How to open an account

You can start trading across our award-winning* OANDA Trade platform and MT4 in three simple steps: complete our application form, verify your identity and deposit funds. You are now ready to place your first live trade with OANDA. It is as easy as that.

Step 1: Apply for an account

To apply, you must be over 18 years old, and a legal resident of Canada.

We only ask questions that are relevant to your application and for regulatory purposes.

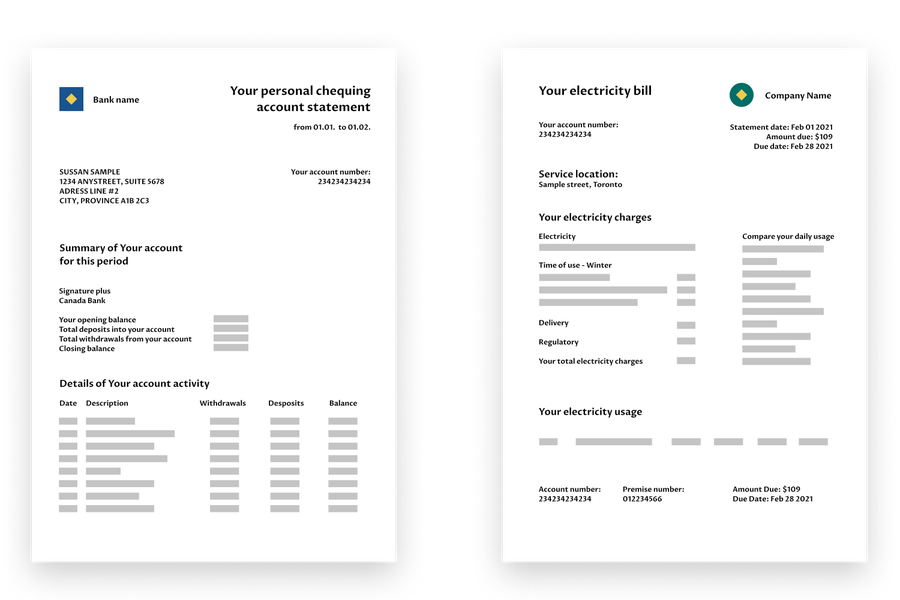

Be prepared to upload proof of address documents, such as a utility bill and a financial statement (issued within the last three months).

Step 2: Verify your address and financial account

Proof of address

We accept one of the following documents:

- Utility bill (electricity, water or telecommunications bill)

- Investment account statement (RRSP, GIC)

- Canadian Revenue Agency (CRA) documentation (assessment notice, GST refund letter, benefits statement, installment reminder)

The document should be in your name and must show your current residential address. It should match the address on your OANDA account application. The bill/statement must be issued within the last three months and should be for an account held in your name. To ‘c/o', ‘PO BOX’, ‘care of’ documents cannot be accepted.

Proof of address documents should be in PDF format and must be downloaded from your online account. Altered/redacted documentation cannot be accepted.

Proof of financial account

We accept one of the following documents:

- Bank statement

- Credit card statement

- Loan account statement (mortgage)

- Cheque that has been processed (cleared) by a financial institution

The statement must be for an account held in your name and issued within the last three months. To ‘c/o' or ‘care of’ documents cannot be accepted.

Proof of financial account documents should be in PDF format and must be downloaded from your online account. Altered/redacted documentation cannot be accepted.

Step 3: Fund and trade

To deposit funds, log in to ‘manage funds’ using your OANDA account details and click on the ‘deposit’ button. You can fund your trading account using a number of methods, including bank wire transfer and PayPal. There is no minimum deposit amount.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

*Best Trading Tools winner (Online Personal Wealth Awards 2021). Awarded highest overall client satisfaction (Investment Trends 2021 US Leverage Trading Report, Margin Forex). Awarded highest client satisfaction for mobile platform/app (Investment Trends 2021 US Leverage Trading Report, Margin Forex). Voted Most Popular Broker 2021 (TradingView Broker Awards 2021). Voted Best Forex and CFD Broker 2021 (TradingView Broker Awards 2021).

Depositing and withdrawing funds

It is simple and straightforward to deposit and withdraw funds to and from your OANDA account.

Transparent trading costs

We are upfront about our fees so you know how much you are paying when you trade with us.

Take a position with OANDA Trade

OANDA Trade can be accessed from your web-browser, tablet and mobile device.