Financing costs are daily charges or credits applied to your account to reflect the cost of holding your open position(s). Financing costs are calculated on a per position basis and may result in a charge or a credit being applied to your account. You can review the financing costs applied to your account via the account portal.

Please note that when trading on a hedging enabled sub-account, financing costs will be applied to both sides of a hedged trade.

All financing costs are calculated as follows:

Financing charge or credit = size or position value x applicable funding rate x duration x conversion rate to account currency

(Position value = size of position x price at 5pm ET).

Both duration and funding rates are calculated slightly differently depending on the asset class of the position you are holding.

| FX, Gold and Silver: | Financing charge or credit = size of position x applicable funding rate/365 x applicable duration x conversion rate to account currency |

|---|---|

| Indices, Shares and ETFs: | Financing charge or credit = position value x applicable funding rate/365 x applicable duration x conversion rate to account currency |

| Commodities, Metals (excluding Gold and Silver) and Bonds: | Financing charge or credit = position value x applicable funding rate x [trade duration/ 365] x conversion rate to account currency |

Funding rates vary depending on the instrument and may change on a daily basis. They are comprised of OANDA’s admin fee and an appropriate market rate. Funding rates are quoted as an annual rate. Each instrument has two quoted rates: one for a buy/long position and the other for a sell/short position. A negative funding rate will result in a charge being debited from your account and a positive funding rate will result in a credit to your account.

The table below details how funding rates are calculated for different asset classes:

| Market Rate | Admin Fee - Long Position | Admin Fee - Short Position | |

|---|---|---|---|

| FX | Rates are baed on underlying liquidity providers' tom-next SWAP rates. | Instrument-specific admin fees (see table below***) | Instrument-specific admin fees (see table below***) |

| Gold and Silver | Rates are based underlying liquidity providers' tom-next SWAP rates | 1% | 1% |

| Indices | Rates used in the country whose currency is the instruments' quote currency using the table below*. | 2.5% | 2.5% |

| Shares | Rates used in the country whose currency is the instruments' quote currency using the table below**. | 2.5% |

2.5% (Admin fee may be increased by the additional cost of borrowing rates for short positions held overnight.) |

| ETFs | Rates used in the country whose currency is the instruments' quote currency using the table below** | 2.5% |

2.5% (Admin fee may be increased by the additional cost of borrowing rates for short positions held overnight.) |

| Commodities, Metals (excluding Gold and Silver) and Bonds: | Second-by-second rates are derived from the shape of the underlying futures curve | 2.5% | 2.5% |

