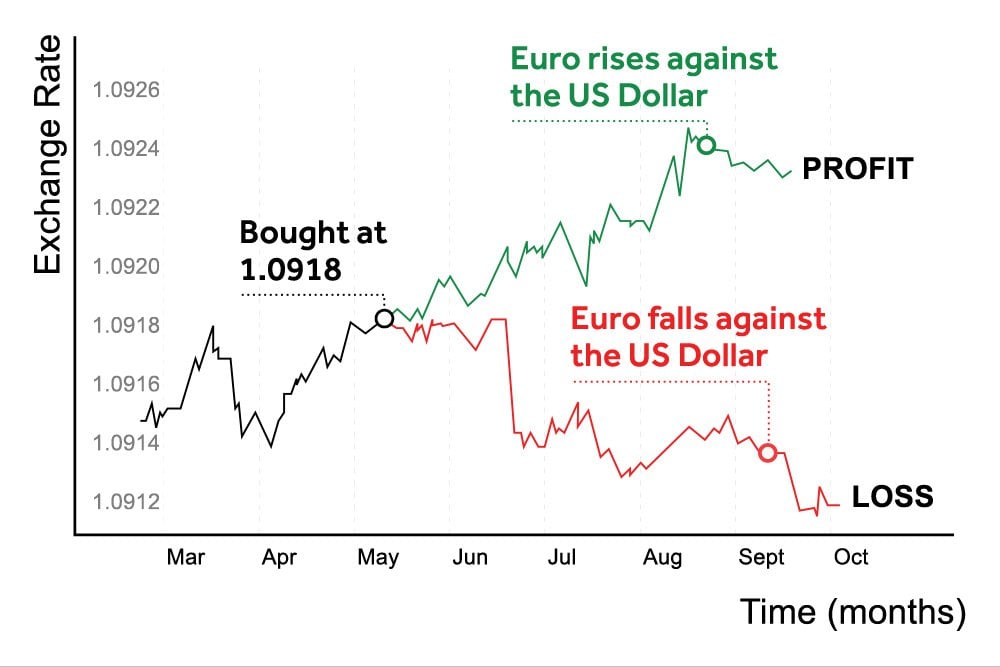

Forex trading is the buying and selling of one country’s currency in exchange for another with the aim of making a profit. Forex derives from conflating three words: foreign and currency exchange. This means that as an FX trader, you are looking to make a profit on the difference between the open price and closing price of your trade.

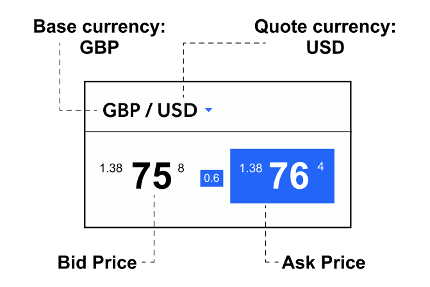

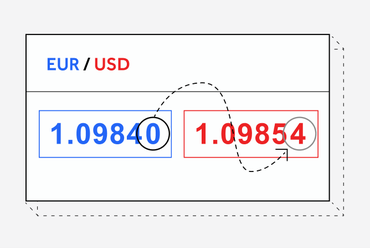

Forex is always traded in pairs. The first currency in the pair is called the base or quote currency, while the second is known as the counter currency. When buying or selling forex, the base currency is bought or sold against the counter currency. For example, in the EUR/USD pair, if you believe the value of the euro will rise against the US dollar, you would buy EUR/USD. If, on the other hand, you believe the euro will fall against the US dollar, you would sell the EUR/USD currency pair.

What is the forex market?

The forex market is an over-the-counter market, or OTC market, where individuals, banks and other financial institutions can trade currencies all the year round, even through holidays, evenings and weekends.

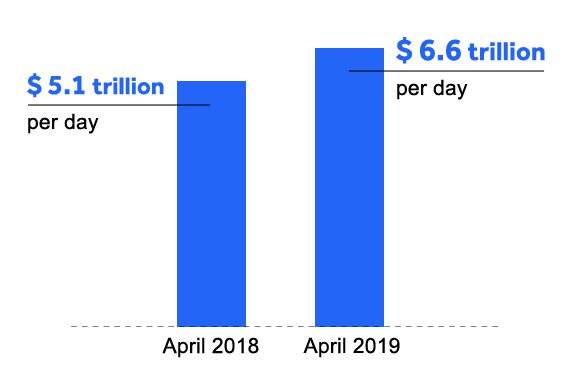

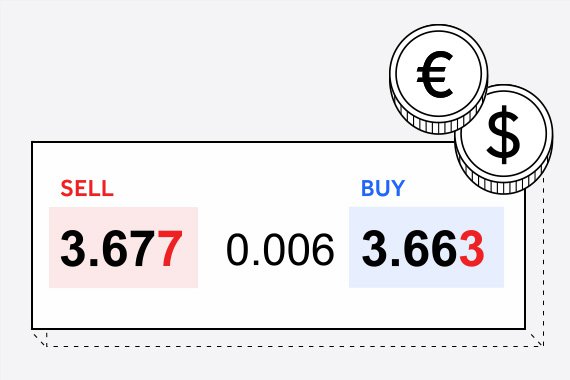

The foreign exchange market, or forex market, is one of the most liquid markets in the world. And by liquid we mean a market where there are many available buyers and sellers and low transaction costs compared to shares. This allows traders to open positions quickly, at a desirable price and on low spreads. A spread is the difference between the ‘buy’ or ‘ask’ price and ‘sell’ or ‘bid’ price. According to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets, forex trading volumes reached $6.6 trillion per day in April 2019, up from $5.1 trillion three years earlier1. With the influx of new traders since 2020, this figure is growing at speed.

