Trading resources

Sharpen your trading skills with our comprehensive trading resources section. From understanding leveraged trading to getting your head around technical and fundamental analysis, indicators, oscillators and risk management. Find everything you need in this section to build a smarter trading strategy.

Introduction to leveraged trading

Understand the difference between leverage and other forms of trading.

What is leverage trading?

Leverage trading is the use of a smaller amount of initial funds or capital to gain exposure to larger trade positions in an underlying asset or financial instrument.

Beginners guide to trading with margin

Leverage the funds in your account to potentially generate larger profits or losses while trading.

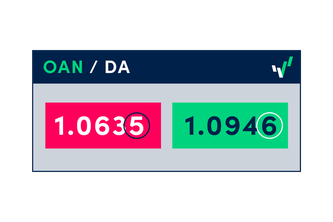

What is a pip in leverage trading?

Our article explains the basics of pips and how to use pips when trading with OANDA

Fundamental analysis

What is fundamental analysis and why is it important to trading?

The basics of fundamental analysis

How to incorporate fundamental analysis in your trading.

Technical analysis

Technical analysis is an important aspect of a trader’s toolkit. See how it works and how you can use it to your benefit.

Technical analysis in trading

Get to know the basics of technical analysis as it applies to trading the markets.

Indicators and oscillators

What are indicators and oscillators and why are they important in leveraged trading?

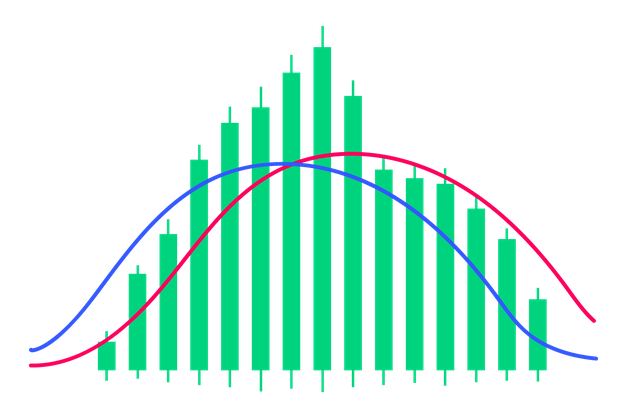

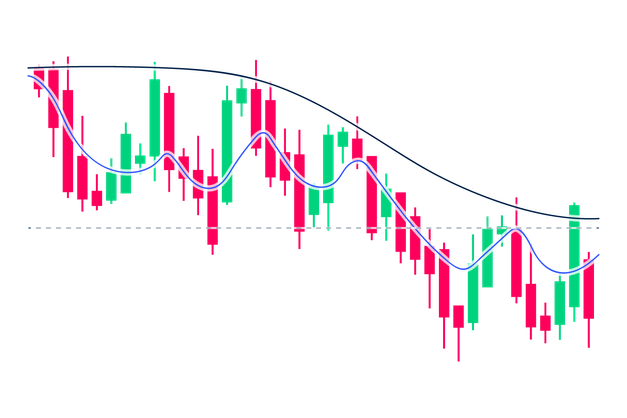

Beginners guide to moving averages

Learn to identify price reversals in markets using moving averages.

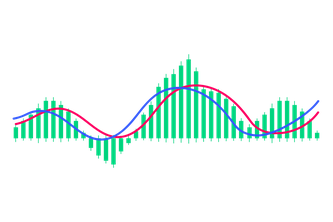

MACD: Finding entry and exit points

Use the MACD indicator (oscillator) to identify potential entry and exit points in the financial markets.