| Index | Reference rate |

|---|---|

| Australia 200 | AONIA |

| China A50 | SOFR |

| Germany 40 | ESTR |

| Europe 50 | ESTR |

| France 40 | ESTR |

| Hong Kong 33 | HKD DEPOSIT 1WK |

| Japan 225 | SOFR |

| US Nas 100 | SOFR |

| Netherlands 25 | ESTR |

| Singapore 30 | SORA |

| US SPX 500 | SOFR |

| Taiwan Index | SOFR |

| UK 100 | SONIA |

| US Russell 2000 | SOFR |

| US Wall St 30 | SOFR |

| Spain 35 | ESTR |

| Switzerland 20 | SARON |

| ChinaH Shares | HKD DEPOSIT 1WK |

| Japan 225 (JPY) | TONA |

| Share/ETF | Alternative reference rate |

|---|---|

| EUR | ESTR |

| USD | SOFR |

| GBX | SONIA |

| SEK | SWESTR |

| DKK | DESTRA |

| Instrument | Admin fee |

|---|---|

| TRY pairs | 4.00% |

| CZK, HUF, SAR, THB, ZAR pairs | 2.00% |

| Other pairs | 1.00% |

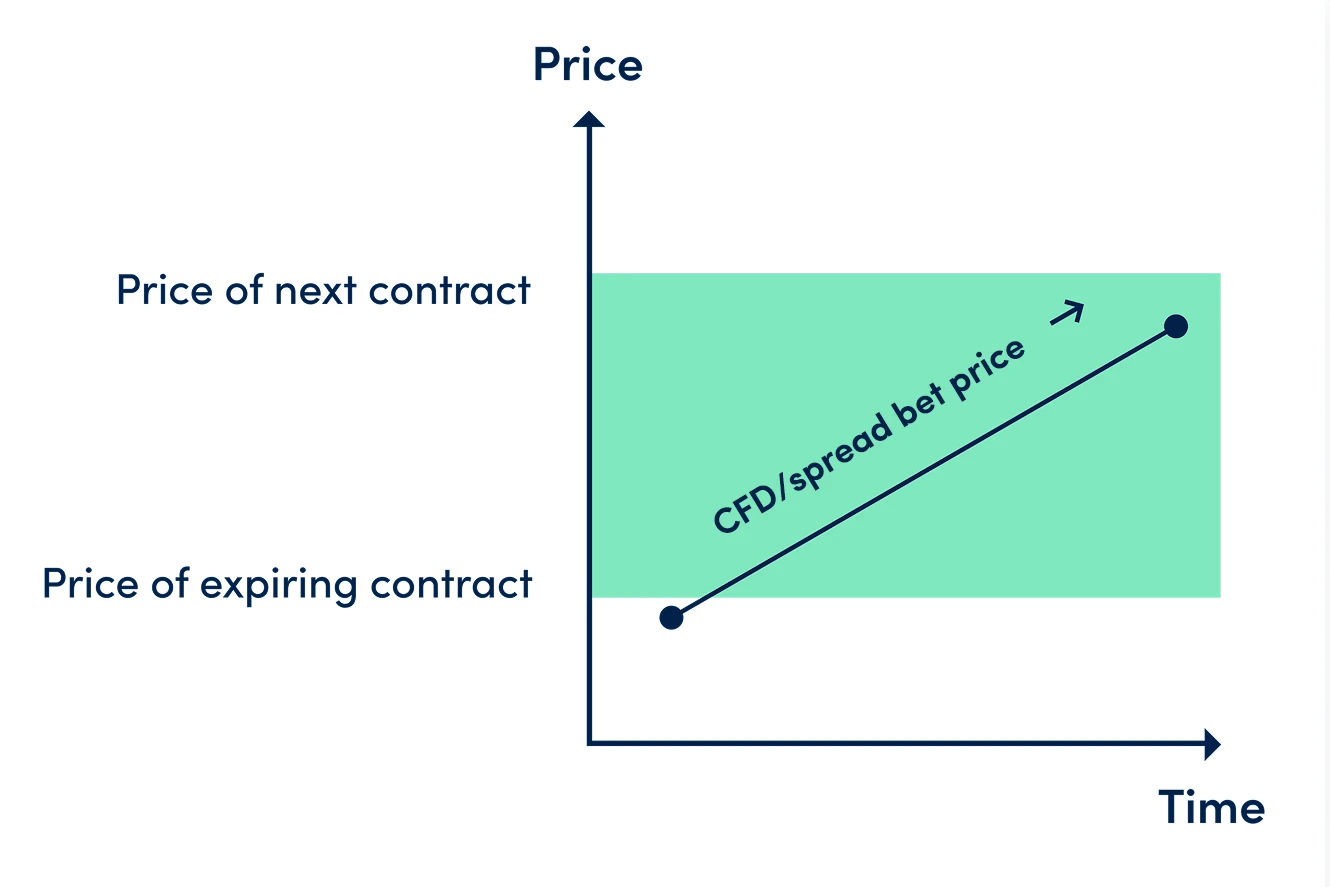