Learn about the currencies you trade

Forex pairs that have the US dollar as either the base or counter currency are called major currency pairs. For example, EUR/USD, USD/JPY and GBP/USD. EUR/USD is the most widely traded forex pair in the world, and therefore the most liquid, followed by USD/JPY. Currency pairs that do not have the US dollar as either the base or counter currency are called minor currency pairs. For example, EUR/GBP, GBP/JPY and so on. The lesser known pairs are known as ‘exotics’. An example of an exotic is EUR/TRY (Euro/Turkish Lira). Since these pairs are much less liquid, their spreads tend to be wide so they’re best avoided if you are just starting out in forex trading.

The GBP/USD currency pair is also known as ‘cable’. The term ‘cable’ was coined in the mid-nineteenth century when the pound sterling and US dollar exchange rate was transmitted across the transatlantic by a deep-sea cable.

What affects forex prices?

Forex prices fluctuate throughout the day and are affected by numerous factors, including politics, social, news and economic events. For example: elections, Brexit, civic unrest, national calamities and, as in recent times, a pandemic.

Economic events and announcements

Positive events such as strong GDP or employment data can positively impact the value of a country’s currency, while unforeseen or negative events such as natural disasters or civic unrest may adversely affect the value of a country’s currency, causing a sell-off. For example, the impact on pound sterling during Brexit.

Some forex traders are more cautious trading on days when a government or central bank is due to make an announcement that may produce extra volatility in the market. For instance, if you look at an economic calendar and see that the Fed is due to announce figures for non-farm payroll (figures for employment), you might want to avoid trading the US dollar that day, as the news could impact your analysis on dollar pairs. See our economic calendar

Forex trading risks

As with any other form of trading, forex trading has its risks. Implementing risk management tools and using a stop loss on your trades will help you to minimise your losses should the markets go against you.

What is leverage?

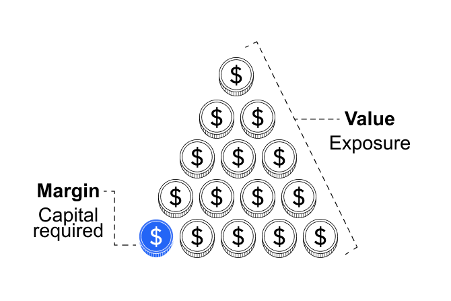

Leverage with FX trading allows you to trade a larger financial position with a smaller sum. When you open a live account and make a deposit at OANDA, we are effectively ‘lending’ you money to give you increased exposure to an underlying asset that is of interest to you. Put simply, leverage effectively amplifies the amount of money you are putting down to trade with. So, with leverage of 10:1, your money is amplified 10 times, if 30:1, 30 times, and so on. The flip side of trading with leverage is that, if the trade goes against you, your losses will be amplified. Greater exposure leads to bigger ups and bigger downs, in other words.

What is the best way to learn forex trading?

There are essentially two components to forex trading analysis: technical and fundamental analysis. Some traders prefer to use only technical analysis, using charts to study movements in supply and demand – and therefore price action – regarding fundamentals mostly as an unwelcome distraction. Others prefer to use a combination of price action and fundamental analysis to create their strategy.

If you want to be a good forex trader, you need a good forex trading education. Luckily, there’s no shortage of webinars, workshops and how-to videos on OANDA that can help you learn forex trading for free. Once you’ve opened an account, live or demo, you can start to implement some of the forex strategies that we cover in getting started.

KEY TAKEAWAYS

- Forex is the most widely traded market in the world, with a trading volume of $6.6 trillion per day in April 2019.

- Forex is traded in pairs of one currency against another, for example EUR/USD.

- The first currency in a pair is called the base currency, while the second is known as the counter currency.

- We offer the award-winning OANDA Trade platform* and MetaTrader. You can also trade using the TradingView social platform.

- Forex pairs that have the US dollar as one of the currencies in the pair are known as major currency pairs. Pairs without the dollar are called minor currency pairs.

FAQs

What is the difference between spot and forward FX pairs?

In currency markets, the spot rate refers to the exchange rate now or ‘on the spot’. The forward rate, on the other hand, refers to the future exchange rate that is agreed upon in the future.

What is margin trading in FX?

Margin trading describes a way of trading assets using funds provided by a third party. With a margin account, as a trader, you can access greater sums of capital, allowing you to leverage your trade positions. Essentially, margin trading amplifies your trading results – wins and losses – according to the leverage you are using, be that 10:1 or 100:1. The flipside to this potential to amplify your gains is that any losses you may incur will be amplified by the same amount. To minimise your losses and reduce the negative effect of leverage on a losing trade, it’s always a good idea to use a stop-loss order.

How do I trade metals as forex pairs?

Precious metals such as gold, silver and platinum can all be traded as pairs with other currencies, typically the dollar, and are referred to as spot gold (XAU/USD), spot silver (XAG/USD) and so on. The principle is the same as for foreign currency, but each metal has its own idiosyncrasies and, arguably, these spot pairs are more sensitive to economic news.

1 Bank for International Settlements. "Foreign Exchange Turnover in April 2019." Accessed Oct. 3, 2020.

*Voted Best Broker 2023 (TradingView Broker Awards 2023). Most Popular Broker 3 years in a row (TradingView Broker Awards 2020, 2021, 2022). Best Trading Tools winner (Online Personal Wealth Awards 2021). Awarded highest client satisfaction for telephone customer service (Investment Trends 2021 UK Leverage Trading Report, Industry Analysis).

Difference between leveraged and other forms of financial trading.

expand_less expand_moreUse fundamental analysis to your advantage.

expand_less expand_moreHow is technical analysis different from fundamental analysis?

expand_less expand_moreHow to build a robust trading strategy using indicators and oscillators.

expand_less expand_more