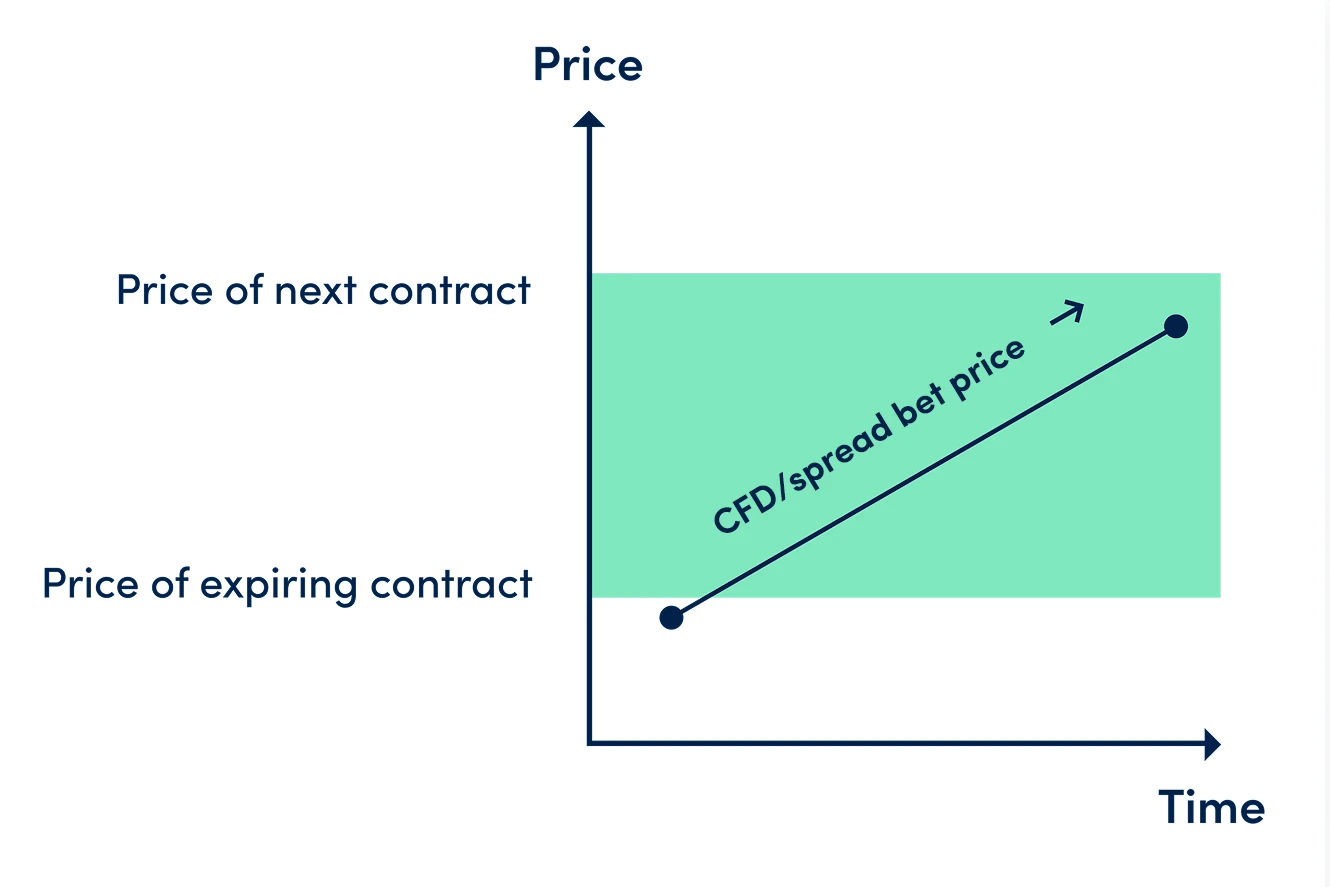

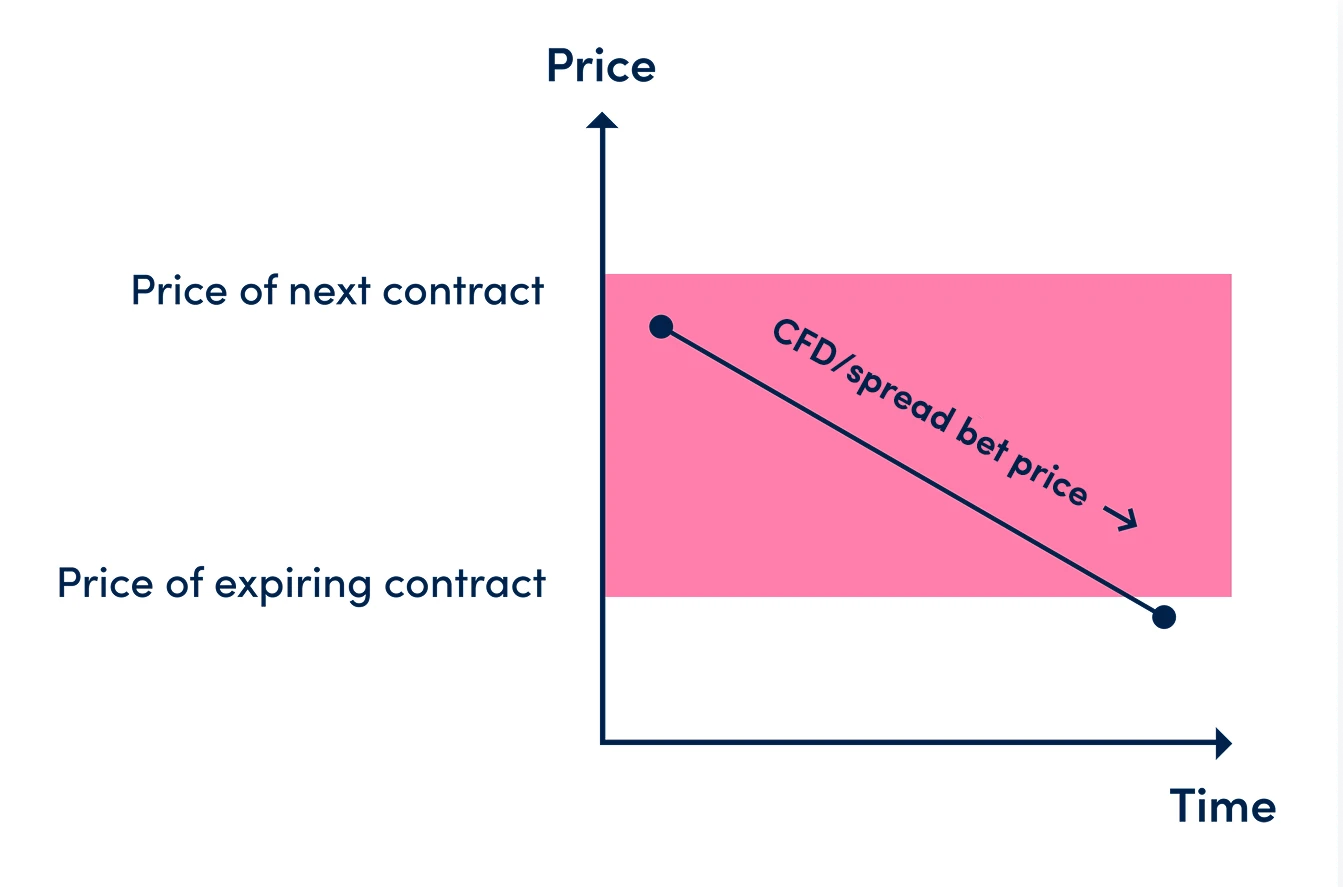

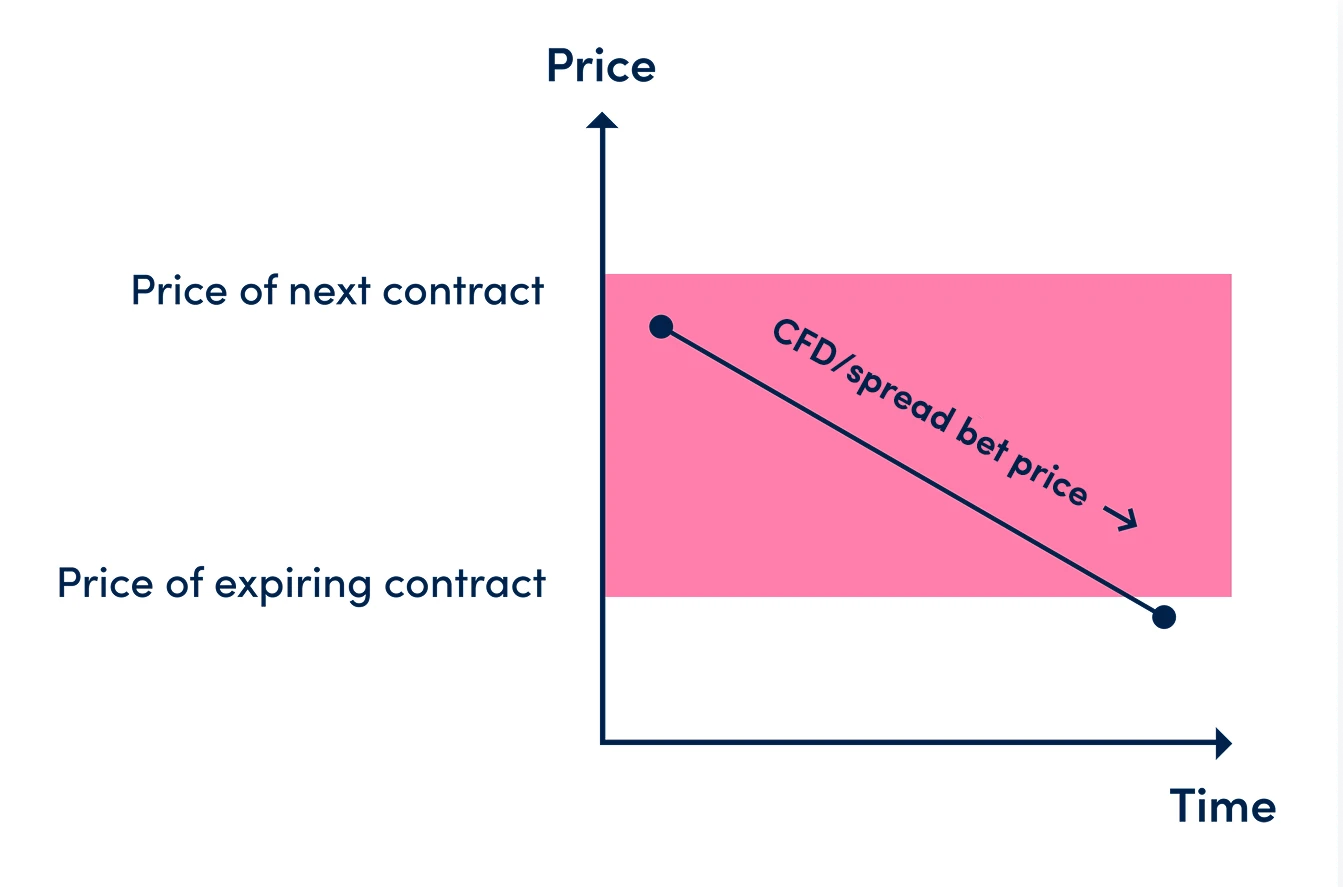

OANDA prices Commodities, Metals (excluding Gold and Silver) and Bonds based on underlying futures contracts. When an underlying futures contract is near expiry, we calculate the basis rate, which represents the difference in price between the expiring futures contract and the next futures contract. From that point forward, our spread bet/CFD price is calculated as the present value of the price of the next futures contract, using the basis rate for the present value calculation. The present value is calculated continuously, second-by-second.

When the basis rate is positive, the price will tend to move upwards towards the contract price. When the basis rate is negative, the price will tend to move downwards towards the contract price.

(CFD/spread bet price trending to move higher towards next contract price)

(CFD/spread bet price trending to move lower towards next contract price)

Financing costs on Commodity, Metal (excluding gold and silver) and Bond positions are therefore calculated on a continuous, second-by-second basis. This is why ‘duration’ is calculated differently when applying financing costs for Commodities, Metals and Bonds positions.

For the duration of the trade, the resultant financing charge/credit is debited/credited at the end of each day (5pm ET), and when the trade is closed.

All positions on a client’s account at the end of each trading day (5pm ET) are considered to be held overnight and subject to either a financing charge or a financing credit.

Different asset classes settle on different days.

FX, Gold, and Silver trades typically settle on a T+2 basis, which effectively means that weekend financing is usually applied two days earlier on Wednesdays (tripling the usual daily rate), although this timeline is similarly impacted by public holidays.

Indices and Shares typically factor in weekend financing on a Friday (tripling the usual daily rate), although this timeline is also similarly impacted by public holidays.

Accordingly, the actual funding rate on any given day may reflect more than one day’s costs.

The basis of financing costs is the same across open positions held on all accounts irrespective of the trading platform used to place the trades, but the time of application varies.

Financing costs are credited/debited to your account daily.

This cost is usually applied to your account daily at 5pm ET, but may occur earlier for closed positions in Metals, Commodities and Bonds (see above).

For most instruments, financing costs accrue on your open position, impacting unrealised profit or loss. These accumulated costs are credited or debited to your account when the position is closed.

However, for commodity positions, financing costs are credited/debited to the account daily.

For more information, see our Sub-account differences page.

You have a long position of 200,000 EURUSD on your account that is denominated in GBP. This position is still open at the end of the trading day on a Tuesday, 5pm ET.

The long funding rate noted for EURUSD on this particular day is -2.68% (including 1% admin fee); which means that you will pay financing for holding this position at 2.68% per annum.

Financing charge or credit = size of position x applicable funding rate/365 x applicable duration x conversion rate to account currency

As you are converting a negative EUR value to GBP (your account currency) you need to buy EURGBP, (the end of day price was 0.8573/0.8575).

This rate is calculated by applying a 0.5% mark-up/mark-down (depending on whether a debit or credit is to be applied) to the midpoint price (buy plus sell price divided in half) at the time of conversion.

So conversion rate to account currency is: [(0.8575 - 0.8573)/ 2 + 0.8573] + 0.5% = 0.8617

Therefore, the calculation is:

Daily financing charge = 200,000 x (2.68% / 365) x 1 x 0.8617 = £12.65

You have a long position of 100 units of XPDUSD (Palladium) on your account that is denominated in USD.

As outlined above, financing costs in this instrument are calculated on a continuous second-by-second financing basis.

You opened your position at 11:00:00 and closed it at 16:30:54.

Firstly, you need to know the number of seconds in which the position was open, so 5hr, 30 mins, 54 seconds converted to seconds is 19,854 seconds.

The number of seconds in a 365-day year is 31,536,000.

The funding rate for Palladium is -4.40% (including 2.5% admin fee).

The price of XPDUSD when the position was closed was 1209.565/1213.557.

If the funding rate is positive, then the bid/sell price is used, if negative, then the ask/buy price.

Financing charge or credit = position value x applicable funding rate x [trade duration (in seconds)/ 31,536,000] x conversion rate to account currency

Financing charge = (100 x 1213.557) x 4.40% x (19,854/ 31,536,000) x 1 = USD3.36

Go from application to trading in three easy steps:

^Subject to meeting our criteria. Additional information/documentation may be requested prior to account activation to establish eligibility.

With over 25 years experience, we offer multiple platforms and powerful tools to help you trade smarter.

Transparent trading costs.

We are upfront about our fees so you know how much you are paying when you trade with us.

We offer CFD prices on a range of financial instruments, including indices, forex pairs, commodities, metals and bonds.

Our operation hours coincide with the global financial markets. Find out when you can trade with us.